The recent sharp price drop in Ethereum has sparked a flurry of speculation among investors, raising questions about whether the bearish trend will persist.

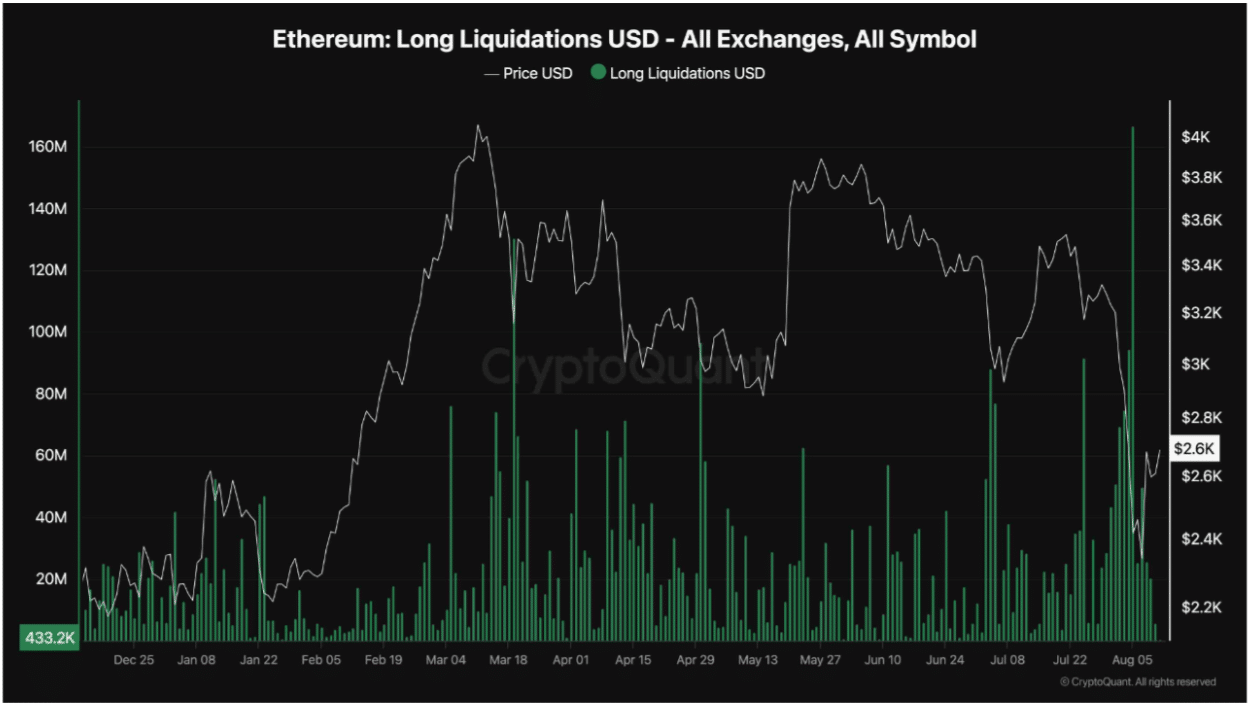

However, emerging data from the futures market indicates a possible reversal driven by significant changes in long liquidations across exchanges. Recent data from CryptoQuant highlights a major liquidation event in Ethereum’s futures market, reaching levels unseen since November 2022.

These liquidations measure the forced closure of long perpetual positions due to price declines, which have recently triggered a cascade of liquidations across all exchanges. This development may indicate a cooling period in the futures market, as many leveraged positions have been purged.

CryptoQuant’s analyst Shayan highlighted that such a reset could typically stabilize the market, paving the way for renewed investor interest. The potential for a bullish surge increases if demand returns, as a reset futures market often attracts new buyers.

Historical Context

Historically, Ethereum’s price declines have often triggered significant spikes in long liquidations. For instance, in January, a price dip led to over $50 million in liquidations, followed by a swift recovery.

Similarly, as Ethereum’s price dropped to below $3,200 in March, liquidations exceeded $120 million, contributing to a notable market drop before rebounding. Most recently, in August, the chart shows a dramatic liquidation spike of over $160 million as Ethereum’s price fell to $2,100.

Essentially, with leveraged traders flushed out in the latest price drop, spot buying pressure is taking over, as evidenced by the fact that $ETH has since rebounded to $2,700.

Emerging Buying Interest?

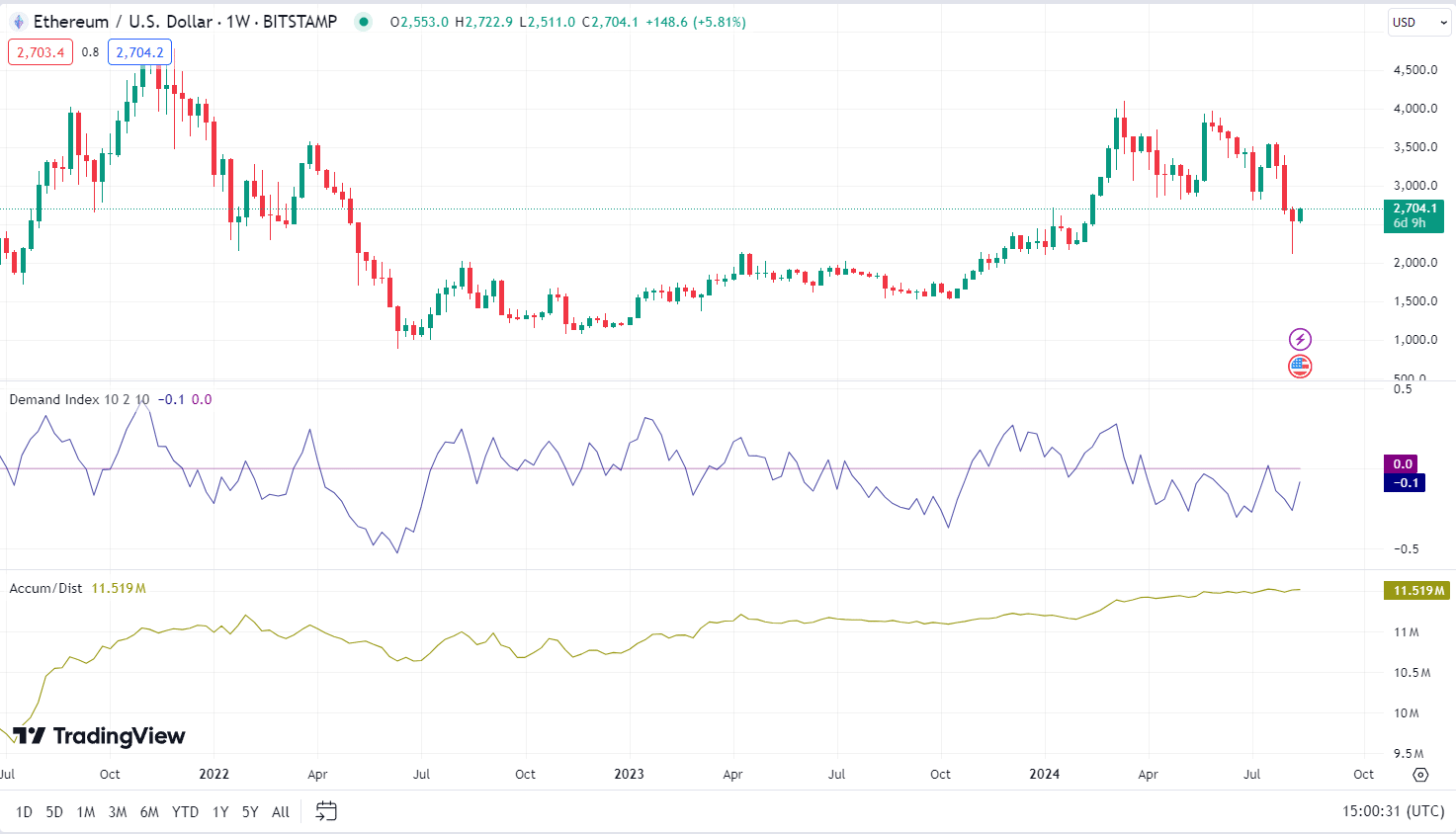

Key technical indicators suggest that Ethereum’s market may be stabilizing, with the potential for a bullish turnaround. Notably, the Demand Index, currently slightly below zero at -0.1, shows signs of flattening and a slight upward movement. This indicates that selling pressure could be diminishing, with buying interest beginning to resurface.

Additionally, the Accumulation/Distribution indicator has been trending upward, with a current value of 11.519 million. This steady accumulation suggests that investors are consistently buying Ethereum, a sign that could precede a significant price move. As strong hands gather the asset, the likelihood of a future price surge increases.

Staking Withdrawals Contrast Bullish Sentiment

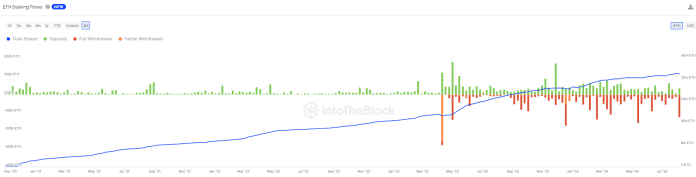

In contrast to these potentially bullish indicators, on-chain data presents a more concerning picture. Ethereum has seen a sharp increase in staking withdrawals, with over 122,000 $ETH withdrawn from staking pools this week alone.

This marks the highest level of withdrawals since May, translating to approximately $521 million. The surge in withdrawals signals increased selling pressure as investors unstake their Ethereum, potentially liquidating their holdings. This added supply in the market could exert downward pressure on Ethereum’s price, particularly if demand remains weak.

thecryptobasic.com

thecryptobasic.com