- Ethereum ETFs set to launch on Tuesday as the SEC declares issuers' prospectus effective.

- Bitcoin Conference coinciding with ETH ETFs launch week could help drive a rally for Ethereum.

- Ethereum traders display uncertainty despite bullish predictions surrounding ETH ETFs' launch.

Ethereum (ETH) is down nearly 1% on Monday as the Securities & Exchange Commission (SEC) confirmed via its website on Tuesday that it has given the final approval for spot ETH ETFs. Considering the ETH ETF launch and the upcoming Bitcoin Conference, this week could prove crucial for Ethereum.

Daily digest market movers: Ethereum ETFs, Bitcoin Conference, ETH inflows

Ethereum may be set for an explosive week ahead with several potential bullish catalysts on the horizon:

- According to SEC updates on its website, it has approved the S-1 registratements of spot ETH ETF issuers.

Ethereum ETFs

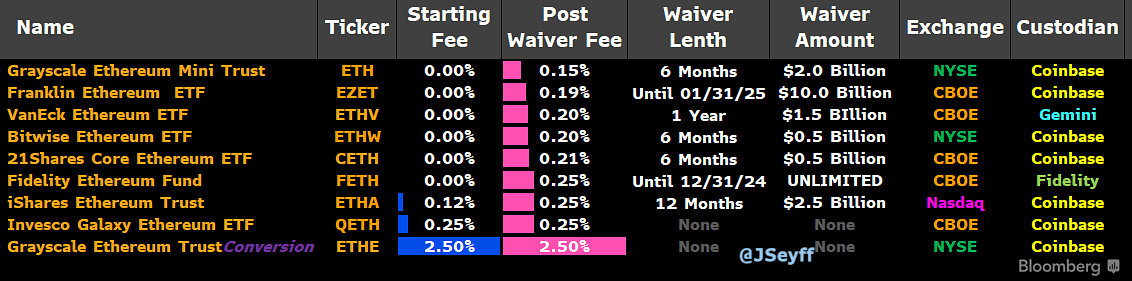

- The Exchange NYSE Arca confirmed that it has approval to list and begin trading Grayscale Ethereum Trust and Bitwise Ethereum ETF on Tuesday. The Chicago Board Options Exchange (Cboe) had earlier revealed that Fidelity Ethereum Fund, Franklin Ethereum ETF, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF and 21Shares Core Ethereum ETF will also begin trading on Tuesday.

- The Bitcoin 2024 Conference will kick off on July 25, and with Republican nominee Donald Trump set to discuss a potential US Bitcoin strategy during the conference, Bitcoin is expected to see a brief rally. Many expect ETH to largely benefit from the rise due to its positive correlation with Bitcoin and Ethereum ETFs launching in the same week.

- Traditional investors seem to be bullish on ETH ETFs' launch as Ethereum investment products recorded $45 million in inflows last week, according to CoinShares data. The move brought its year-to-date net flows to $103 million.

- Several experts including analysts from Bitwise and Galaxy have predicted that ETH ETFs will see inflows of about $3 billion to $5 billion within the first six months of launch.

ETH technical analysis: Ethereum traders are uncertain despite upcoming Tuesday ETH ETF launch

Ethereum is trading around $3,460 on Monday, down about 1% on the day. In the past 24 hours, ETH has seen $39.87 million in liquidations, with long and short liquidations accounting for 76% and 24%, respectively.

Ethereum is expected to see increased volatility this week following Tuesday's potential launch of ETH ETFs. This is evident in ETH options' implied volatility, which jumped from 56% to 70% last week, according to data from Deribit.

In addition, ETH options with a notional value of $1.89 billion will expire on Friday. The strike price of these options is heavily concentrated around $3,700, with a Put/Call Ratio (PCR) of 0.45. Since the PCR favors calls, it signifies that most traders are bullish, betting on the price of ETH to rise above $3,700 before the month ends.

End-of-month options expiry has triggered a significant decrease in ETH options open interest in the past two months. If a similar move occurs this time around, it may signify uncertainty among ETH investors. ETH futures open interest declining slightly by 1% in the past 24 hours also aligns with the uncertainty among options traders.

Another key metric to watch is the ETH futures Long/Short Ratio, which is at 0.88. This indicates that a larger portion of ETH futures traders are bearish.

ETH/USDT 12-hour chart

With uncertainty brewing in the market despite the confirmation of ETH ETFs' launch, the bullish sentiment from inflows may not be able to trigger a massive rally this week, as many predict. On the upside, ETH could rise by 8% to the $3,731 key level while finding support around $3,205 on the downside.

fxstreet.com

fxstreet.com