An on-chain smart money trader recently purchased 4,000 $ETH tokens worth $12.58 million, making a move that aligns with their past successful trading patterns.

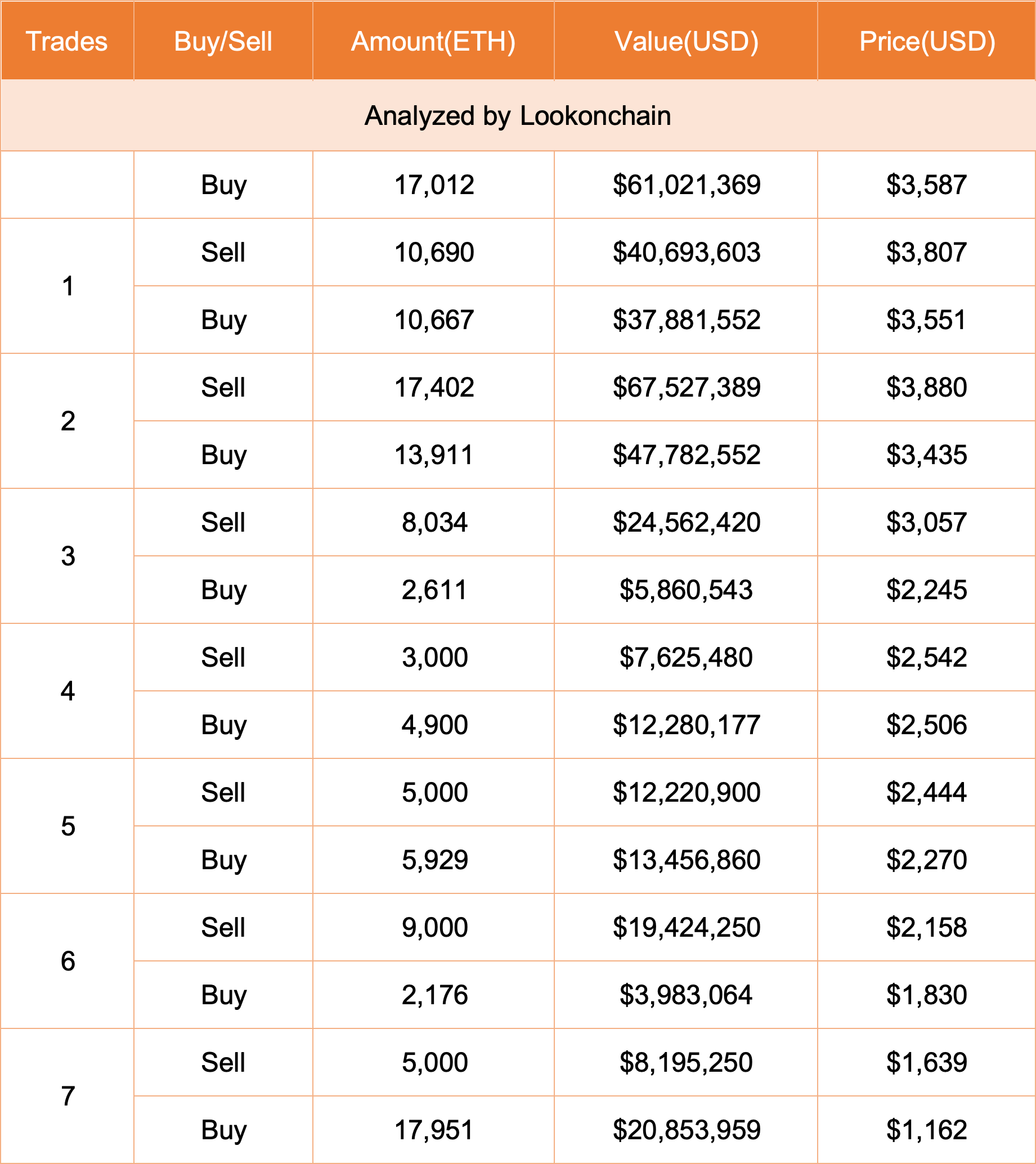

This trader, noted for a 100% win rate, has consistently bought $ETH at lower prices and sold at higher prices, accumulating a profit exceeding $38 million since November 2022. Lookonchain, a well-known crypto surveillance, called attention to this trader’s activities in a recent update.

Strategic Buy and Sell Patterns

The smart money trader’s history of $ETH transactions reveals a clear strategy of capitalizing on price dips. Between November 2022 and May 2024, they bought and sold $ETH seven times, each time achieving significant profits.

Most Recent Transactions

The most recent transaction saw the purchase of nearly 4,000 $ETH from Binance to the address 0x75Ba13D7…c778bC62f. Five days prior to the recent $ETH purchase, the same address received 2,399.9987 $ETH from Binance, reaffirming the trader’s commitment to their established strategy.

Cumulatively, the trader has acquired a total of 17,012 $ETH for $61 million at an average price of $3,587 since May. However, the current market price of Ethereum positions the smart investor with a temporary loss of $7.6 million.

At press time, Ethereum trades at $3,150, which is 12% below the investor’s average purchase price of $3,587.

Considering this investor’s track record of success in their Ethereum trading strategies, Lookonchain ponders whether the investor would similarly net a clean sheet in their latest accumulation spree. Overall, the continued accumulation of $ETH tokens since May, regardless of price fluctuations, suggests an anticipation of a market rebound.

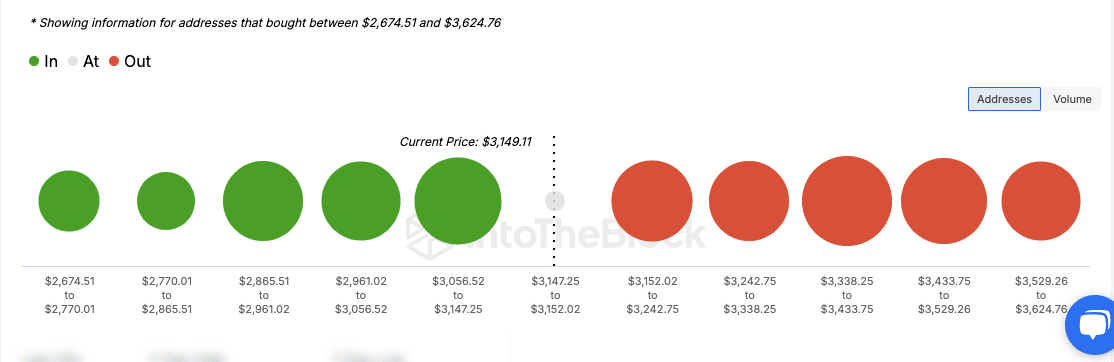

$ETH Addresses in Profit Below $3,156.80

Analysis from IntoTheBlock provides a snapshot of $ETH address distributions based on the current price of $3,155. Addresses that acquired $ETH between $2,674 and $3,147 are presently profitable.

Conversely, addresses that bought above $3,152 are experiencing losses, potentially contributing to selling pressure if prices do not recover. This positions the smart money trader’s recent purchase as a calculated risk, anticipating a market upswing that could turn current losses into future gains.

thecryptobasic.com

thecryptobasic.com