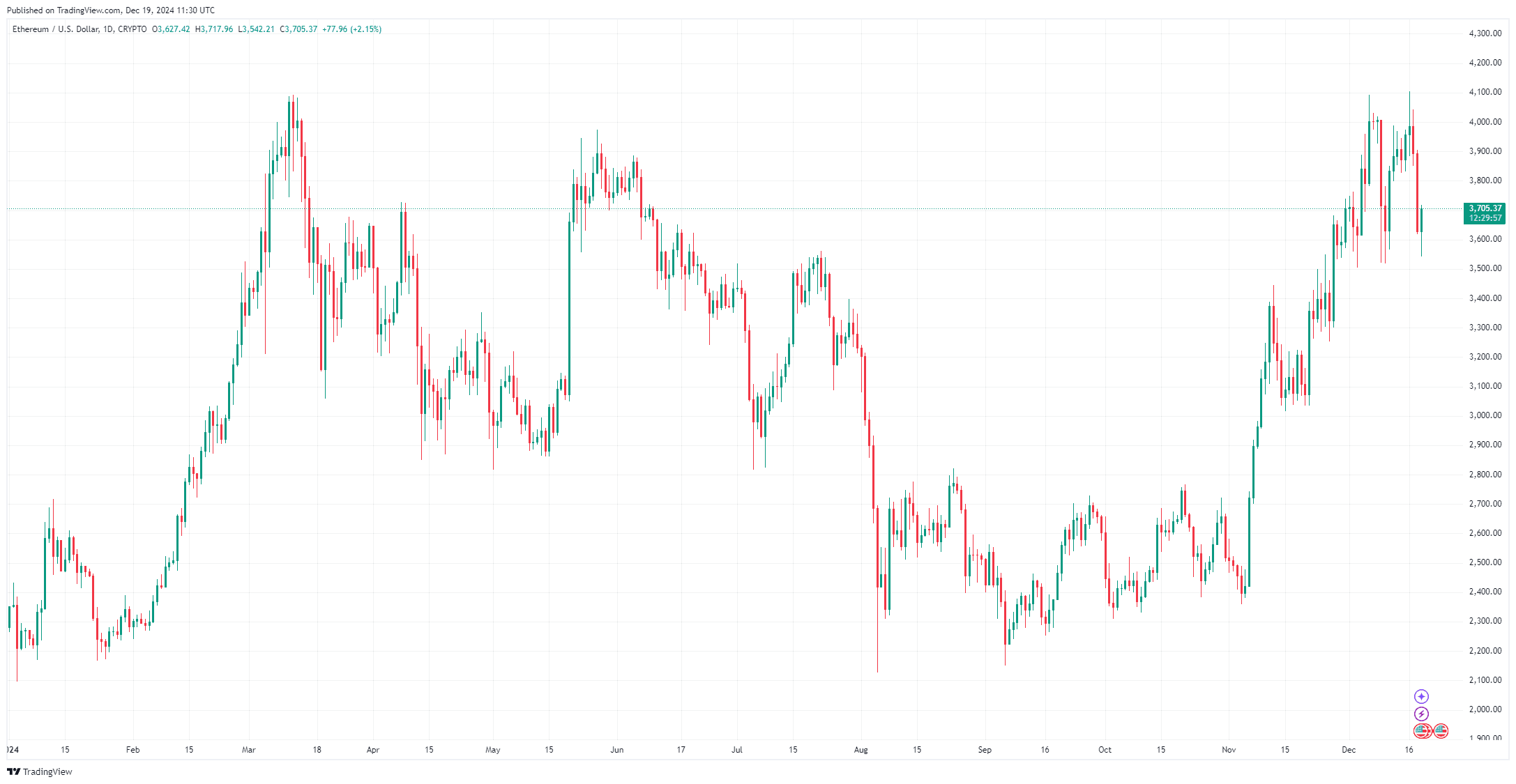

Ethereum price is under pressure, currently trading at $3,699 with a market capitalization of $445.55 billion. The recent downturn has raised concerns of a potential price crash, especially as Ethereum struggles to reclaim the $4,000 level. In this article, we’ll explore key market insights, expert predictions, and technical analysis on where $ETH might be headed next.

Ethereum Sentiment Drops to a 1-Year Low

Investor sentiment toward Ethereum has reached its lowest point in a year. According to crypto analyst Ali Martinez, social sentiment for $ETH is at its most negative level since December 2023, when $ETH was trading between $2,100 and $2,200. Interestingly, this bearish sentiment could signal a bullish opportunity. Historically, when sentiment reached this low, Ethereum’s price rallied by 30%, eventually climbing from $2,200 to $2,700 before continuing its rally to $4,093 in March 2024.

Martinez believes that if $ETH follows a similar pattern, the price could rise to the $4,900–$5,000 range. However, for this bullish scenario to materialize, $ETH must first break through the $4,100 resistance level. Once that’s achieved, he suggests that $6,000 could act as a price magnet for the cryptocurrency.

Technical Indicators Signal More Losses for $ETH

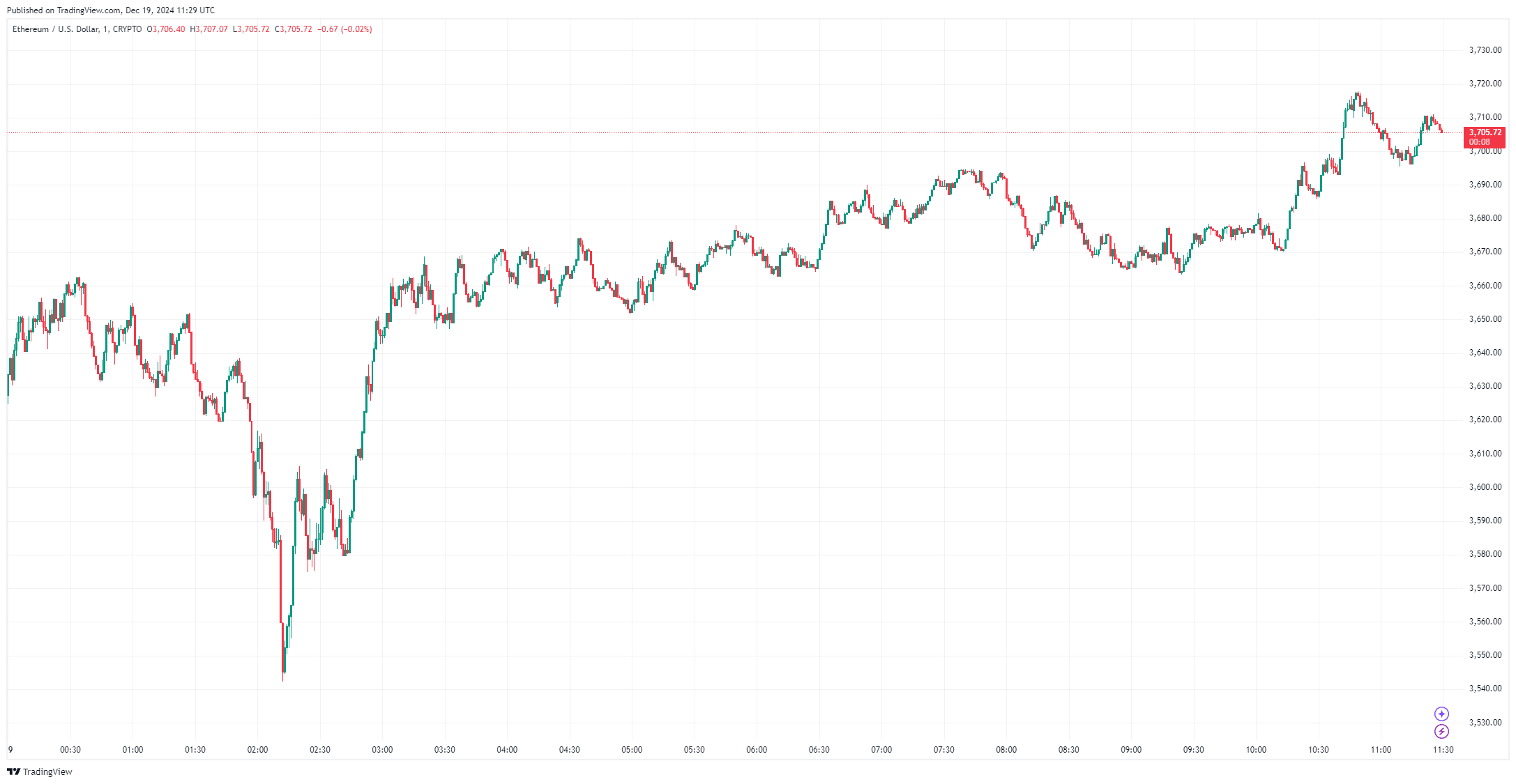

Technical analysis reveals that Ethereum’s price is showing strong bearish signs. $ETH recently dropped below key support levels, including $3,880, $3,800, and $3,680. It is now trading below $3,620 and the 100-hourly Simple Moving Average. A bearish trendline is also forming, with resistance at $3,800, which could act as a significant hurdle for any upward movement.

If $ETH fails to clear the $3,680 resistance, further declines could be expected. Key support levels to watch include $3,550 and $3,500. A breach below $3,500 could send Ethereum’s price to $3,450 or even $3,350. In a worst-case scenario, analysts see support at $3,220 as the final line of defense before a larger sell-off.

Can $ETH Reclaim the $4,000 Level?

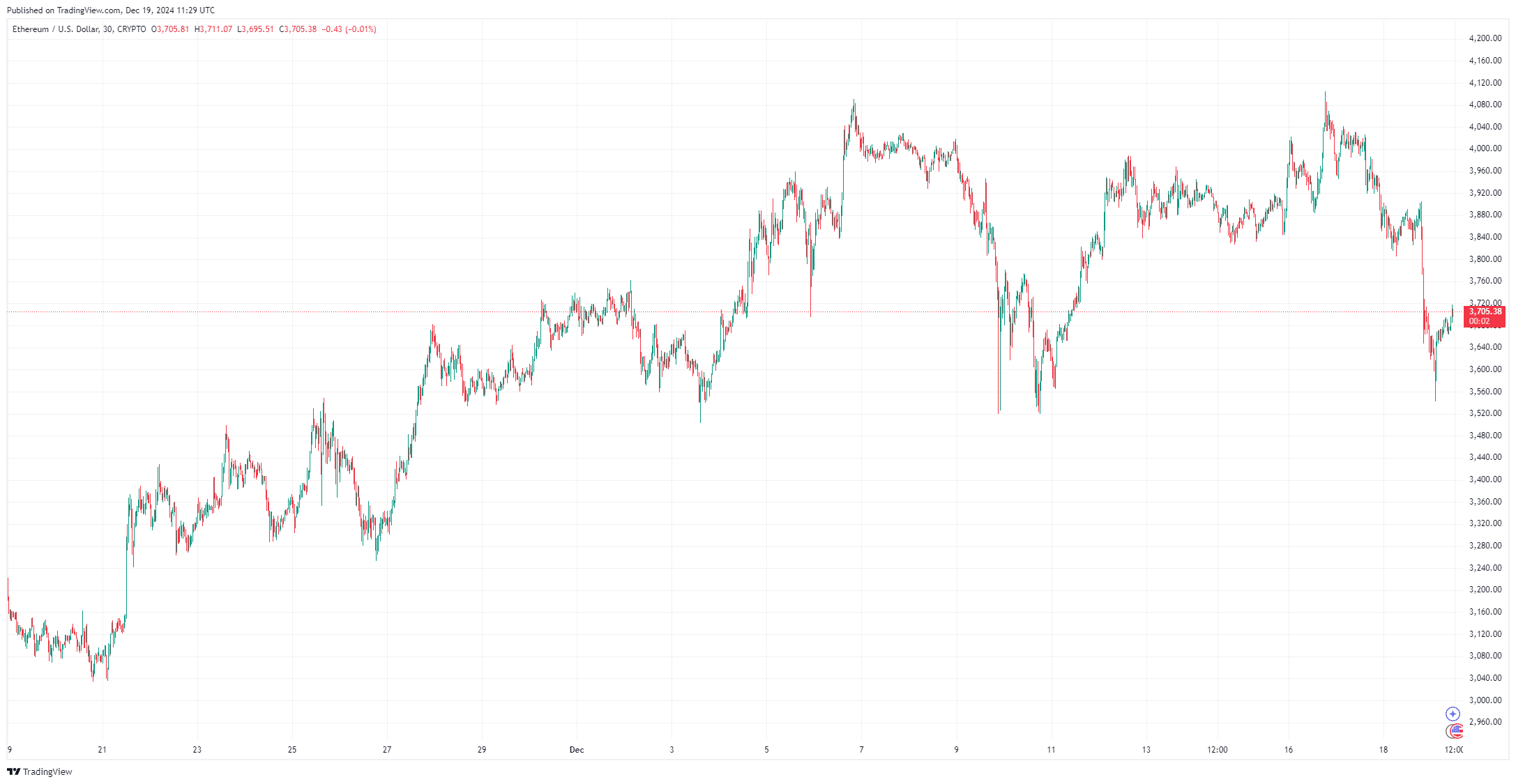

Breaking through the $4,000 level has proven to be a major challenge for Ethereum. Recent attempts to reclaim it were met with strong resistance, pushing the price back to $3,800 and lower. Market observers have compared $ETH’s current price action to Bitcoin’s performance when it hovered near the $70,000 mark. Similar to BTC’s historical behavior, $ETH price may experience multiple rejections before it can sustainably break above the $4,000 mark.

Crypto analyst Altcoin Sherpa notes that $ETH’s ability to reclaim $4,000 could signal the start of a new bullish run. However, this would require significant buying pressure, as sellers have been topping up supply at this price point. Holding above $3,800 is seen as crucial to sustaining any bullish momentum.

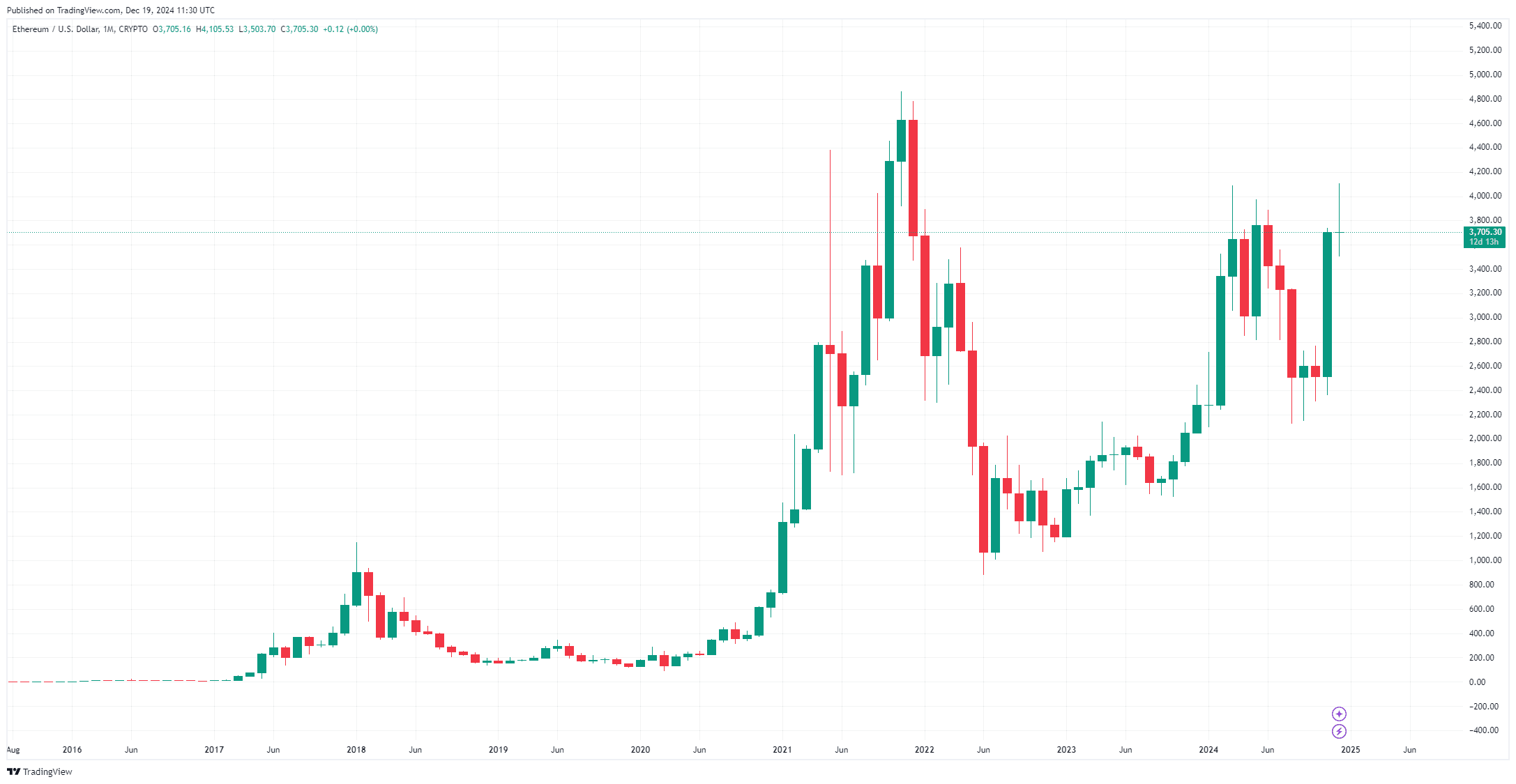

Ethereum’s Role in the Next Altcoin Season

The broader altcoin market may play a significant role in Ethereum’s next move. Market expert Lark Davis points out that the total altcoin market cap is approaching its 2021 high of $1.13 trillion. He argues that once this threshold is breached, it could trigger a historic altcoin season. Given Ethereum’s prominence as the "King of Altcoins," any upward movement in the altcoin market could fuel renewed interest in $ETH.

Crypto analyst Miles Deutscher echoes this sentiment, noting that $ETH has historically performed well during altcoin seasons. From January to May, $ETH’s monthly returns averaged 28%, compared to just 3% for the rest of the year. As Bitcoin’s dominance rises, it’s often followed by a capital rotation into altcoins, which could benefit Ethereum significantly.

Ethereum Price Prediction

Analysts are divided on Ethereum price next move. While some predict a further decline below $3,500, others believe that the bearish sentiment is a classic indicator of an impending bullish reversal. Here’s a summary of possible scenarios:

- Bearish Scenario: $ETH fails to reclaim the $3,800 resistance, leading to further declines. Key support levels to watch are $3,550, $3,500, and $3,350. A breach of $3,220 could trigger a sharp sell-off.

- Bullish Scenario: If $ETH breaks above $3,800 and reclaims $4,000, it could trigger a move to $4,900–$5,000. Should it clear $4,100, $6,000 could become the next price target.

Ethereum price is at a critical juncture as it faces significant resistance at $4,000 and key support at $3,500. Sentiment is at its lowest point in a year, a potential bullish indicator according to historical data. However, bearish technical indicators suggest further losses may be on the horizon. The outcome will likely depend on whether $ETH can reclaim the $4,000 level or if it succumbs to the bearish pressures pushing it lower. Investors should watch key support and resistance levels closely in the coming weeks.

cryptoticker.io

cryptoticker.io