Monochrome Bitcoin ETF (Ticker: $IBTC) AUM as of 10/10/24

invezz.com

14 October 2024 08:09, UTC

invezz.com

14 October 2024 08:09, UTC

Monochrome, a leading Australian crypto investment firm, is poised to launch the country’s first spot ether (ETH) exchange-traded fund (ETF) on Tuesday.

The Monochrome Ethereum ETF (IETH) will debut at 10:00 local time, marking a major milestone for the Australian crypto investment landscape.

This follows the successful launch of Monochrome’s spot bitcoin ETF in August.

As global interest in spot crypto ETFs rises, Monochrome’s latest offering provides Australian investors a regulated way to gain exposure to ether, the second-largest cryptocurrency by market capitalisation.

As of October 10, 2024, Hong Kong’s spot bitcoin and ether ETFs hold a combined $298.04 million in net assets, with $262.97 million in bitcoin and $35.07 million in ether.

In contrast, as per SoSoValue, US-listed crypto ETFs dominate the market, with bitcoin ETFs holding a massive $58.66 billion and ether ETFs managing $6.74 billion.

The smaller scale of non-US ETFs reflects the maturity and broader acceptance of crypto investments in the US market, but countries like Australia are catching up with the launch of regulated products such as the IETH.

Monochrome’s IETH stands out by allowing both cash and in-kind applications and redemptions, a feature seen in Hong Kong’s crypto ETFs.

This allows investors to buy into or redeem their holdings directly with ether, providing flexibility that is not always available in traditional crypto investment vehicles.

This structure could appeal to sophisticated investors looking to optimise their portfolios with direct ether exposure while minimising the need for cash conversions.

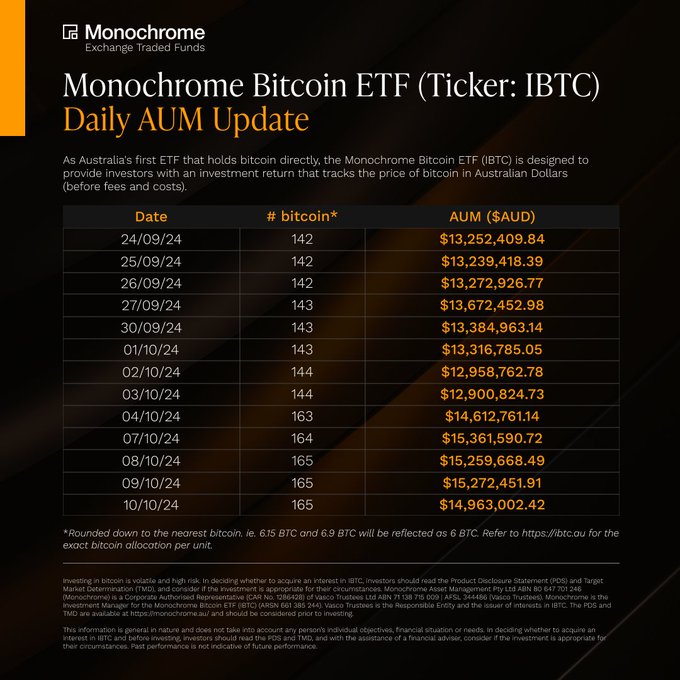

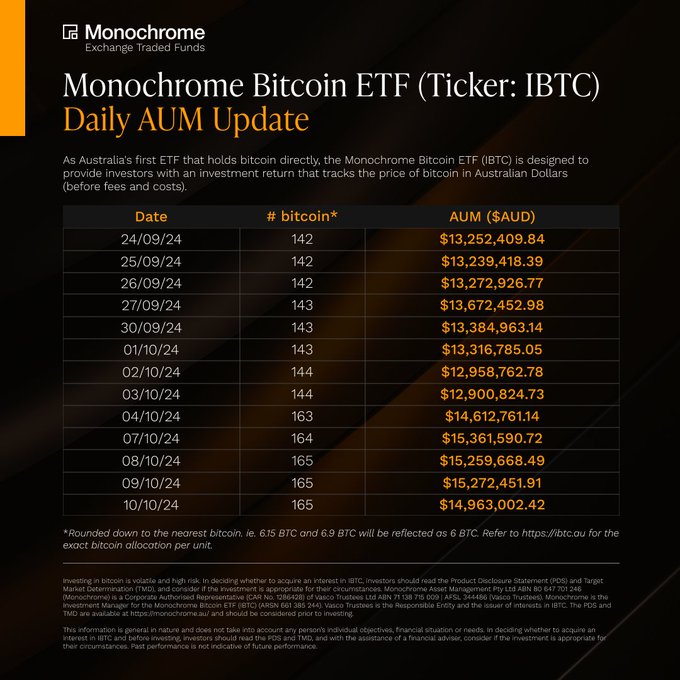

Monochrome’s IETH comes on the heels of its spot bitcoin ETF, which held 165 bitcoin as of October 10, valued just over $10 million.

While the bitcoin ETF’s holdings are relatively modest compared to global benchmarks, it has paved the way for regulated crypto products in Australia.

Monochrome Bitcoin ETF (Ticker: $IBTC) AUM as of 10/10/24

The launch of IETH underscores Monochrome’s confidence in the continued growth of the Australian crypto market and the appetite for diverse crypto exposure, including bitcoin’s primary competitor, ether.

Since the first US spot crypto ETFs debuted in January 2024, several other countries have approved listings, although none have yet reached the same scale.

For example, South Korea is now considering approving crypto ETFs, with the Financial Services Commission reportedly weighing its options.

The global race to launch more crypto ETFs continues, and Monochrome’s latest launch positions Australia as a serious contender in this space.

The success of Monochrome’s IETH could set the stage for more spot crypto ETFs in Australia.

With the government showing a more open stance toward regulating the crypto sector, and investors looking for alternatives to traditional asset classes, Australia’s ETF market could expand rapidly.

This would not only strengthen the country’s financial markets but also provide more options for investors eager to diversify their portfolios with digital assets.

The post Monochrome launches Australia’s first spot Ether ETF after bitcoin success appeared first on Invezz