Lido, a well-known liquid staking protocol, is about to revolutionize the logic of Ethereum’s Proof-of-Stake through a major crypto update.

The project has just released the Community Staking Module, which allows anyone to become a network validator by committing only 2.4 $ETH.

Until today, to run a validator node on Ethereum, 32 $ETH were required.

This solution makes access to consensus easier, potentially bringing more decentralization within the network.

Let’s see all the details below.

Summary

Lido activates the Community Staking Module on Ethereum’s crypto ecosystem: validators with 2.4 $ETH

Lido, the famous $25.2 billion LSD protocol, has just voted for the release and activation of a much-discussed crypto upgrade.

Let’s talk about the “Community Staking Module” (CSM), whose governance proposal was opened on October 22 and concluded just two days later.

Thanks to the positive vote outcome from the community, the update will soon come into effect on Lido and will introduce special advantages.

First of all, it will allow individual users to run validator nodes on the Ethereum PoS blockchain without requiring the threshold of 32 $ETH.

In its place, the initial minimum requirement of 2.4 $ETH will be introduced, with the first validator staking only 1.3 $ETH.

In addition, those who qualify for the early adoption phase will be able to take advantage of the feature by locking crypto in stake for 1.5 $ETH.

🗳️ New on chain vote is live!

— Lido (@LidoFinance) October 22, 2024

Lido contributors are proposing the release of the Community Staking Module (CSM), and upgrading the Staking Router to enhance compatibility with CSM and future modules.

📅 Main phase ends October 24th at 4PM UTC. https://t.co/q6urmprFww pic.twitter.com/45CCd2roOt

The Community Staking Module of Lido greatly reduces the obstacles of Ethereum staking, eliminating technical expertise and economic barriers.

The CSM aligns closely with the vision of Ethereum co-founder Vitalik Buterin of solo stakers playing a crucial role in enhancing the network’s resilience.

With more independent stakers, the crypto network is indeed more diversified in terms of operators and capable of better repelling possible censorship attempts.

The testnet phase of this upgrade was initiated on July 1st on the Holesky chain, continuing for the following 3 months.

During the process, more than 370 unique node operators joined, including 70 “solo staker” in the first 10 days.

Now that the CSM has been approved by the community, Lido is expected to significantly increase the number of node operators using the protocol.

The current entry barrier for validator nodes at 32 $ETH

Currently, to participate in the execution of a validator node on Ethereum, without going through the crypto protocol Lido, at least 32 $ETH are required.

As part of the Proof-of-Stake consensus mechanism, users who want to participate in securing the network, while earning a yield at the same time, must stake a minimum amount, set precisely at 32 $ETH.

Currently, the Ethereum network has over 1 million validators, with a total of more than 34 million $ETH staked. The yield is 3.1%.

The assumption of the minimum requirement of 32 $ETH mainly serves to encourage the participation of whale. With a lower threshold, they would have to engage more individual validators, causing greater strain on the network during the entry and exit phases.

On the other hand, however, such a high sum, equivalent to a value of 82 thousand dollars, represents a strong entry barrier for small users.

A wide range of people in the crypto world do not have such an amount in $ETH and are forced to do staking through third-party services, such as LSD protocols.

By doing so, the small fish must necessarily concentrate around large staking pools to enjoy the interest on deposits, centralizing the network.

Several times this problem had been discussed in the past among the Ethereum community, but a definitive solution had never been reached.

Now, however, it seems to have reached a turning point.

The new CSM upgrade of Lido interrupts this inefficiency, opening the doors of the validators’ network even to small investors.

This should favor the decentralization of the crypto network, consequently improving its security and resilience.

Furthermore, the new module will also support the thriving global community of solo stakers through the Community Lifeguards Initiative, offering an educational contribution.

As confirmed in the press conference by Dmitry Gusakov, collaborator of the Lido protocol and technical manager CSM:

“We want to break down the barriers, making it possible for anyone, regardless of financial circumstances or technical skills, to help protect Ethereum.”

Lido still leads the liquid staking sector while the crypto $LDO experiences price bear

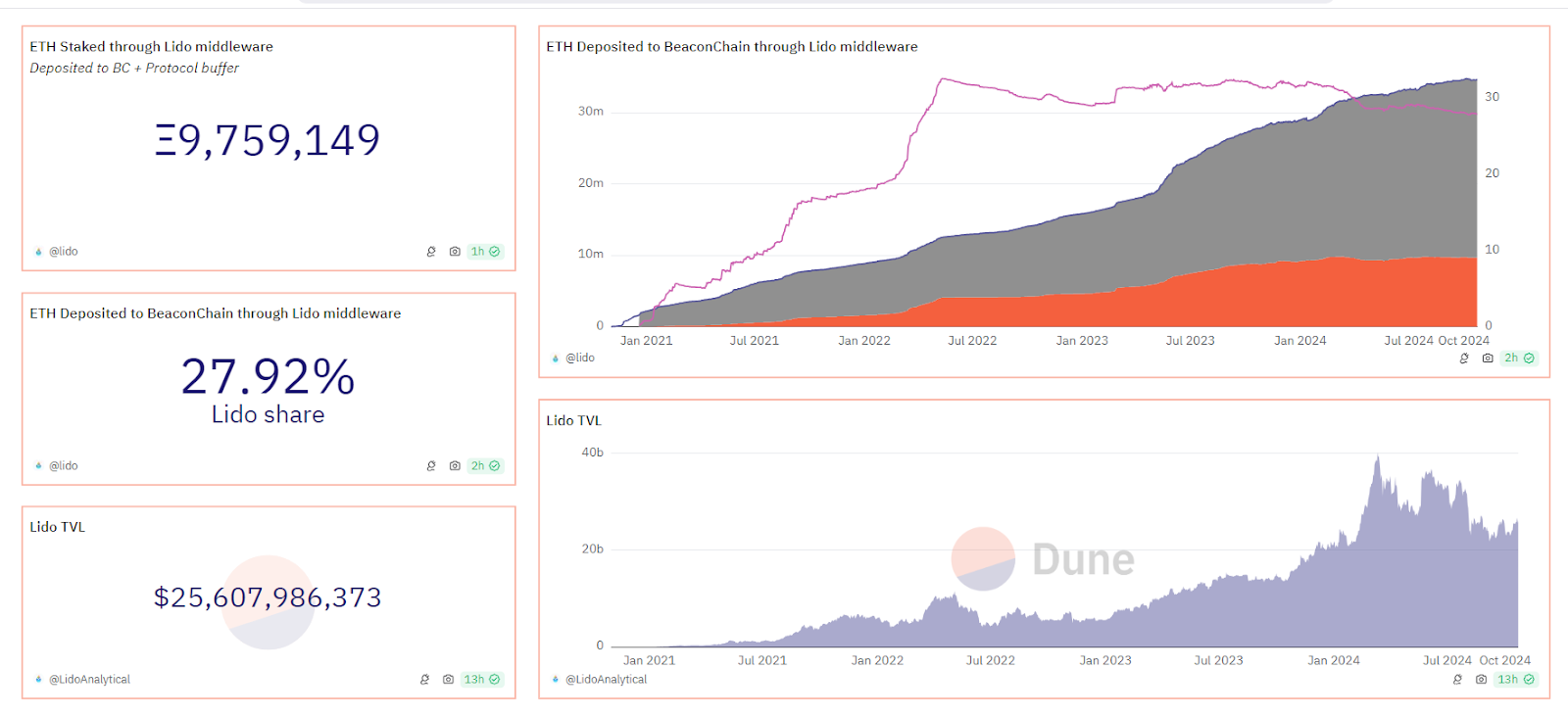

According to the data from Dune Analytics, Lido still seems to dominate the Ethereum crypto staking market, despite the declining numbers.

The protocol holds a market share of 27.92% with 9.75 million $ETH deposited through the same middleware.

This means that almost 1 out of 3 validators on the Ethereum network is managed entirely by Lido.

The platform boasts a TVL of 25.6 billion dollars, making it the dapp richest in the DeFi ecosystem.

In any case, it is important to clarify that from July 2022 onwards, Lido has consistently lost ground, ending up offering competitors 5% of the market share.

This situation contributes to the expansion of the restaking sector, which has introduced important players to the market such as Etherfi, Renzo, and EigenLayer.

Just to give an idea of the trend that is underway, in the last 7 days the EigenPods of EigenLayer have introduced 62,000 $ETH on the Beacon Chain.

In the same period, Lido experienced an outflow of 22,000 $ETH, highlighting a greater appeal of the latest generation protocols.

In the meantime $LDO, crypto of governance of Lido, must face a critical drop in prices.

In the last year, the currency has lost 38% of its value, dropping from 1.8 to the current 1.1 dollars.

After a rapid rise at the beginning of 2024, with prices reaching even 3.8 dollars, the bears have returned to make their presence felt, pushing strongly downward.

From September onwards, the contraction phase seems to have subsided, giving way to a sideways trend.

It is not excluded that in the bull market $LDO may also offer excellent percentage returns, but currently the scenario is anything but bullish.

As the first sign of recovery, we should see the crypto return at least above 1.6 dollars, and then continue in the bull climb.

The market cap of $LDO is 1 billion dollars at the time of writing, 25 times less than the TVL of the same Lido protocol.

en.cryptonomist.ch

en.cryptonomist.ch