Real Vision analyst Jamie Coutts believes Ethereum ($ETH) could be on the cusp of a massive rally based on several market conditions.

Coutts says on the social media platform X that momentum is building in the crypto space which could signal that the smart contract platform is about to surge.

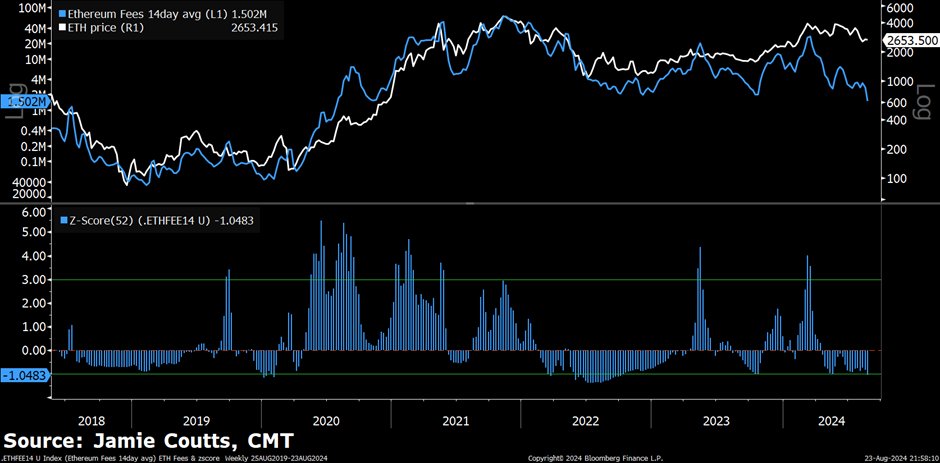

However, the analyst warns that $ETH’s network activity needs to see a significant increase before an uptrend is ignited.

“While the conditions for a rally are forming, Ethereum will struggle to rally without a resurgence in activity. Fees are at four-year lows.

On the positive side:

- Layer-2 (L2) adoption has been strong, with DAUs (daily active users) +200% in the past year.

- Global liquidity is turning higher.

- Stablecoin supply increasing, nearing ATHs (all-time highs)

- RWA (real-world asset) tokenization is up 70% to $11.3 billion year-to-date.

On the negative side:

- Some forward cashflow estimates are likely adjusting to lower fee expectations and a growing realization that L2 value accrual is at the expense of the L1 (layer-1) long term.”

Ethereum is trading for $2,761 at time of writing, up over 4% in the last 24 hours.

The analyst also notes that revenues are down across the whole crypto ecosystem on a year-over-year (YoY) basis.

“Crypto Ecosystem Update across two key metrics: active addresses (DAUs) and fees (July-2024) 1. YoY aggregate performance: DAUs up 150%. Fees down 20%.”

Lower fees indicate diminished network activity as users are not competing as much to transact on crypto networks.

Generated Image: DALLE3

dailyhodl.com

dailyhodl.com