- Ethereum market dominance has shrunk by 1.5% since the FTX implosion in November 2022.

- BlackRock iShares Ethereum Trust has crossed $1 billion in cumulative net inflows despite ETH ETF outflows.

- Ethereum continues consolidation as it fails to move above key trendline again.

Ethereum (ETH) is up 2% on Wednesday following Glassnode's report showing its market cap dominance loss compared to Bitcoin. Meanwhile, despite negative flows in the broader ETH ETF category, BlackRock's iShares Ethereum Trust (ETHA) crossed the $1 billion net inflow milestone.

Daily digest market movers: Ethereum dominance, BlackRock's ETHA milestone

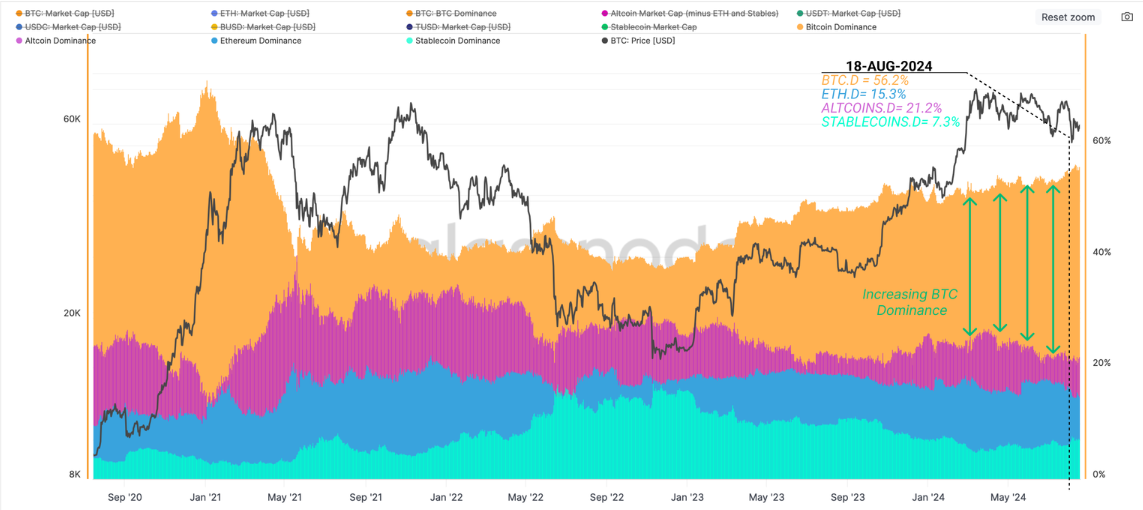

Ethereum dominance has shrunk from 16.8% to 15.2% since the FTX exchange implosion in November 2022, noted Glassnode in a recent report. Dominance is the ratio of an asset's market capitalization to the cumulative market capitalization of all other cryptocurrencies.

"As the second largest asset in the ecosystem, Ethereum has recorded a dominance decline of 1.5%, remaining relatively flat over the past two years," wrote Glassnode analysts.

In comparison, Bitcoin's market dominance has grown from 38.7% to over 56% within the same time. The rise also comes at the expense of stablecoin and altcoin dominance, which have declined by 9.9% and 5.9%, respectively.

Major Asset Dominance

Despite the market capitalization contraction, capital has fairly continued flowing into Ethereum since late October 2023.

Additionally, Ethereum's sell-side vs buy-side (USD) inflow reduced consistently since March and has now turned positive for the first time since June 2023, as per Glassnode data. A potential reason for the positive data may be heavy buying pressure from investors after prices dipped on August 5 to lows last seen in January.

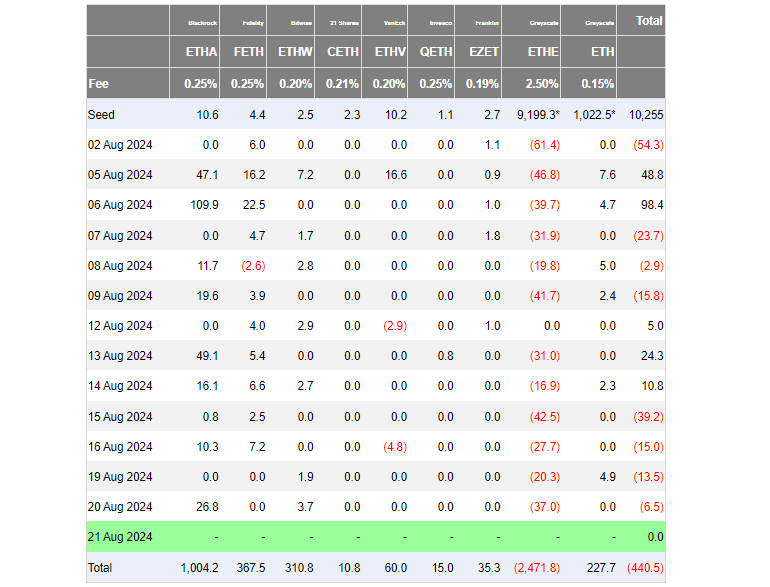

Meanwhile, BlackRock's iShares Ethereum Trust (ETHA) crossed the $1 billion threshold on Tuesday after recording a net inflow of $26.8 million, according to data from Farside Investors. The milestone places ETHA among the top seven ETF launches, noted Nate Geraci, president of the ETF Store.

Despite ETHA's positive move, the combined net flows for Ethereum ETFs were negative, posting net outflows of $6.5 million. ETH ETFs have now stretched their outflow streak to four consecutive trading days of negative flows. This is in contrast to Bitcoin ETFs, which have recorded four consecutive days of net inflows.

Ethereum ETF Flow

ETH technical analysis: Ethereum continues failed attempts to move above key trendline

Ethereum is trading around $2,630 on Wednesday, up 2% on the day. In the past 24 hours, Ethereum traders have sustained over $40 million in liquidations, with long and short liquidations accounting for $35.36 million and $4.66 million, respectively.

Ethereum's price has been consolidating in the past week, indicating indecisiveness among traders. While buyers have attempted to stage a recovery, the resistance around $2,783 and a descending trendline extending from May 27 to September 27 has held ETH around the $2,500 to $2,700 range.

ETH/USDT Daily chart" src="https://cnews24.ru/uploads/838/838873a633757be6eeaf86d3517888c987ad87ea.png" size="1281x571">

ETH/USDT Daily chart

The trendline suggests ETH could decline toward the $2,000 to $2,200 range in the coming weeks before staging a rally. ETH posted similar declines from August 2022 to November 2022 and July 2023 to October 2023 before eventually riding a three-month rally on both occasions.

The Relative Strength Index (RSI) is below its midline at 40, indicating neutrality. However, the Awesome Oscillator posting consecutive shorter green bars below the zero line suggests a bullish turnaround may be on the cards despite the prevailing bearish trend.

A daily candlestick close above the $2,783 resistance will invalidate the short-term bearish thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

fxstreet.com

fxstreet.com