Over the past few days, Ethereum’s (ETH) price has oscillated within a narrow trading range. This mirrors the broader cryptocurrency market trend, which is in a consolidation phase.

However, a significant outflow of ETH from cryptocurrency exchanges has ignited hopes for a potential rally towards the $4,000 mark. This analysis explains why this is likely in the near term.

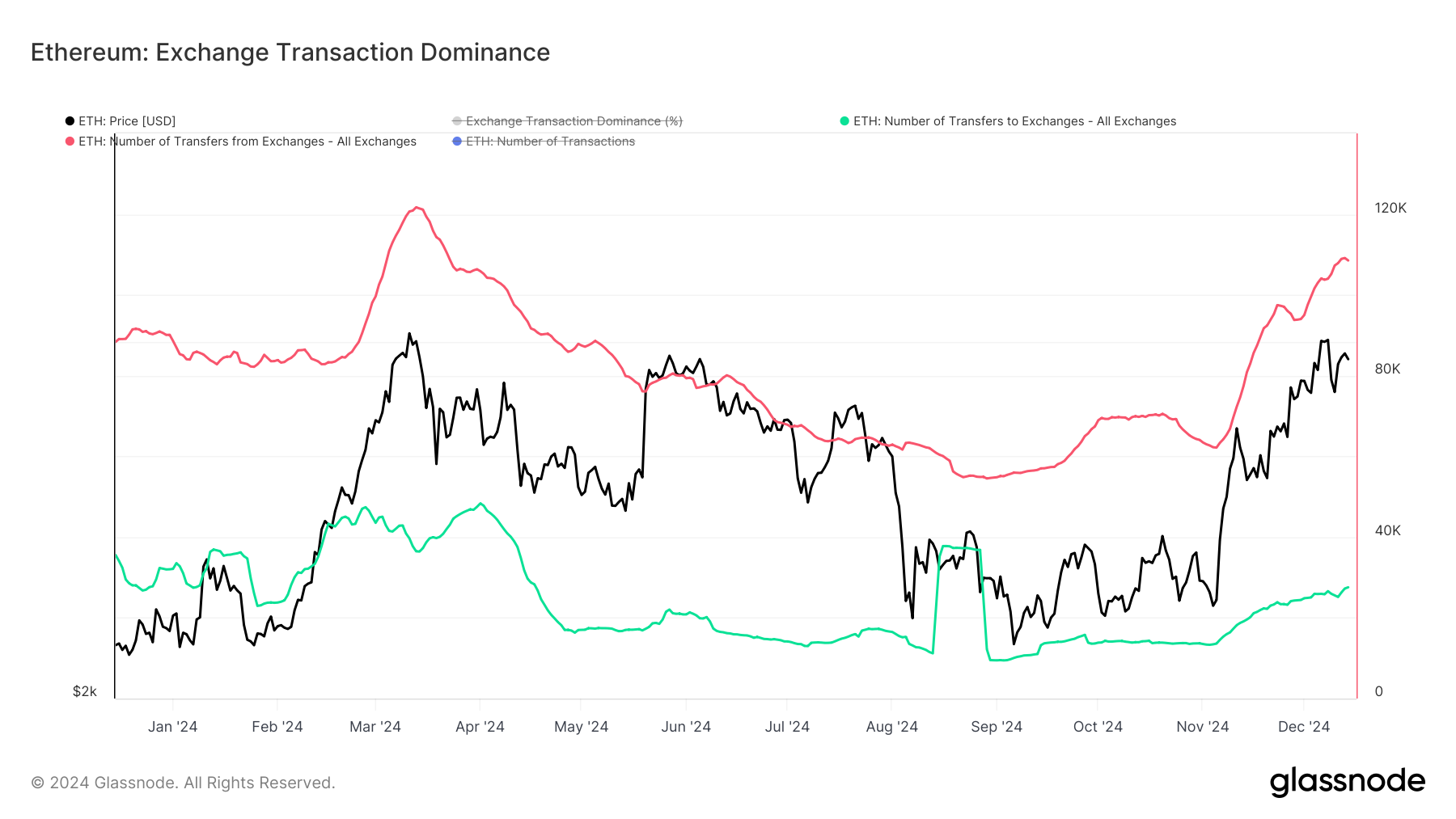

Ethereum Exchange Outflows Touch Multi-Month Highs

On December 14, 108,521 ETH worth above $418 million at current market prices were withdrawn from exchanges. According to Glassnode, this represented the highest number of ETH removed from cryptocurrency exchanges in a single day since March 13.

This substantial outflow is bullish, suggesting investors are holding onto their ETH rather than selling it. Reduced selling pressure often creates an environment where prices are more likely to rise. Hence, ETH may break out of its narrow trading pattern if buying activity resurges.

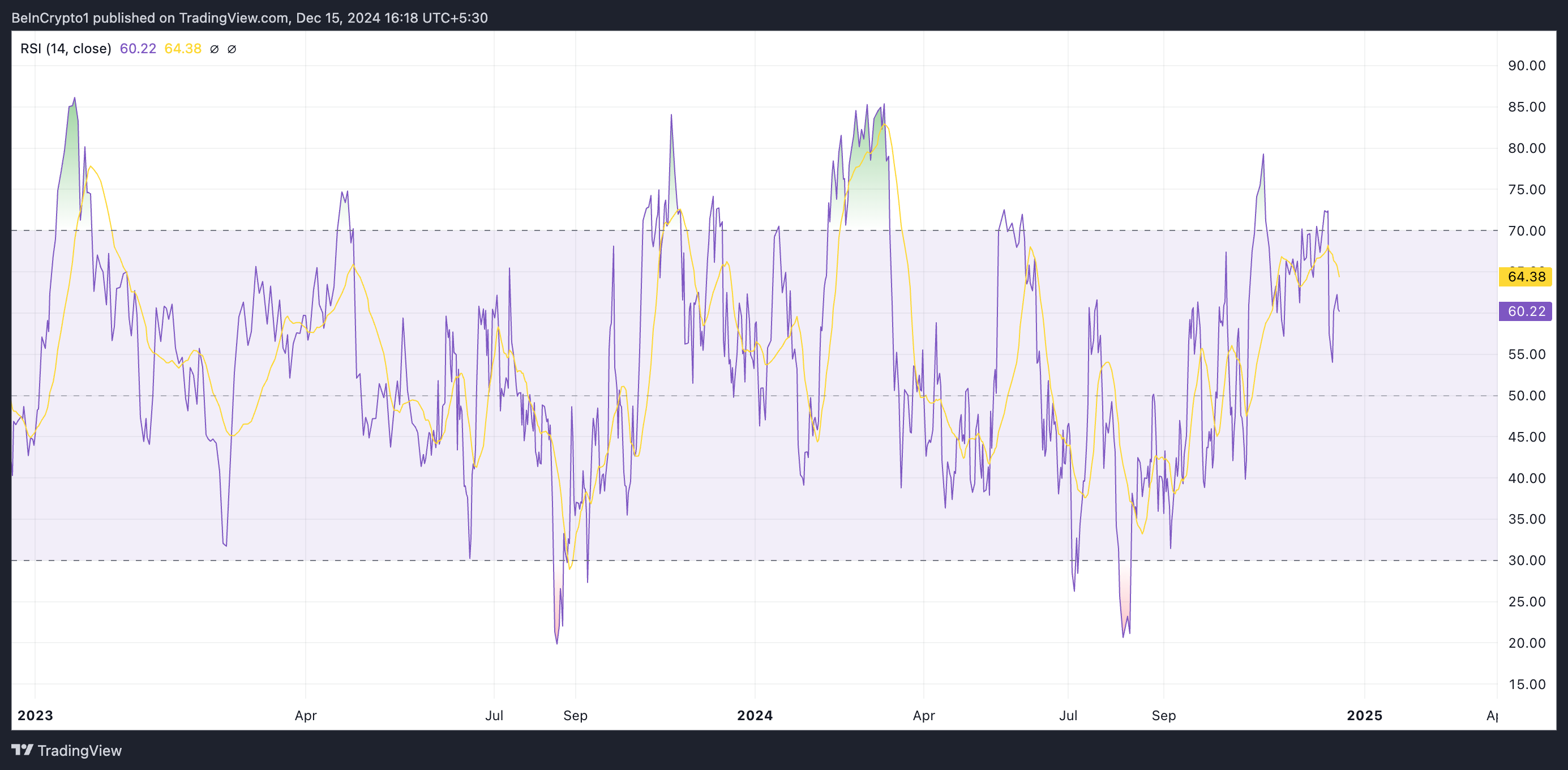

Moreover, the coin’s Relative Strength Index (RSI) is at 60.22, indicating a steady demand for the leading altcoin. This indicator measures an asset’s overbought and oversold market conditions. Ranging from 0 to 100, values above 70 signify overbought conditions and potential price declines, while values below 30 indicate oversold conditions, suggesting a possible rebound.

At 60.22, ETH’s RSI indicates that the altcoin is in a moderately bullish zone but not yet overbought. This suggests there is still room for further price appreciation before approaching overbought territory.

ETH Price Prediction: Rally Above $4000 Within Reach

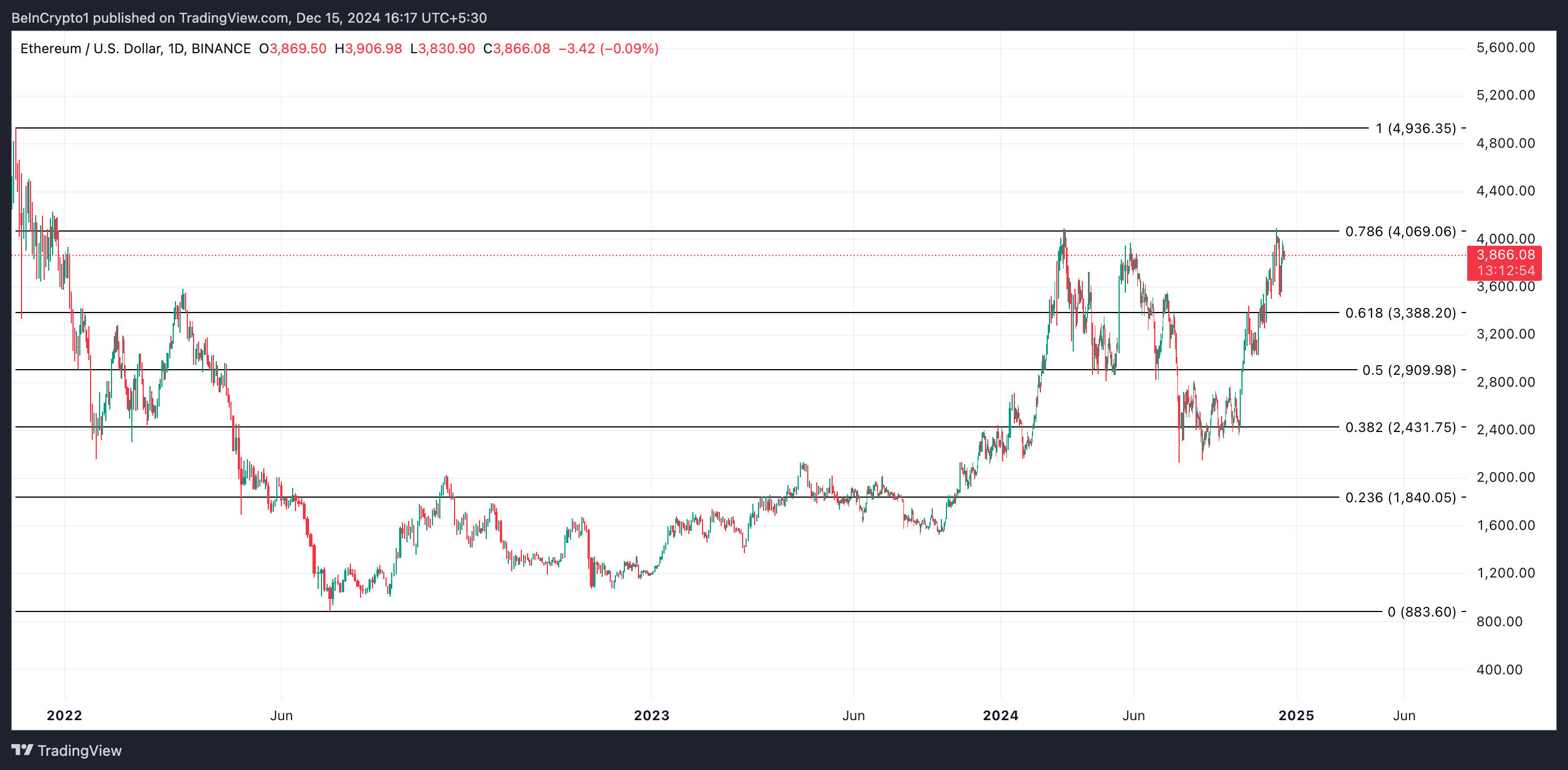

ETH currently trades at $3,866, just below resistance at $4,069. If selling pressure weakens further, ETH’s price may break above this resistance and attempt to reclaim its all-time high of $4,936, last reached in November 2021.

However, a rise in selling activity will invalidate this bullish projection. Should ETH holders resume profit-taking, its price may drop to $3,388.

beincrypto.com

beincrypto.com