The New York Stock Exchange (NYSE) has applied to the Securities and Exchange Commission (SEC) to list and trade options for ETH exchange-traded funds (ETFs) issued by Grayscale and Bitwise. The proposed rule change would see options for Grayscale Ethereum ETF (ETHE), Grayscale ETH ETF mini (ETH), and Bitwise ETH ETF (ETHW) trade on the NYSE.

The move follows a similar application by Nasdaq to list options for BlackRock iShares ETH ETF (ETHA). Options are contracts that give traders the right without an obligation to buy or sell an underlying asset at a specified price on or before a certain date. It is one of the many ways to profit from changes in stock prices.

NYSE explains that options trading will benefit investors

The NYSE proposed to amend Rule 915, noting that this aligns with the current regulatory standards. According to its proposal, ETFs representing specific interests, such as trusts holding financial instruments and instruments deemed as commodities, are appropriate for options trading.

It added that this application approval would benefit investors as the options would be cost-effective and provide more exposure to Ether exchange-traded products.

The exchange said:

“Offering options on Ether ETPs, including the Bitwise Ethereum ETF, the Grayscale Ethereum Trust (ETH), and the Grayscale Ethereum Trust Mini, will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.”

The proposal has been sent in and will be available for public comments over the next 21 days before the SEC considers it. However, the SEC is not the only regulator that needs to approve the proposal. The Commodities Futures Trading Commission (CFTC) and the Options Clearing Corporation (OCC) must also approve it.

Exchanges proposing options for Ether may have to be patient as they wait for approval from the regulatory bodies. Exchanges have already proposed listing options on Spot Bitcoin ETFs, which became available over six months ago. However, the SEC extended the time to make its decision in July.

Ethereum ETFs flows

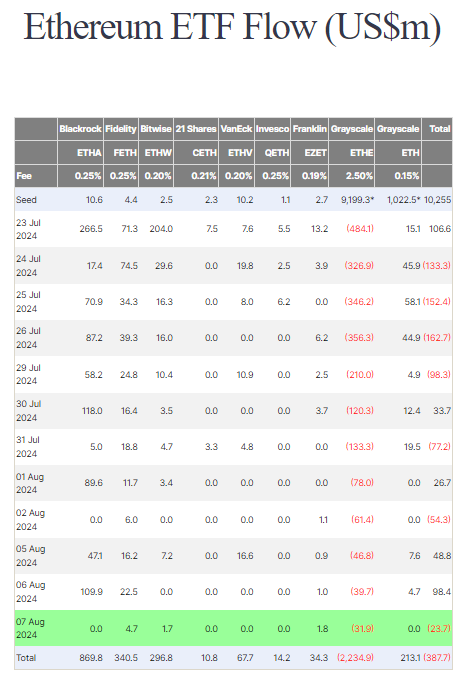

Ethereum ETFs have had an interesting performance since their launch last month. Compared to the first days of spot Bitcoin ETF, which saw $4.6 billion in trading volume and $655 million in inflows, Ether ETFs had lower volume on the first day, with $1.1 billion and $106.7 million in inflows.

Since then, the performance has been mixed with inflows into the eight new ETFs, constantly offset by outflows from the Grayscale ETHA. However, the ETFs recorded their second-highest day of netflow on August 6, with over $98 million in inflow. It also marked the second consecutive day of inflows for the asset class after recording a $49 million net flow on August 5, a first for the ETFs.

Interestingly, the ETH ETFs’ total net flow remains negative at —$387 million due to the over $2.2 billion outflows from Grayscale ETHE. Further, the arrival of the Ethereum ETFs has yet to translate into improved price performance for ETH, as the digital asset has fallen about 30% since the ETFs started trading, going from over $3,400 to around $2,400 presently.

Meanwhile, the decline is not necessarily tied to the ETFs. The crypto market has experienced a major downturn in the last seven days, losing about 13% of its market cap. ETH was one of the worst-hit digital assets during that period, dropping 24%.

cryptopolitan.com

cryptopolitan.com