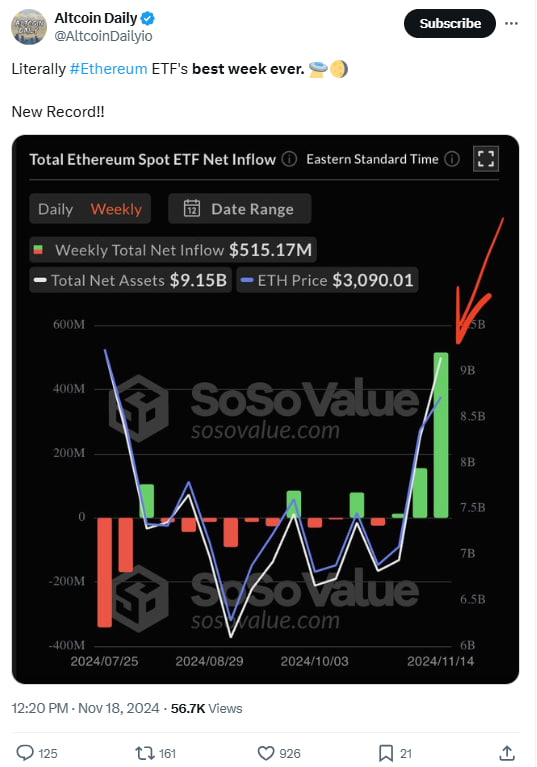

Ethereum spot ETF experienced its highest inflow period during the past week. The week ending Friday, November 15, saw the ETH spot ETF record a total net inflow of $515.17 million, over three times more than the previous record.

In the meantime, it is crucial to note that last week’s inflow marks the second consecutive period that the Ethereum spot ETF recorded new milestones. Before the latest record, Soso Value data showed that the novel financial product attracted $154.66 million in inflows in the previous week.

Further details reveal that the spot ETH ETF accumulated $9.15 billion in total net assets, adding $880 million from the previous week. However, the increase in spot Ethereum ETF inflow did not cause a matching rise in ETH’s value.

Soso Value’s data reveals a minor increase in Ethereum’s price, with the crypto token rising from $2,961 the previous week to $3,090 in the week under review. However, those figures do not tell the entire story of Ethereum’s price trajectory throughout the week. TradingView’s data show that Ethereum surged to a $3.446 local high before embarking on a retracement.

The flagship altcoin reflected significant momentum since it began a post-election rally, breaking above significant resistance to deliver a 45% rally. Most analysts believe the recent pullback to be a temporary profit-taking move by speculators and provides an opportunity for investors to increase their holdings in the second-largest cryptocurrency.

The exceptional spot Ethereum ETH inflow from the past signal is a notable signal for retail investors, who are usually keen to monitor institutional investors’ actions while gauging the potential moves of digital assets. On that note, most analysts expect more capital inflow into the Ethereum ecosystem, which could increase ETH’s price as the bull market develops.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com