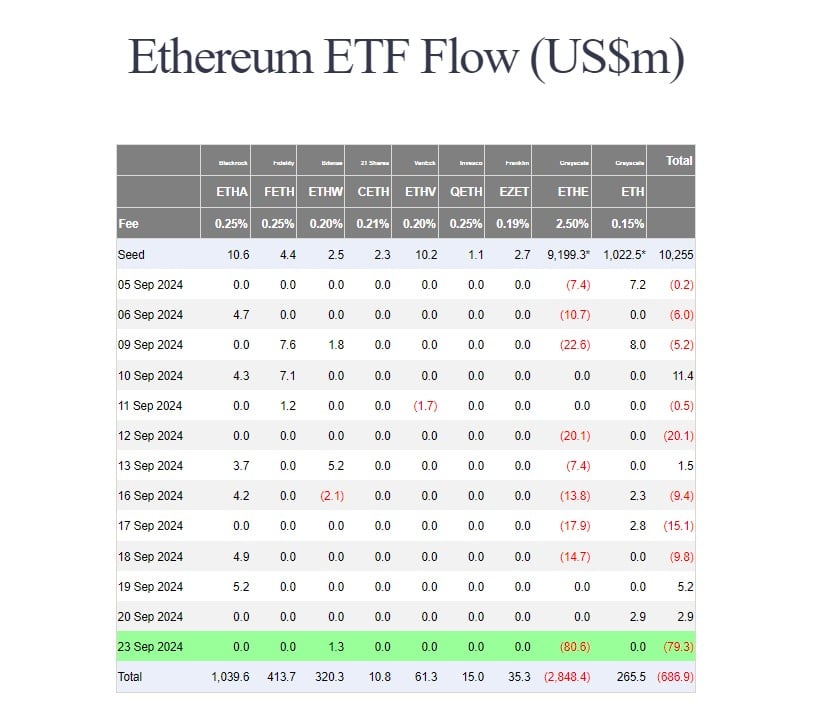

Over $79 million was withdrawn from nine US spot Ethereum ETFs on Monday, the largest single-day outflow since July 29, according to data tracked by Farside Investors. The Grayscale Ethereum Trust, or ETHE, led redemptions, with investors pulling over $80 million from the fund.

Since its ETF conversion, the ETHE fund has seen net outflows of over $2.8 billion. Despite continued bleeding, it is still the largest Ether fund in the world with around $4,6 billion in assets under management.

Monday’s outflows ended a brief two-day gain for these ETFs. In contrast to ETHE, the Bitwise Ethereum ETF ($ETHW) was the sole gainer on the day with zero flows reported from most competing funds. Investors bought over $1 million worth of shares in Bitwise’s $ETHW offering.

As of September 23, $ETHW’s net buying topped $320 million, while its Ether holdings exceeded 97,700, worth around $261 million at current prices.

The sluggish demand for US-listed Ethereum ETFs has continued since their market debut on July 23. BlackRock’s iShares Ethereum Trust (ETHA) currently leads in net inflows and was the first to reach $1 billion in net capital. It is followed by Fidelity’s Ethereum Fund (FETH) and Bitwise’s $ETHW.

While Ethereum ETFs faced a downturn, their Bitcoin counterparts enjoyed a third consecutive day of gains, collectively adding $4.5 million, Farside’s data shows.

Gains from Fidelity’s Bitcoin Fund (FBTC), BlackRock’s iShares Bitcoin Trust (IBIT), and Grayscale’s Bitcoin Mini Trust (BTC) offset substantial outflows from Grayscale’s Ethereum Trust.

cryptobriefing.com

cryptobriefing.com