The price of Ethereum has recently seen a significant drop, causing a wave of losses for many traders. With over $95 million in long positions liquidated, the market has experienced increased volatility, leading to a bearish momentum. But why did this happen? In this Ethereum price prediction article, we will explore the key factors behind the recent dip in Ethereum's price, what it means for traders and investors, and how the market's volatility has influenced this downward trend.

How has the Ethereum Price Moved Recently?

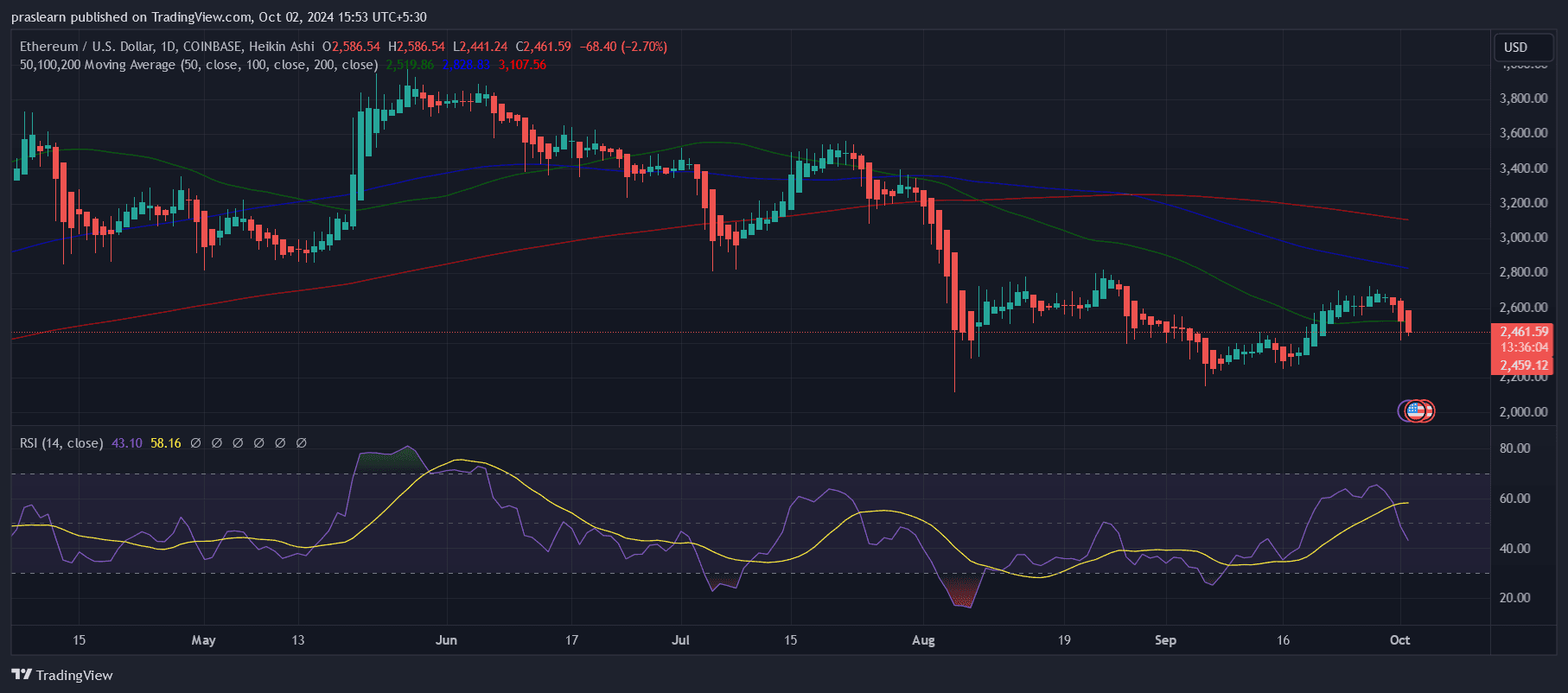

Currently, Ethereum is priced at $2,454.59, with a 24-hour trading volume of $34.53 billion, a market cap of $295.45 billion, and holds a market dominance of 13.71%. Over the past 24 hours, the price of ETH has dropped by 6.92%.

Ethereum hit its peak on November 10, 2021, reaching an all-time high of $4,867.17. On the other hand, its lowest price was recorded on October 21, 2015, when it traded at just $0.420897. The lowest point since its all-time high was $897.01 (cycle low), and the highest price since that point was $4,094.18 (cycle high). Currently, the market sentiment for Ethereum leans bearish, with the Fear & Greed Index indicating a level of 42, signaling a state of "Fear."

Ethereum's circulating supply stands at 120.37 million ETH, with an annual supply growth rate of 0.11%, resulting in the creation of 128,056 ETH over the last year.

Why Ethereum Price Drops?

The recent drop in Ethereum's price can be attributed to the escalating tensions in the Middle East, particularly between Israel and Iran, which have caused a ripple effect in global markets.

As the conflict intensified, with Israeli Prime Minister Benjamin Netanyahu vowing a response to Iranian missile attacks, investors reacted by shifting their assets from riskier investments like cryptocurrencies to more traditional safe havens, such as gold and crude oil. This flight to safety is a common response in times of geopolitical instability, as investors seek to protect their capital from potential market downturns.

The consequence of this market shift is a decline in Ethereum’s price, leading to the liquidation of many long positions. When traders anticipate a price rally and the market moves against their position, the value of their assets drops to a level where the exchange forcefully closes their positions, resulting in a liquidation.

This mechanism protects exchanges from bearing the losses but often results in significant losses for traders. In Ethereum's case, the unexpected market downturn forced many to sell their positions at a lower price, exacerbating the price drop. According to Coinglass data, ETH long positions saw liquidations totaling $96 million on Monday, marking the highest single-day liquidation in nearly two months.

The predictive outlook for Ethereum suggests that the market could remain bearish as long as the Middle East tensions persist and global market volatility remains high. Such geopolitical events often create uncertainty, causing investors to be cautious and favor assets perceived as more stable.

The cycle of liquidation further pressures the price downward, as more traders exit their long positions to avoid further losses. If the situation stabilizes or tensions ease, Ethereum might regain its upward trajectory; however, in the current climate, caution and volatility are likely to persist. As the Fear & Greed Index indicates a "Fear" sentiment, traders should keep a close watch on global developments, as any escalation could further influence Ethereum's price and market direction.

Will Ethereum Price Rise in the Next 7 Days?

Predicting Ethereum’s price movement in the next 7 days requires analyzing both market sentiment and underlying external factors that could influence investor behavior. Currently, Ethereum faces downward pressure due to macroeconomic uncertainty and geopolitical tensions, which have historically led to market volatility. However, several key factors could potentially trigger a short-term price rebound or further stabilize its value.

From a market dynamics perspective, Ethereum's price movement often correlates with overall cryptocurrency market sentiment and Bitcoin's performance. If Bitcoin shows signs of recovery or stability, it could positively affect Ethereum's price as investors regain confidence.

Additionally, market indicators like trading volume, open interest in futures, and on-chain data—such as wallet activity and Ethereum staking behavior—will play a crucial role. If these indicators show increased activity or bullish sentiment, this could signal a rise in demand, driving the price upward.

Another factor to consider is any improvement or resolution of geopolitical tensions, which could positively impact global markets and investor sentiment toward riskier assets like cryptocurrencies.

A de-escalation in Middle East tensions or a general calming of market fears would likely encourage traders to reenter the market, potentially leading to a short-term rise in Ethereum's price. Furthermore, Ethereum’s own developments, such as updates related to scalability, network upgrades, or increased adoption of decentralized finance (DeFi) platforms, could drive positive sentiment and boost prices.

However, given the high level of uncertainty in global markets and the potential for further liquidations, the possibility of Ethereum rising in the next 7 days is balanced against significant risks. If the bearish momentum continues and global market fears persist, Ethereum could struggle to achieve a substantial rise within a week. The market may see short-lived rallies or "dead cat bounces," but unless there is a significant change in either the geopolitical situation or a sudden bullish catalyst within the crypto market, sustained upward movement might be limited.

While there is a possibility for Ethereum’s price to rise over the next 7 days if market sentiment shifts positively or external tensions ease, traders should be prepared for continued volatility. The likelihood of a price rally is contingent on broader market dynamics, geopolitical factors, and specific developments within the Ethereum ecosystem. Thus, a cautious, closely monitored approach to trading is advisable during this period.

cryptoticker.io

cryptoticker.io