Even though Ethereum ($ETH) is facing challenges, its price still has the potential to climb. Currently, $ETH is trading at $2,411.

Recently, concerns have surfaced that $ETH could enter a bear cycle. While this is possible, an on-chain analysis suggests how the cryptocurrency might avoid capitulation.

Ethereum Has Strong Support

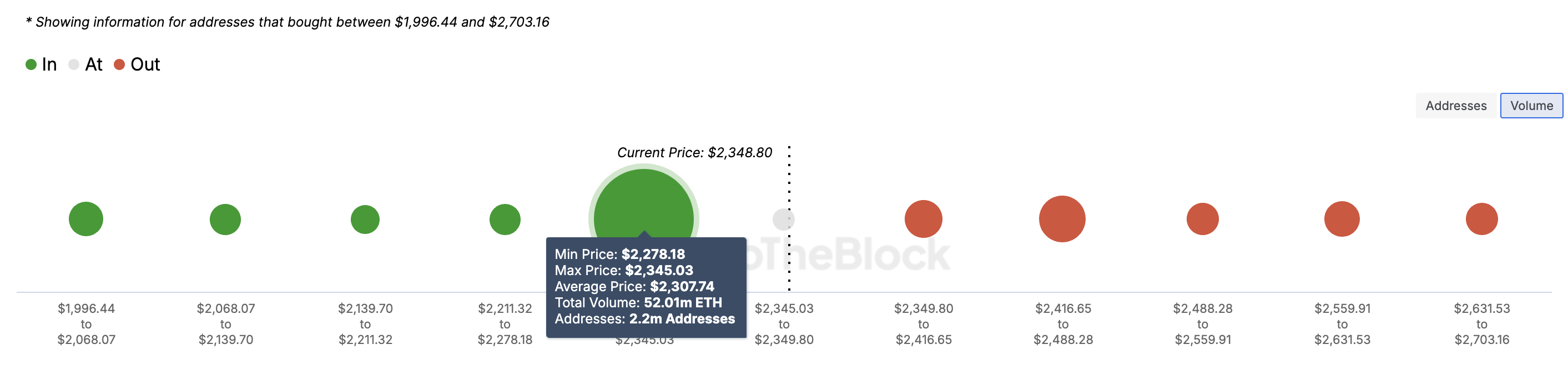

Based on the In/out of Money Around Price (IOMAP), a metric that classifies addresses into those in profits, in loss, and at breakeven point, market participants accumulated 52 million coins at an average price of $2,345,

This volume is higher than the volume purchased between $2,349 and $2,703. Typically, larger volumes at certain price levels have a stronger influence on price movement. If more volume is at a loss, $ETH would face resistance as holders may sell to break even.

On the other hand, higher volume in profit indicates strong support, as holders are less likely to sell at a lower price. Based on this, $ETH has significant support around $2,345, which could help push the price higher and potentially reach $2,800.

Read more: How To Buy Ethereum ($ETH) With a Credit Card: Complete Guide

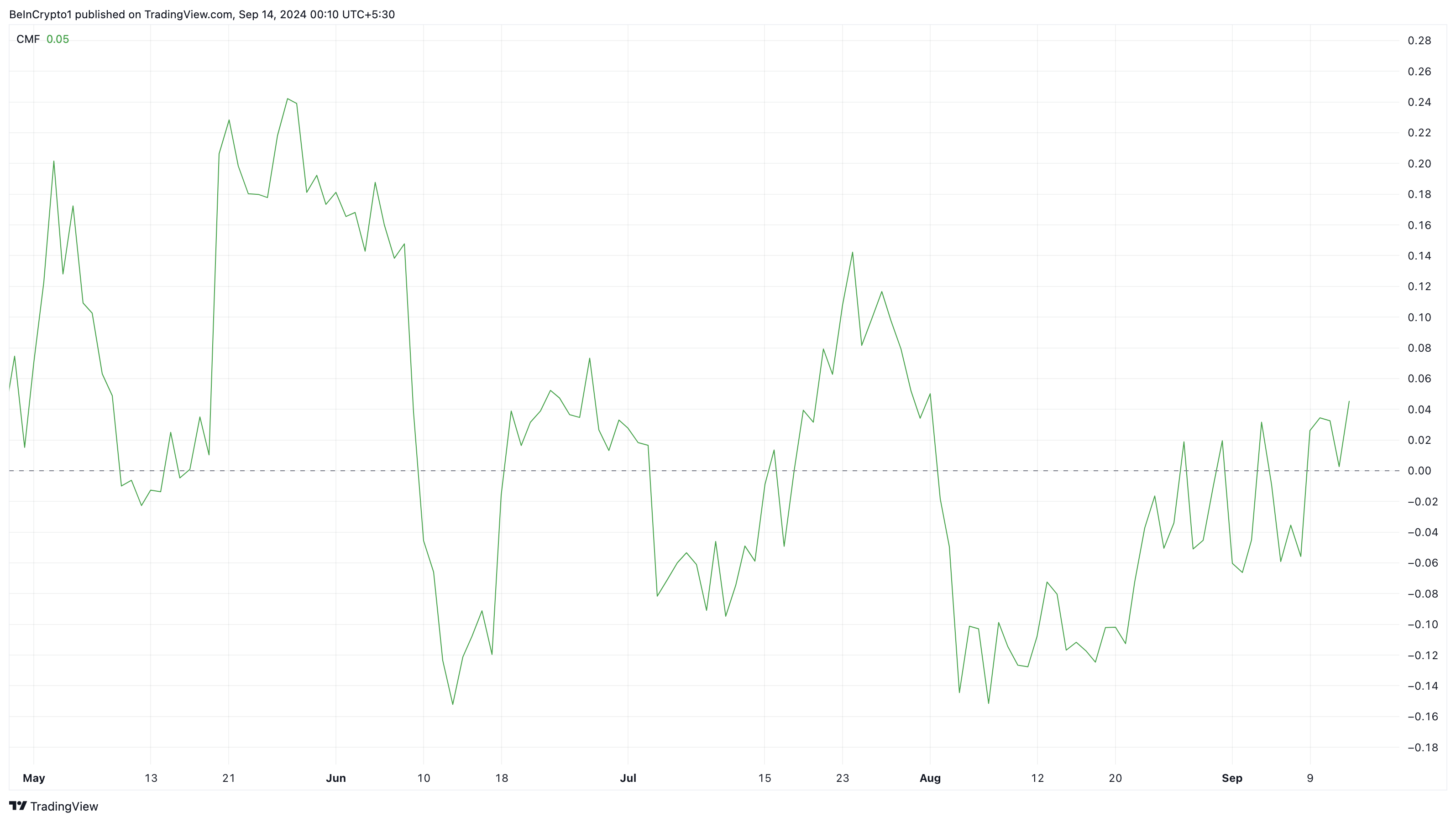

Another indicator reinforcing this outlook is Ethereum’s Chaikin Money Flow (CMF), which measures the balance between accumulation and distribution.

When the CMF rises, it signals that accumulation is outpacing selling pressure. Conversely, a falling CMF indicates higher distribution. On the daily chart, the CMF has moved into the positive region, suggesting that increased buying pressure could help Ethereum recover from recent losses and push its price higher.

$ETH Price Prediction: Demand Rises

On the daily timeframe, Ethereum ($ETH) has risen from $2,225 to $2,421, indicating a steady upward trend that suggests further price increases may be on the horizon.

According to the chart below, a supply zone exists around $2,700, which could act as resistance. However, the $2,400 region serves as a strong demand zone for $ETH, increasing the likelihood of the altcoin surpassing the resistance at $2,581.

Additionally, the sell wall around $2,744 supports the potential for $ETH to push higher. If $ETH clears these obstacles, its price could reach $2,800 and possibly $2,991.

Read more: Ethereum ($ETH) Price Prediction 2024/2025/2030

That said, traders should be cautious of potential market volatility. If the broader market shifts from bullish to bearish, this forecast may no longer hold. In that scenario, $ETH’s price could drop to $2,114.

beincrypto.com

beincrypto.com