Ethereum has been under intense scrutiny due to its recent price fluctuations and market performance. While facing a turbulent period marked by significant declines and market challenges showcasing the bearish trend, Ethereum has also shown signs of resilience and potential recovery that could lead to an opposite and more bullish trend. So, this article explores the latest developments in Ethereum, analyzing key market indicators for both potential trends and comparing its performance with that of Solana.

Ethereum Mixed Signals: What To Expect For $ETH Price?

- Ethereum Price Shows Bullish Signs: Are Whales Buying the Dip?

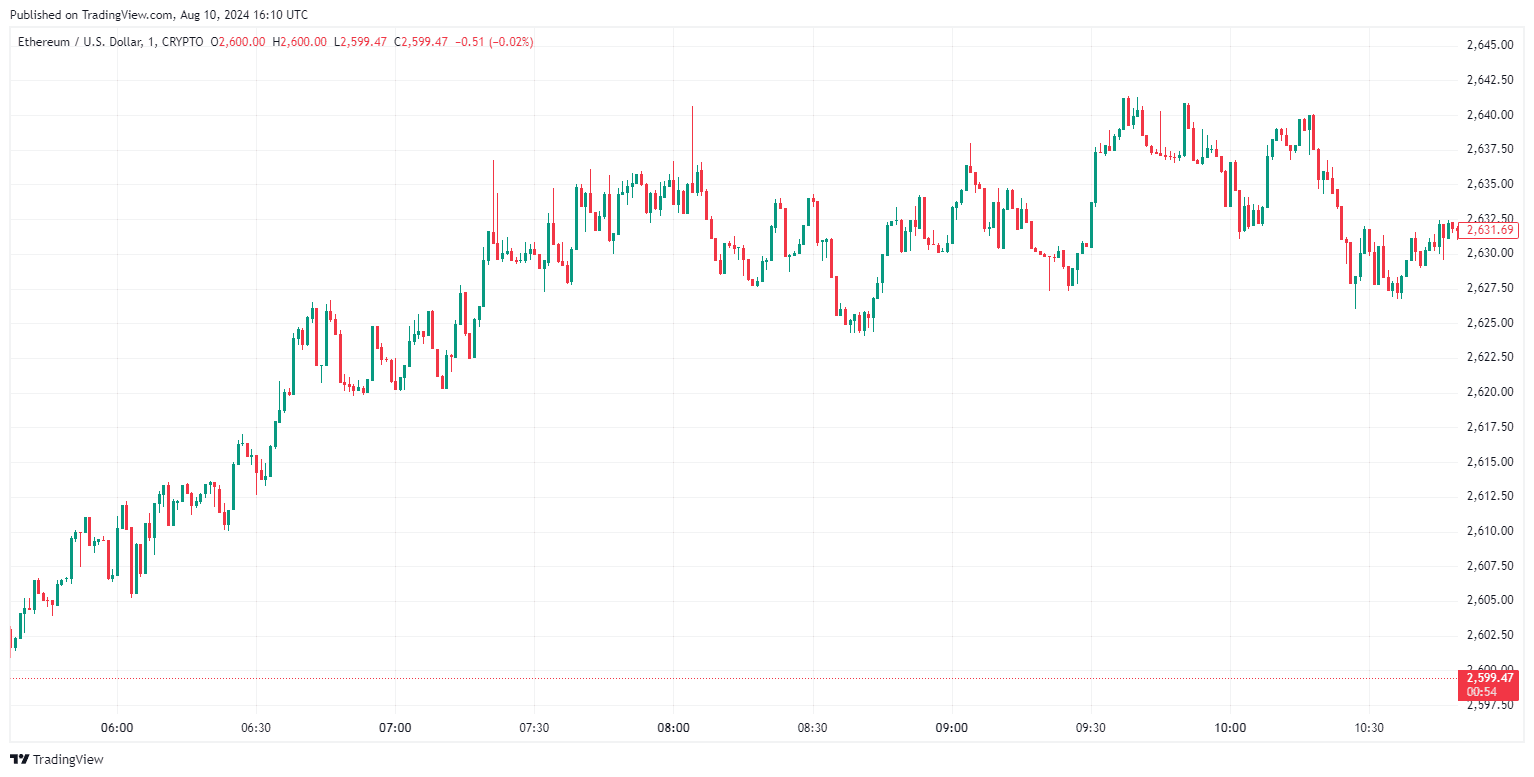

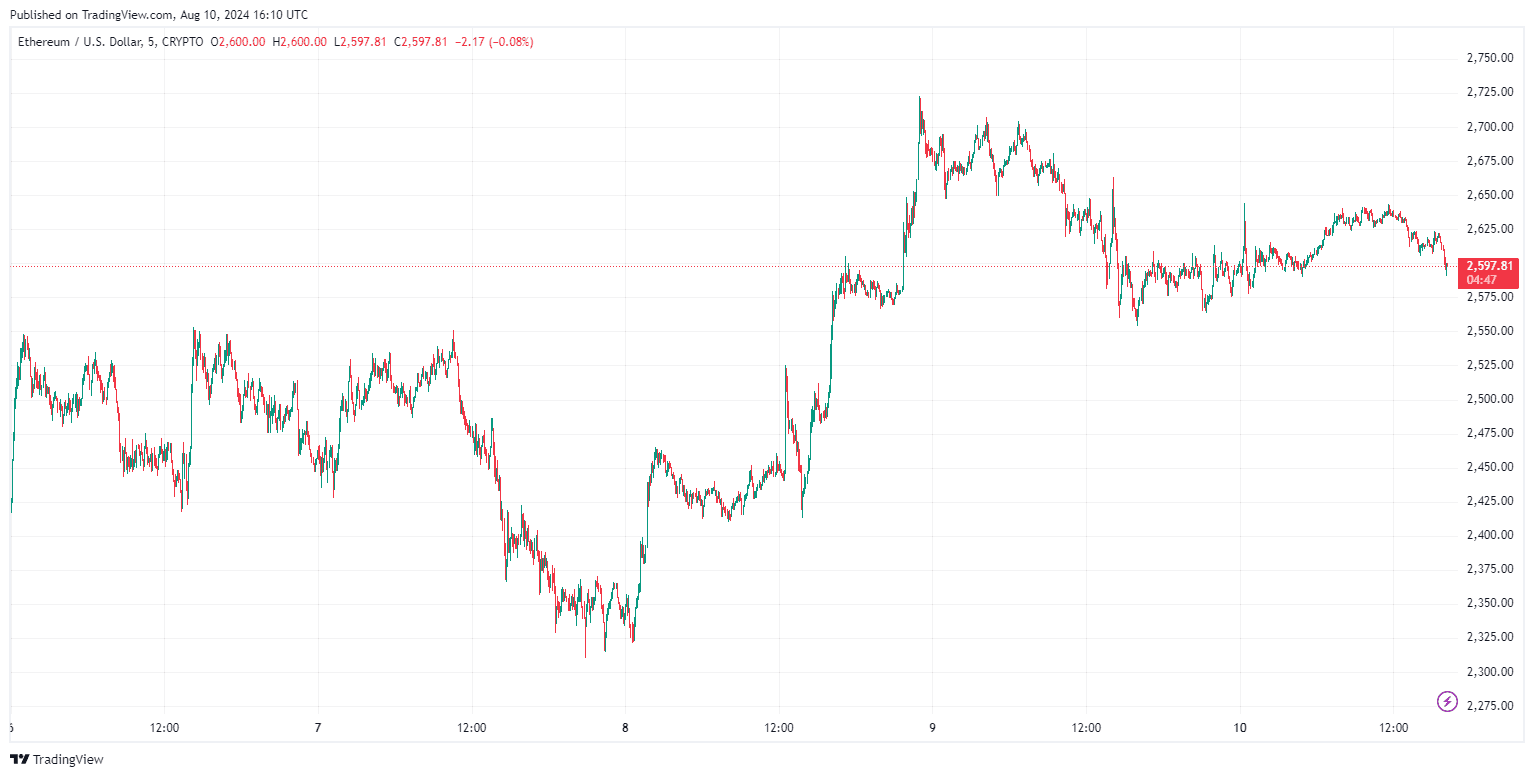

Ethereum bullish trend was detected by $ETH price forming a pennant pattern, which typically signals a potential price breakout. Crypto analysts have identified a critical support zone between $2,314 and $2,435, where a substantial amount of Ethereum has been accumulated. The current target for Ethereum price is set around $2,930, reflecting a possible increase of over 4% from its recent lows.

Despite a steep market correction that saw Ethereum lose nearly a third of its value, the past week has seen a resurgence in the overall crypto market. With Bitcoin reaching $63,000, Ethereum whales have capitalized on the dip, purchasing approximately $56 million worth of $ETH within 24 hours. This activity suggests that influential investors are confident in Ethereum's long-term potential.

- Ethereum Price Shows Bearish Signs: What Does It Mean When Open Interest Declines?

In August, Ethereum open interest—a metric indicating the total number of open derivatives positions—dropped by over 40%, amounting to a $6 billion decline. This sharp reduction in open interest reflects a cautious market sentiment, with investors either closing their positions or facing liquidation amid broader market downturns.

A low Ethereum open interest generally indicates reduced participation in the futures and options markets, which can lead to decreased liquidity and heightened price volatility. Although Ethereum has shown signs of recovery denying an Ethereum bearish trend soon, and however reflecting that the significant drop in open interest suggests that the price of $ETH could remain stable in the short term, with fewer investors engaging in speculative trading.

Ethereum vs Solana: A Comparative Analysis

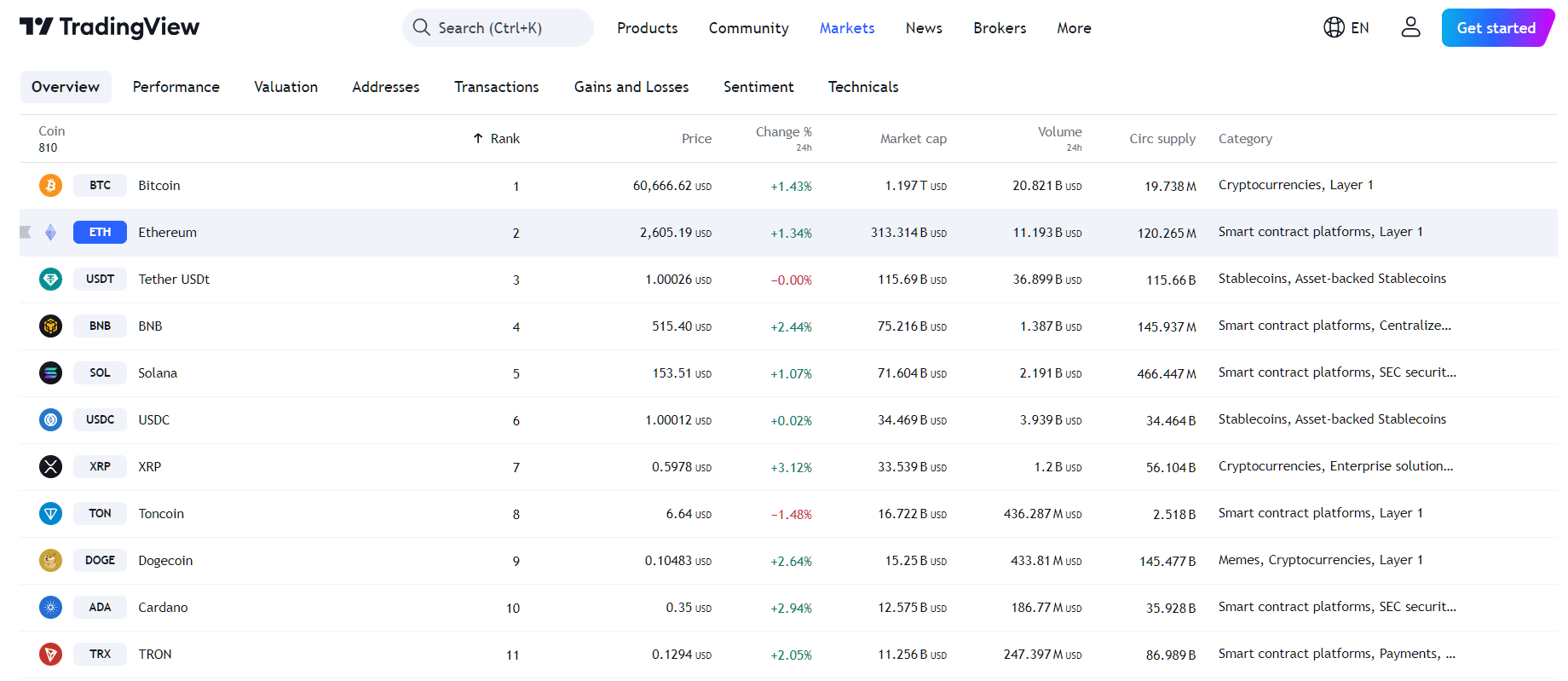

The competition between Ethereum and Solana has intensified, with prominent crypto analysts offering differing views on their relative strengths. A renowned trader, recently highlighted Solana's advantages over Ethereum, citing faster transaction speeds, lower costs, and ease of use as key factors that make Solana a superior blockchain.

While Ethereum remains the second-largest cryptocurrency by market capitalization, it has faced criticism for its slower transaction speeds and higher fees. Additionally, concerns about Ethereum's decentralization have been raised, further fueling the debate.

On the other hand, Solana's unique Proof of History (PoH) consensus mechanism and robust technical infrastructure have contributed to its growing popularity. He even predicted that Solana could double in value relative to Ethereum in the coming months, signaling a potential shift in market dominance.

$ETH vs $SOL Price Performance (24h)">

$ETH vs $SOL Price Performance (24h)">

Ethereum's recent price movements and market performance have sparked significant interest and debate within the crypto community. While the decline in open interest and the emergence of strong competitors like Solana present challenges, Ethereum's resilience and continued support from major investors indicate that it remains a critical player in the cryptocurrency market. As the market evolves, the ongoing battle between Ethereum and Solana will likely shape the future of decentralized finance.

cryptoticker.io

cryptoticker.io