Cboe, the Chicago Board Options Exchange, is preparing to list five new ether exchange-traded funds (ETFs) on Tuesday, pending regulatory effectiveness. These five spot ethereum ETFs are from 21shares, Fidelity, Franklin, Invesco Galaxy, and Vaneck. The U.S. Securities and Exchange Commission (SEC) approved Form 19b-4 filings for eight spot ether ETFs in May and has since been working with issuers to get their fund registration statements effective.

Cboe Plans to List Five New Ether ETFs on July 23

Cboe, the Chicago Board Options Exchange, has announced that it will list five new ether exchange-traded products (ETPs) on its exchange starting July 23, “pending regulatory effectiveness.” These ether ETFs will be listed and traded on the BZX Exchange, which is one of several securities exchanges operated by Cboe.

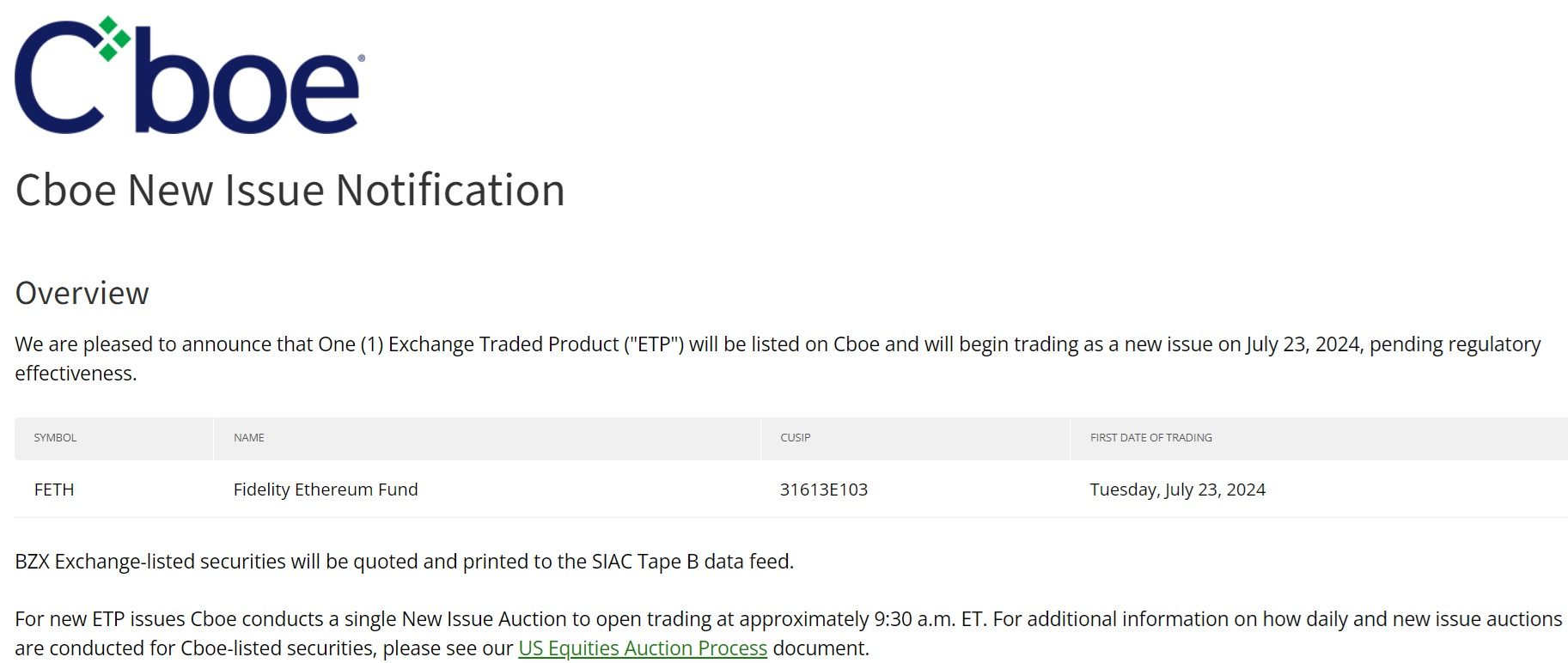

The exchange issued separate new issue notifications for each ETP. The five are 21shares Core Ethereum ETF (CETH) with CUSIP 04071F102, Fidelity Ethereum Fund (FETH) with CUSIP 31613E103, Franklin Ethereum ETF (EZET) with CUSIP 35351J109, Invesco Galaxy Ethereum ETF (QETH) with CUSIP 46148D107, and the Vaneck Ethereum ETF (ETHV) with CUSIP 92189L103. For each notification, Cboe stated that the exchange-traded product “will be listed on Cboe and will begin trading as a new issue on July 23, 2024, pending regulatory effectiveness.”

The U.S. Securities and Exchange Commission (SEC) approved Form 19b-4 filings for eight spot ether ETFs in May, but these funds still need approval of their S-1 registration statements before they can launch. Several analysts predict the funds will launch on July 23.

Bitwise CIO Matt Hougan predicts initial volatility post-ETP launch but expects a positive overall trend. He notes that ETFs will boost demand without affecting Ethereum’s fundamentals. His analysis suggests that the introduction of spot Ethereum exchange-traded funds will significantly impact ether prices, potentially driving ETH above $5,000 by year-end.

Do you think U.S. spot ether ETFs will begin trading on July 23? Let us know in the comments section below.

news.bitcoin.com

news.bitcoin.com