On Thursday, Nov. 21, ethereum (ETH) took the lead, climbing over 7% while bitcoin managed a 3% increase.

Ether Dominance Shrinks, But Today It Steals the Spotlight from Bitcoin

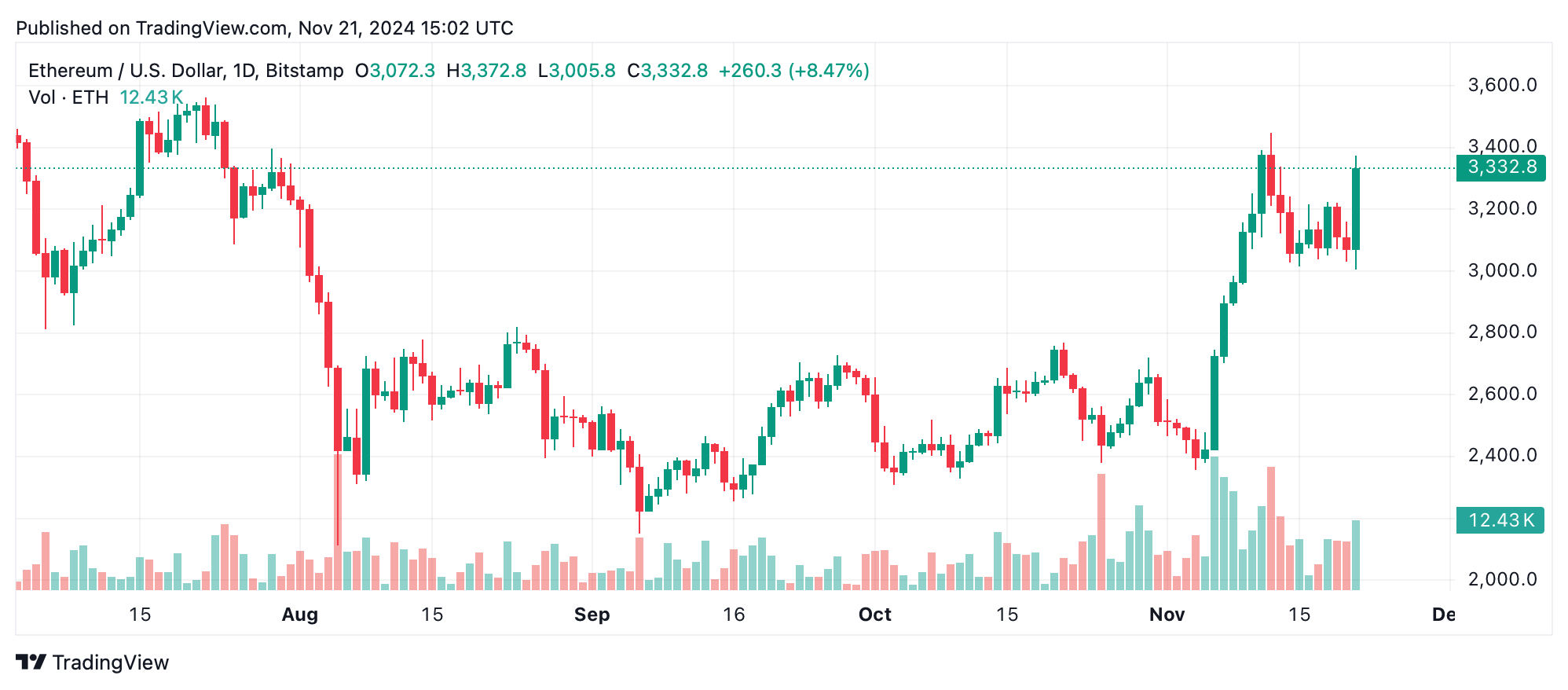

This year has been a rocky road for ethereum (ETH), but on Thursday, the digital asset reached an intraday peak of $3,362 per ether. As of now, ETH is holding steady at $3,331, reflecting a more than 7% gain against the U.S. dollar since the day before.

Even with this uptick, ETH remains over 30% shy of its all-time high of $4,878 per coin, a milestone hit three years ago on Nov. 10, 2021. Beyond today’s spike, ETH has generally lagged behind BTC over the long haul. In the past six months alone, ETH has dropped 36.5% against bitcoin, and over the last 30 days, it’s down 13% relative to BTC.

Historically, a couple of years ago, ethereum captured a 17% to 20% slice of the crypto economy’s total value. Fast forward to today, Nov. 21, and ETH’s market dominance has shrunk to 12.5% of the $3.21 trillion crypto market. Bitcoin, by contrast, commands a formidable 69% of the market’s net worth.

Sometimes, when BTC’s rally loses steam, ETH picks up speed. However, consistency in outpacing bitcoin has proven elusive for ethereum. Alongside BTC, it contends with stiff competition from layer one (L1) projects like Solana, Cardano, Tron, Avalanche, and Ton.

Ethereum’s recent climb showcases its potential for short-term growth, even as it grapples with challenges in maintaining dominance against both bitcoin and emerging L1 players. This ebb and flow reflects the ever-changing nature of cryptocurrency, where adaptability and innovation are essential for staying relevant.

Although Ethereum’s gains may excite investors, its declining market share and weakening position relative to bitcoin suggest that bouncing back to its former glory will take more than momentary price surges. The key to sustained success likely lies in tackling challenges from rival blockchains and staying at the forefront of a rapidly evolving industry.

news.bitcoin.com

news.bitcoin.com