Ethereum price wobbled towards the $3,100 level on August 1 2024, as markets reacted negatively to the US Fed rate pause, here’s how ETH price could react in the coming weeks.

Fed Rate Pause Reactions Send ETH Price Spiralling to $3,100

On July 31, The US Federal Reserve unanimously elected to hold the monetary policy interest rate unchanged at a range between 5.25% and 5.5%. This triggered a negative reaction across risk assets markets, including stocks and cryptocurrencies, on Thursday.

Following the announcement ETH surrendered gains booked during the market euphoria triggered by ETFs launch euphoria and Donald Trump comments last week. During this week, ETFs have suffered a streak of 4 consecutive days of outflows.

Following dovish from the latest Non-Farm Payrolls (NFP) and Consumer Price Index (CPI) published on July 5, many crypto investors anticipated the US Fed would execute its first rate cut on July 31.

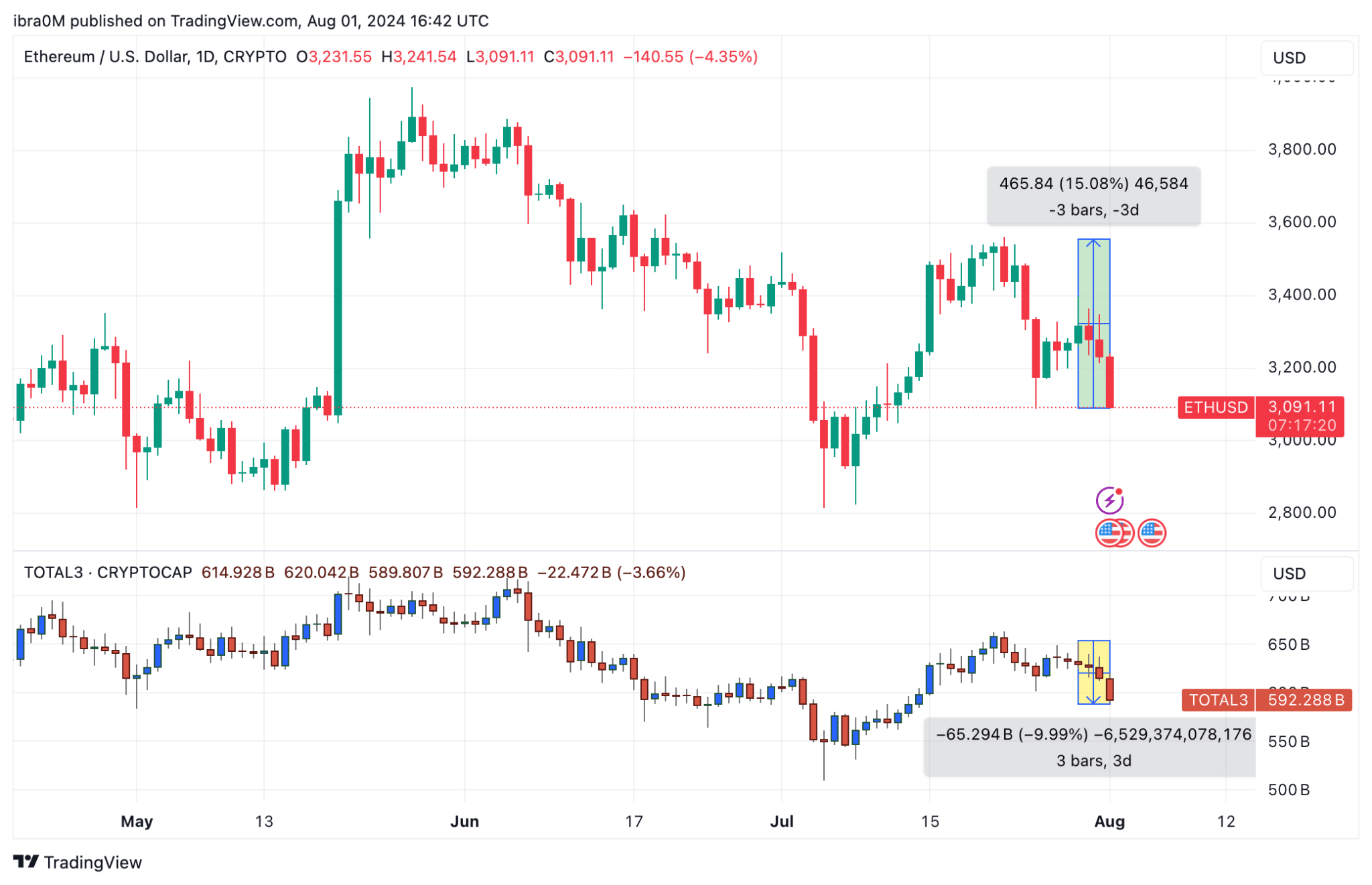

With those hopes now dashed, cascading liquidations across the crypto markets sent ETH prices spiraling towards $3,100. The chart above shows that ETH’s dip around noon (Eastern Time) on August 1 represents a 15.08% decline.

Meanwhile, the TOTAL3 chart, shows that the global altcoin market has shrunk by less than 10% during that period. This clearly indicates that Ethereum’s price has fallen behind the the altcoin sector average since the beginning of the week.

With Ethereum’s price now lagging behind the broader market trend, strategic investors could consider it undervalued. If they opt to capitalize on the discounted ETH prices by entering new positions, ETH prices could be on the verge of a major breakout in August. But first, investors will be on the lookout to see how the ETFs fare as they enter their first full month of trading.

Notably, following Bitcoin ETF’s launch in January, it took until March 2024, before BTC recorded its biggest price breakout, amid a stream of inflows from the newly-launched derivatives assets.

If Ethereum follows in the same pattern, ETH will likely break key resistance levels in August, as it sets up for a possible breakout, if the US fed cut rates in September as widely anticipated.

Ethereum Price Forecast: Can ETFs Avert $3,000 Reverse?

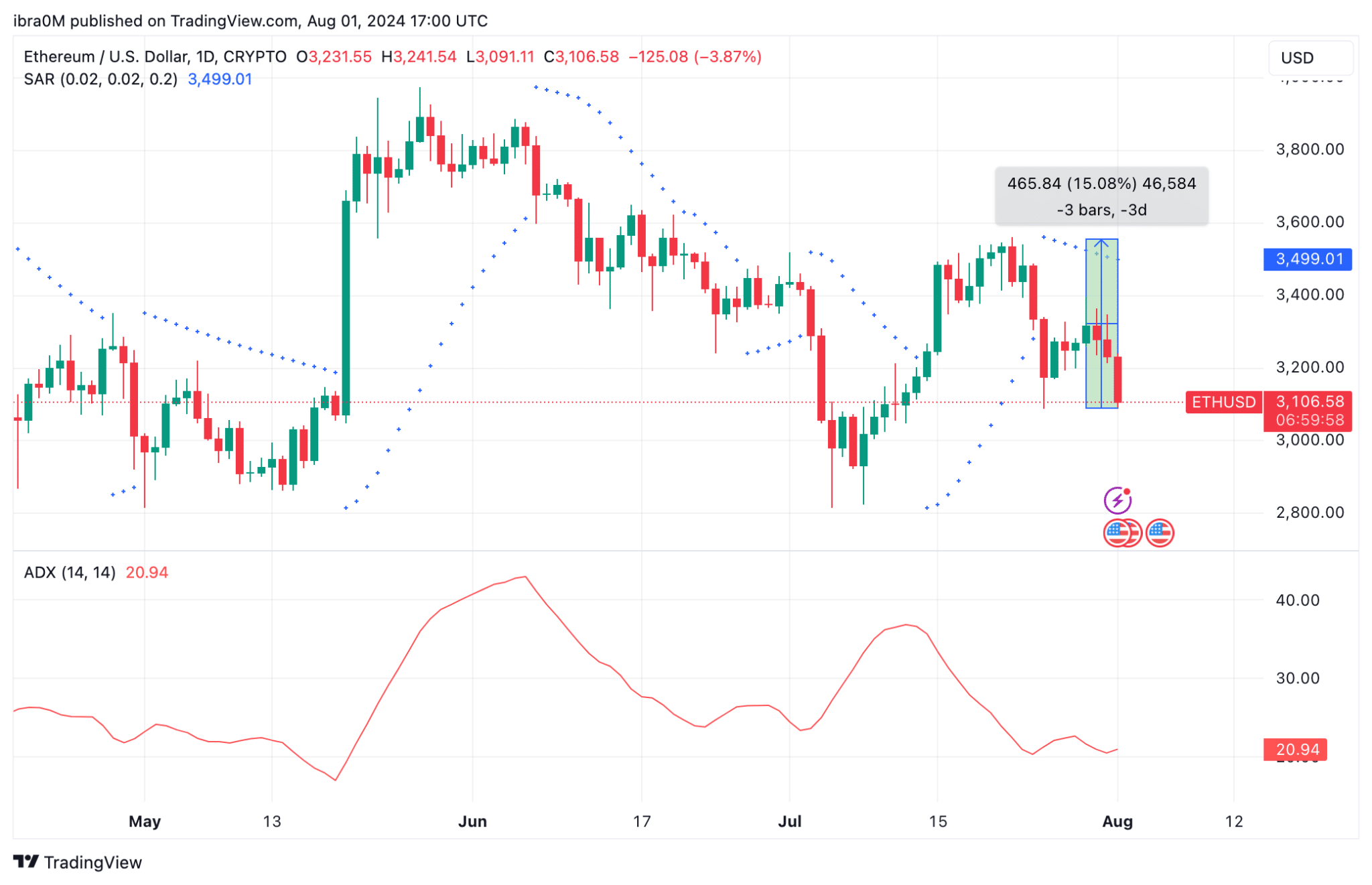

Ethereum’s recent price action, as depicted in the daily chart, indicates a potential bearish continuation despite previous gains. The price experienced a significant upward move of 15.08% over a three-day period, peaking at $3,396.01. However, this rally was met with strong resistance, causing a sharp pullback. Currently, Ethereum is trading at $3,106.58, reflecting a 3.87% decline in the Aug 1 session.

The Parabolic SAR (Stop and Reverse) dots, which are positioned above the price, signal a bearish trend. This suggests that the downward momentum might continue unless there is a significant reversal. The immediate resistance level is around $3,499.01, followed by a more substantial barrier at $3,600. Failing to break these levels could result in further downward pressure.

On the downside, Ethereum is approaching a critical support level at $3,000. A decisive break below this level could accelerate the bearish trend, pushing the price towards the next support at $2,800. The ADX (Average Directional Index), currently at 20.94, indicates a weak trend, but any increase in the ADX could confirm the strengthening bearish momentum if it crosses above 25.

While the introduction of ETH ETFs initially provided some bullish sentiment in late July, the overall trend appears bearish unless significant resistance levels are breached. Investors should closely monitor the $3,000 level, as a break below it could signal a deeper correction.

thecryptobasic.com

thecryptobasic.com