- A Celsius Network-linked address conducts major Ethereum transfers to FalconX, sparking interest.

- Joint Ethereum movements signal institutional-level asset shifts from Celsius.

- Ethereum’s indicators show slight bullish signals, with stable price action and neutral RSI.

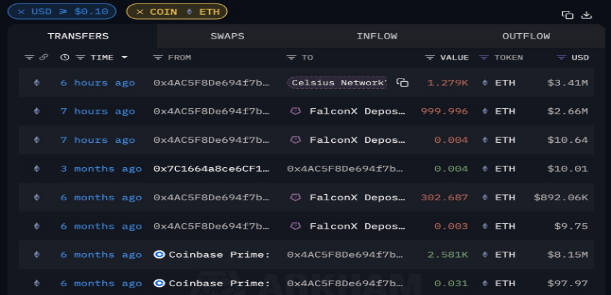

An address believed to be associated with the recently bankrupt crypto lender Celsius Network has conducted notable Ethereum (ETH) transactions, raising attention in the crypto market. The address transferred 2,278 ETH, valued at approximately $6.07 million, to the digital asset trading platform FalconX.

时隔三个月,Celsius Network 关联地址再次向 #FalconX 充值 2278 枚 ETH,价值 607 万美金,充值价格 $2664💰

— Ai 姨 (@ai_9684xtpa) October 31, 2024

至此,该地址六个月前从 Coinbase Prime 收到的 2581 枚 ETH 已全部流向交易所,Arkham 标记充值地址归属于 Celsius

钱包地址 https://t.co/hVezV1hBsK pic.twitter.com/Gt790K4gML

This transaction happened twice, with an initial deposit followed by another three months later, showing a price of $2,664 per ETH in the second transfer.

Over the past six months, the Celsius-linked address has reportedly received 2,581 ETH from Coinbase Prime, with each transfer linked to this address. The Arkham-marked address linked to Celsius appears to be central to these large-scale transactions, suggesting coordinated asset flows rather than isolated trades.

Large ETH Transactions Point to Institutional Activity

Data indicates several ETH transactions by the Celsius-linked address. The largest of these transactions occurred six hours ago, involving the transfer of 1,279 ETH, valued at approximately $3.41 million, to Celsius Network.

Additional transfers include 1,000 ETH worth $2.66 million and a smaller movement of 302.7 ETH, equivalent to $892,060, directed to FalconX deposits.

Ethereum’s Market Performance Reflects Stable Activity

Following these transactions, Ethereum’s market performance has shown slight appreciation. As of press time, the asset was trading at $2,652.06, recording an increase of 0.38% in price. Additionally, Ethereum’s market cap was at $319.33 billion, with a trading volume of $21.67 billion, recording a rise of 6.56% over the last day.

According to technical indicators, Ethereum’s movements show mixed signals. The MACD line has crossed above the signal line, suggesting possible bullish momentum. However, the histogram is relatively flat, pointing to decreased buying pressure.

Additionally, the RSI stands at 56.99, placing ETH in a neutral position without signs of being overbought or oversold.

Related:

Understanding the Legal Challenges of Crypto Bankruptcies

Ethereum Slumps As Celsius Transfers 13K ETH to Coinbase and FalconX

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com