Ethereum has seen increased exchange activity as investors wait for the spot exchange-traded funds to start trading in the United States.

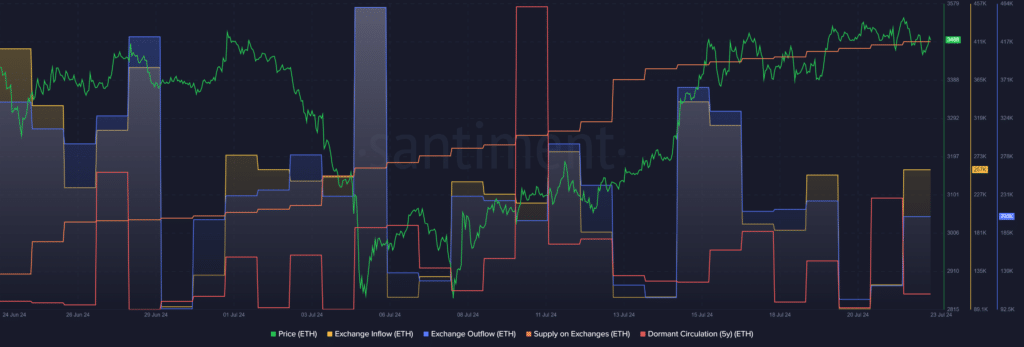

According to data provided by Santiment, the amount of Ethereum (ETH) flowing into centralized and decentralized exchanges rallied by 116% in the past 24 hours — rising from 118,970 to 257,550 tokens.

This movement is usually expected in bearish market conditions, but the approval of spot ETH ETFs has triggered a quite similar on-chain momentum since traders might be eying short-term profits.

Data from the market intelligence platform shows that the Ethereum exchange outflow also witnessed a 69% surge over the past day — rising from 121,460 to 205,460 tokens. While the outflow hints at an accumulation trend, the rallying inflows show potential short-term profit-taking.

Per data from Santiment, the total amount of ETH supply sitting on exchanges increased by 1.2 million coins over the past 30 days — rising from 18.41 million ETH on June 24 to 19.61 million ETH at the reporting time.

This was majorly due to the market-wide bearish momentum that brought the Ethereum price down from the $3,500 mark to around $2,800 in the first week of July.

On the other hand, long-term Ethereum holders stopped moving their assets after a busy Monday, July 22. According to Santiment, the five-year dormant ETH circulation plunged from 16,888 to 3,022 coins over the past day.

At this point, five-year ETH holders remain bullish on the second-largest cryptocurrency thanks to the spot ETH ETF green light from the U.S. SEC. Per the crypto.news report, the investment products are set to start trading today, July 23.

Ethereum is up by 1.3% in the past 24 hours and is trading at $3,530 at the time of writing. The asset’s market cap is sitting at $424.3 billion with a daily trading volume of $21.5 billion.