- Ethereum ETF inflows and positive funding rates could help maintain bullish momentum.

- Investors need to be cautious of $ETH's rising exchange reserve.

- Ethereum could retest the $2,707 resistance after bouncing off the 50-day SMA.

Ethereum ($ETH) traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by $ETH ETF net inflows and an uptrend in funding rates. However, investors may be wary of a potential correction from $ETH's rising exchange reserve.

Ethereum ETF inflows and positive funding rates paint bullish outlook

Ethereum ETFs recorded net inflows of $43.2 million on Wednesday, bringing their total inflows within the past two days to over $105 million. BlackRock's ETHA and Grayscale Mini Ethereum Trust were largely responsible for the positive flows, with inflows of $9.4 million and $26.6 million, respectively.

The high inflows follow renewed investor interest in Ethereum since the US Federal Reserve (Fed) decision to cut rates by 50 basis points (bps) on September 18.

Several investors have earlier predicted that $ETH ETFs' underperformance was due to their launch during the summer holiday season. As investors return from the holiday and a historically positive Q4 season approaches, $ETH ETFs may begin to record more inflows — especially if Grayscale's ETHE exodus cools.

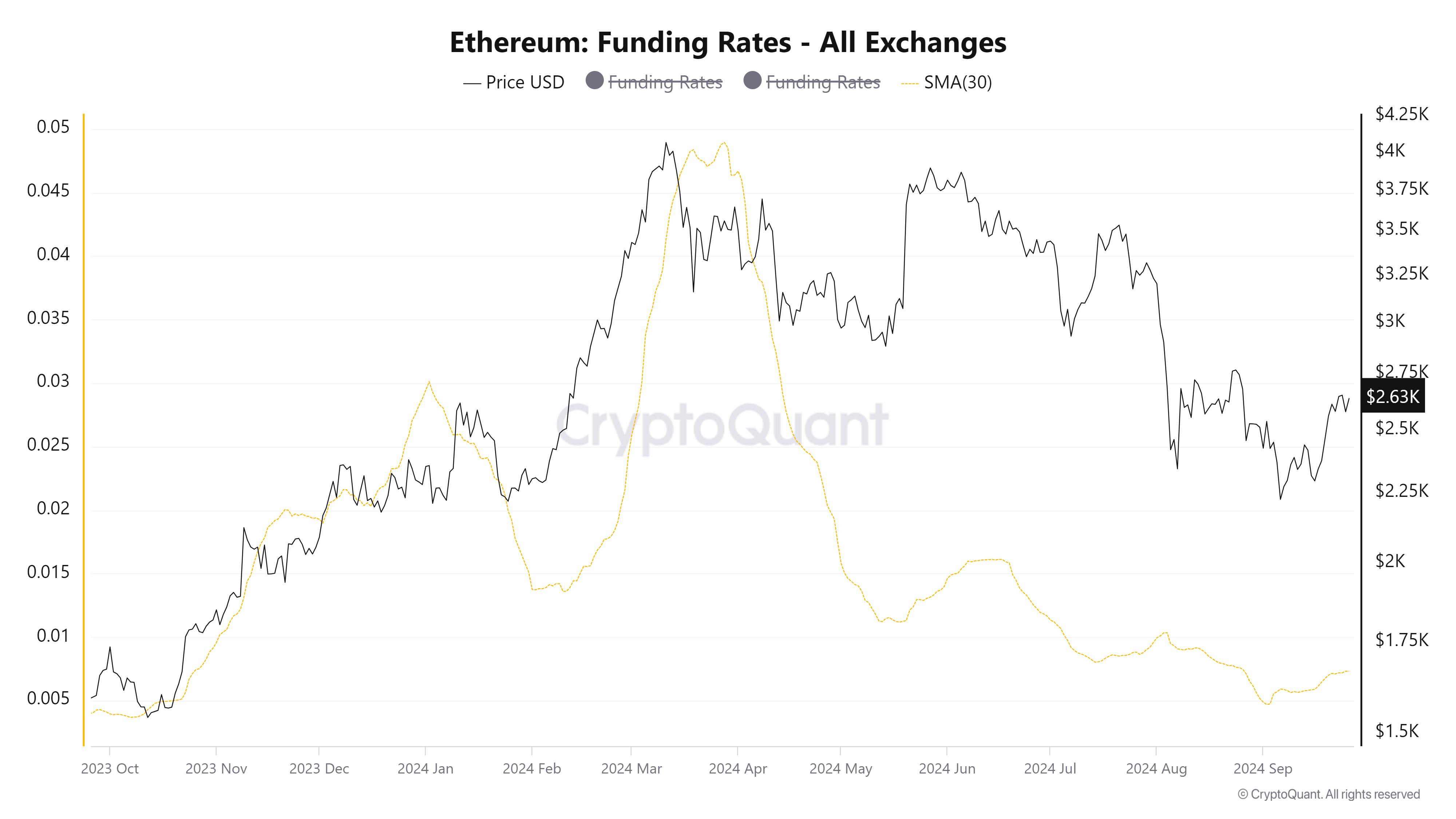

The bullish outlook is supported by a shift to an uptrend in Ethereum's 30-day simple moving average (SMA) funding rate.

Funding rates are periodic payments between perpetual traders to maintain parity between an asset's spot price and futures contracts. A positive funding rate indicates long positions are dominant in the market, while vice versa for a negative funding rate.

Ethereum Exchange Funding Rates

Since reaching a low on September 3, the funding rate 30-day SMA has been rising, indicating growing bullish sentiment among traders.

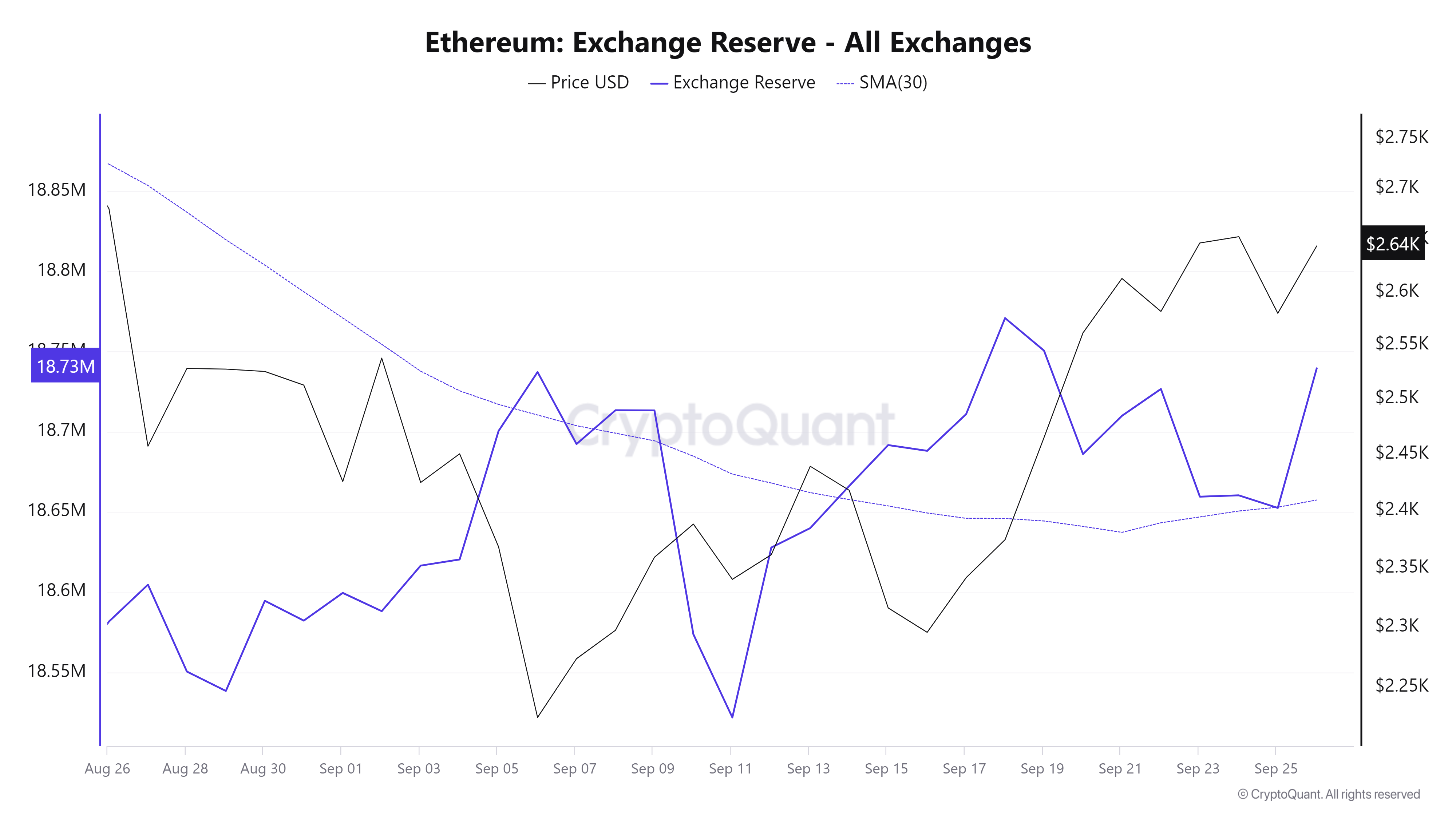

However, investors need to be cautious of $ETH's rising exchange reserve, which has taken a slightly upward turn in the past month. Rising exchange reserves could lead to increased selling pressure and a subsequent price decline.

Ethereum Exchange Reserve

Ethereum finds support around 50-day SMA

Ethereum traded around $2,640 on Thursday, up 2.6% on the day. In the past 24 hours, $ETH has recorded over $21 million in liquidations, with long and short liquidations accounting for $7.47 million and $13.97 million, respectively.

On the 4-hour chart, Ethereum reclaimed the $2,595 support after bouncing off the 50-day SMA. If the bullish momentum continues, $ETH could rally to test the $2,707 resistance. A successful move above this level could see $ETH aim to reclaim the $2,817 price level, which held as a key support level for over four months.

The Relative Strength Index (RSI) and Stochastic Oscillator momentum indicators are above their neutral levels, indicating a bullish bias.

$ETH/$USDT 4-hour chart" src="https://cnews24.ru/uploads/a7b/a7b10f7adb977ba9f147b1e33c01ae016554e34a.png" size="1281x571">

$ETH/$USDT 4-hour chart

On the downside, if $ETH breaks the $2,595 level, the 50-day, 100-day and 200-day SMAs could provide support to prices. A daily candlestick close below $2,395 will spark heavy bearish momentum for $ETH.

fxstreet.com

fxstreet.com