Widely followed analyst and trader Michaël van de Poppe believes that Ethereum ($ETH) could suddenly take off on a massive rally for one main reason.

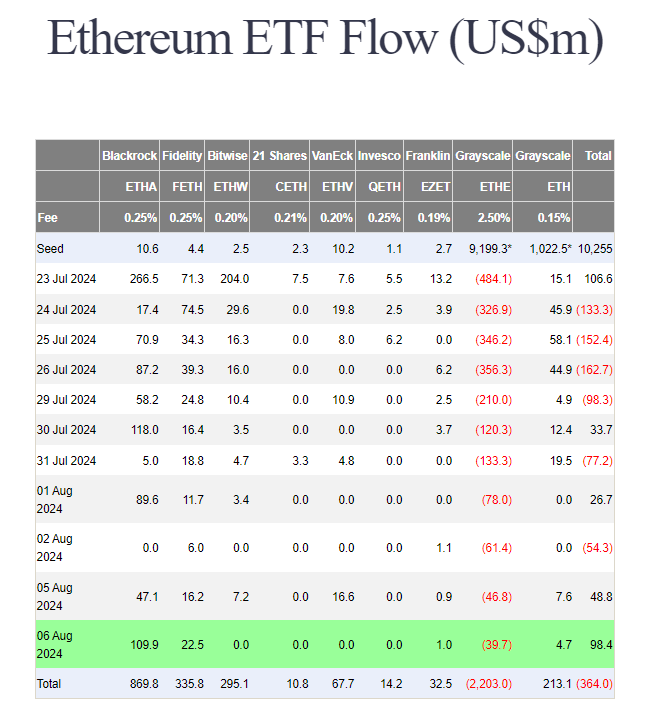

Van de Poppe tells his 722,000 followers on the social media platform X that inflows into the spot $ETH exchange-traded funds (ETFs) are exceeding new supply, which he believes is a bullish catalyst.

“The $ETH supply was created in 2024: $160 million. The net inflow in $ETH ETF in the past two days: $150 million. The demand is exceeding the supply.”

However, the analyst suggests that $ETH’s big rally will likely depend on whether the ETF inflows persist.

“I think Ethereum is super undervalued and ready for a big run if this inflow sustains.”

The analyst believes that Ethereum could soar to around $4,000 within weeks if it can hold $2,600 as support on the weekly chart.

“The second scenario took place for $ETH, which was way deeper than we expected. However, I think that, if Ethereum closes above $2,600, we’ve seen the actual low and are ready for a big surge upwards. The inflows are super positive.”

Ethereum is trading for $2,496 at time of writing, up 3.7% in the last 24 hours.

The analyst also says that the crypto market may have reached a bottom after this week’s deep correction and suggests rallies could come for projects like Ethereum scaling solution Optimism (OP).

“This week is providing massive weekly candles. A deep wick, but quickly returning and some are even turning green. I think that there’s a significant chance that we’ve actually seen the low. Substantial candle on OP as well.”

Optimism is trading for $1.32 at time of writing, up 5.4% in the last 24 hours.

Lastly, the analyst predicts a big breakout for money market protocol Aave ($AAVE) after consolidating around the $100 level.

“One of the most promising charts in crypto is $AAVE. DeFi (decentralized finance) is looking awesome for a big run.”

Aave is trading for $96.78 at time of writing, down more than 5% in the last 24 hours.

Generated Image: DALLE3

dailyhodl.com

dailyhodl.com