- Lookonchain data indicates that on Wednesday, nine spot Ethereum ETFs saw inflows of 44,447 $ETH, valued at $110.1 million.

- Santiment's data shows that dormant wallets are active, signaling a renewed interest and activity.

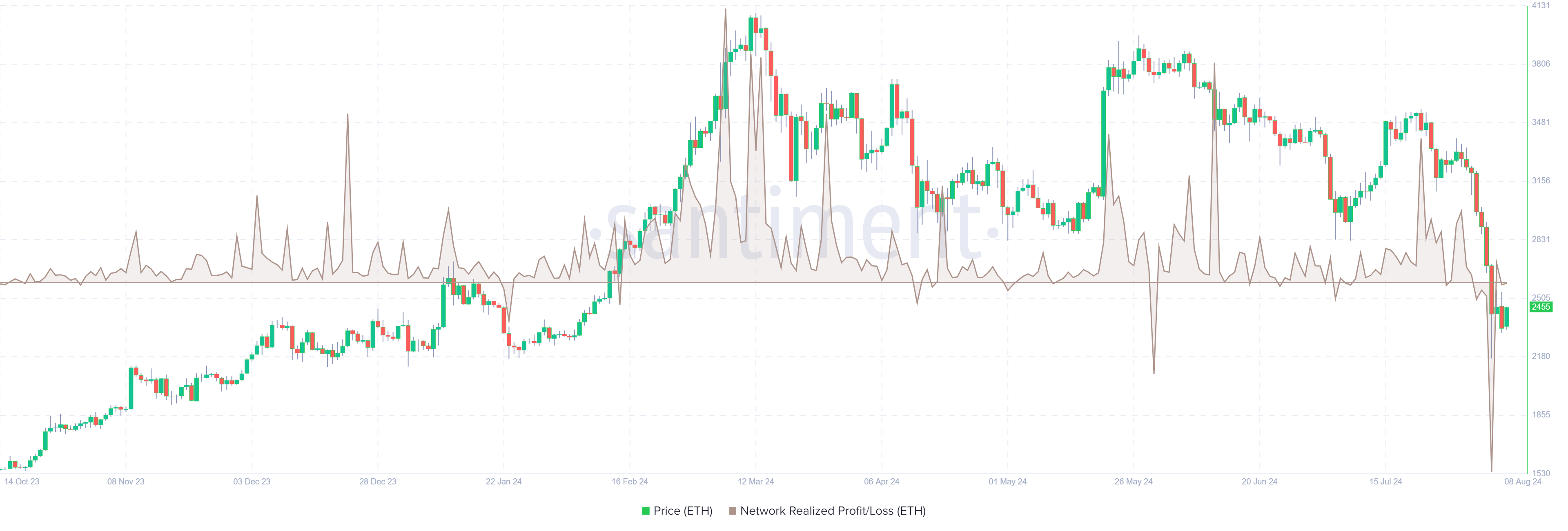

- Santiment's Network Realized Profit/Loss data shows capitulation events from August 3 to August 5.

- Investors should be cautious about decreasing Development Activity.

Ethereum ($ETH) price retested its weekly support on Monday and, by Thursday, had risen by 4.50% to $2,454. Lookonchain data shows that Ethereum Spot ETFs saw inflows of 44,447 $ETH, valued at $110.1 million, on Wednesday, while Santiment's data highlights increased activity in dormant wallets and recent capitulation events, indicating a potential upcoming rally.

Ethereum on-chain data display bullish lean

Lookonchain data indicates that nine spot Ethereum ETFs saw inflows of 44,447 $ETH, valued at $110.1 million, on Wednesday, marking two consecutive days of net inflows this week. This trend underscores the importance of monitoring these ETFs' net flow data to grasp market dynamics and investor sentiment, while their total Ethereum reserves amount to $7.04 billion.

9 #Ethereum ETFs inflows 44,447 $ETH($110.1M), 2 consecutive days of net inflows!

— Lookonchain (@lookonchain) August 7, 2024

Aug 7 Update:

10 #Bitcoin ETFs

NetFlow: -1,899 $BTC(-$109.14)#Fidelity outflows 1,137 $BTC($65.33M) and currently holds 175,858 $BTC($10.11B).

9 #Ethereum ETFs

NetFlow: +44,447… pic.twitter.com/foD2PvmxJy

Santiment's data shows that the transfer of 789,533 $ETH from dormant wallets signals a renewed interest and activity in the Ethereum ecosystem, which can be interpreted as a bullish indicator suggesting that major holders are becoming more active in the market.

Ethereum Age Consumed chart

On-chain data provider Santiment's Network Realized Profit/Loss (NPL) indicator computes a daily network-level Return On Investment (ROI) based on the coin's on-chain transaction volume. Simply put, it is used to measure market pain. Strong spikes in a coin's NPL indicate that its holders are, on average, selling their holdings at a significant profit. On the other hand, strong dips imply that the coin's holders are, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

In $ETH's case, the NPL indicator dipped from -37.32 million to -909.64 million from August 03 to August 5, coinciding with a 19% price crash. This negative downtick indicates that the holders were, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

Ethereum Network Realized Profit/Loss chart

Despite increased activity in Ethereum's dormant wallets, recent capitulation events, and consecutive inflows into spot ETFs, $ETH development activity still needs to be higher, suggesting that investors should not anticipate an immediate price rally for the token.

Ethereum Development Activity chart

fxstreet.com

fxstreet.com