- Ethereum ETFs' net flows turn positive after a four-day streak of strong outflows.

- Ethereum Foundation resumed its $ETH sale following 100 $ETH transfer to exchange.

- Ethereum is showing signs of a potential bullish reversal.

Ethereum ($ETH) is down 0.2% on Wednesday following inflows across $ETH ETFs and the Ethereum Foundation's continuation of its $ETH sale.

Daily digest market movers: $ETH inflows, Ethereum Foundation sale

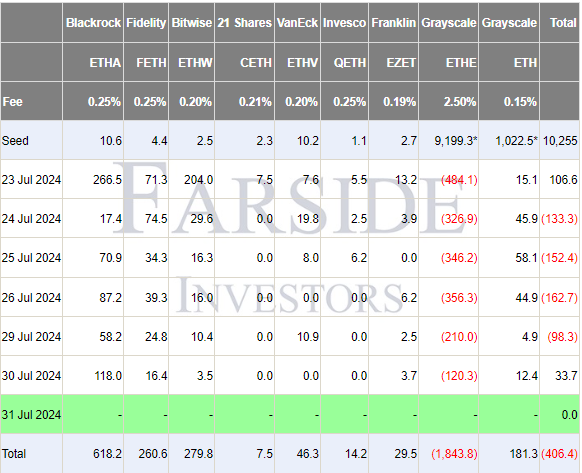

BlackRock's iShares Ethereum ETF (ETHA) charged $ETH ETFs to witness their first day of net inflow since the positive flows on launch day after recording $118 million in inflows, offsetting outflows from Grayscale's Ethereum Trust (ETHE), according to Farside Investors data.

As a result, ETHA broke into the top 15 based on inflows among 330 ETFs launched in 2024, noted Nate Geraci, President of the ETF Store, in an X post on Tuesday. The move pushed the nine spot Ethereum ETFs to a net inflow of $33.67 million.

Ethereum ETF Flow Table

According to data from Spot On Chain, the Ethereum Foundation sold 150 $ETH for 487,260 $DAI today. This follows its earlier sale of 100 $ETH on July 23 when spot $ETH ETFs launched. The Ethereum Foundation has sold 2,516 $ETH for 7.4M $DAI at an average price of $2,940 in 2024.

Historically, most of the Foundation's sales have led to price declines as it appears traders are using its on-chain activity as a proxy to short or sell their tokens.

However, with investors now expecting a price rise following a decline in ETHE outflows, the Foundation's $ETH sale may not trigger a price decline this time. This is evidenced in Glassnode's data, which reveals that whales — wallets holding over $100K worth of $ETH — purchased about 126,000 $ETH worth $440 million in the past two days. Such high buying pressure indicates whales are anticipating a bull run.

Meanwhile, Ethereum co-founder Vitalik Buterin said in a speech at EDCON2024 that Ethereum will focus on building applications in the next 10 years. Some notable crypto applications Ethereum pioneered include DeFi, NFTs, DAOs, DID, etc.

$ETH technical analysis: Ethereum signals bullish move

Ethereum is trading around $3,277 on Wednesday, down 0.2% on the day. $ETH's 24-hour liquidations crossed $30 million, with long and short liquidations accounting for $21.81 million and $8.21 million, respectively.

Ethereum's 50-day moving average is above its current price and acts as a resistance to upward price movements. However, $ETH is forming a rounded bottom, indicating a potential bullish reversal in the coming weeks.

$ETH/$USDT Daily chart" src="https://cnews24.ru/uploads/eb5/eb5f1355acb16bb4acdb595ca632197b04540f54.png" size="1281x571">

$ETH/$USDT Daily chart

A daily candlestick close above the $3,730 resistance could provide $ETH with the needed momentum to rally above its yearly high of $4,093. Such a move could see $ETH rising to set a new all-time high around $5,627 — the upper side of a key boundary.

In the short term, $ETH could decline to bounce around $3,243 where there's a liquidation wall of $35.58 million.

fxstreet.com

fxstreet.com