Ethereum ($ETH) has been experiencing volatility mainly due to its alignment with broader market trends.

Despite the approval of spot $ETH ETFs, the event has not yet impacted the price. However, this could change in the near future.

Do Ethereum ETFs Have a Bright Future?

Spot ETF movements might substantially impact Ethereum’s price in the coming few months. Earlier this week, the US Securities and Exchange Commission (SEC) approved listing spot ETFs by the beginning of July. This has increased investors’ expectations massively.

“We expect the net inflows into $ETH ETFs to be 20-50% of the net inflows into BTC ETFs over the first five months, with 30% as our target, implying $1 billion/month of net inflows,” Galaxy Research Team’s Vice President Charles Yu stated.

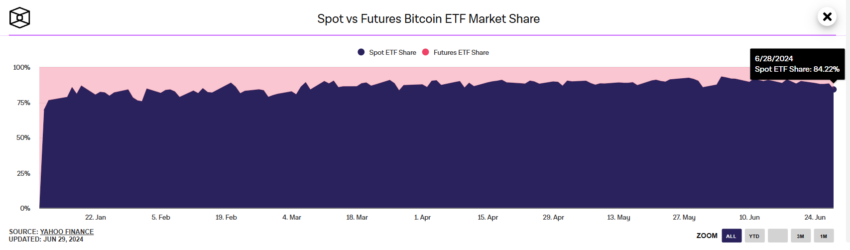

However, this optimistic forecast does not look entirely realistic. To put it into perspective, spot Bitcoin ETFs have only seen $857 million in inflows as of June 21, despite holding 84% of the entire ETF market share, with futures ETFs accounting for just 14%. This raises doubts about whether spot Ethereum ETFs will achieve $1 billion in monthly inflows.

Read more: Ethereum ETF Explained: What It Is and How It Works

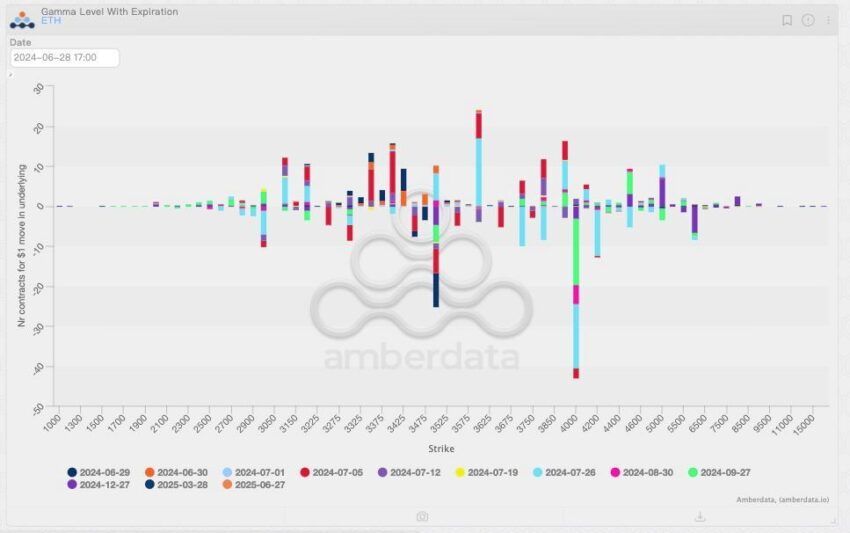

The uncertainty regarding the success of $ETH ETFs in a relatively bearish market could also lead to a surge in market makers’ premiums. Gamma distribution risk, involving the sensitivity of options to price changes, makes market makers adjust their strategies. With the added uncertainty of $ETH ETFs, they are likely to raise premiums to cover potential extreme price swings.

“$ETH can still obtain effective support from market makers hedging on the downward path. As one of the solutions to the above-mentioned gamma distribution risk, market makers have also slightly raised their pricing for tail risk. Due to the additional uncertainty brought by $ETH ETFs, the pricing for $ETH tail risk is relatively high,” Griffin Ardern, Head at BloFin Research & Options, told BeInCrypto.

Put simply, market makers could charge more to account for the chance that the price of $ETH will be affected by something very unusual and extreme. This means investors need to pay extra to hedge their bets, which can discourage excessive speculation and reduce volatility.

Read More: How to Invest in Ethereum ETFs?

Despite the fact the active risk management can help stabilize its price by providing support and mitigating significant price drops, Ethereum’s price might struggle to benefit immediately from the launch of spot ETFs.

$ETH Price Prediction: Eyeing New Highs

Ethereum’s price of $3,395 is far from establishing a new all-time high. The second-largest cryptocurrency rallied by over 30% following the approval of spot $ETH ETFs, but nearly half of this was wiped out when $ETH fell by 13% at the beginning of the month. The uncertainty surrounding the launch drove the price down, along with the bearish broader market cues.

The situation could shift as the market approaches the launch of ETFs. Bitcoin’s price started to trend upward following the introduction of its spot ETFs, and a similar outcome is anticipated for Ethereum.

Should Ethereum’s price manage to capitalize on the potential bullishness and rise to flip $3,829 into support, it would have managed to flip the 61.8% Fibonacci Retracement into support. This line, also known as the bull market support floor, would translate to $ETH’s further gains.

Read More: Ethereum ($ETH) Price Prediction 2024/2025/2030

While a new all-time high is still far away, $ETH will at least have a shot at trying its hand at breaching $4,000. A successful breach will be key in pushing the altcoin further upwards.

But if this fails to happen, Ethereum’s price would be susceptible to remaining consolidated under $4,000. The likely support level could stand between $3,700 and $3,800. Losing this would invalidate the bullish thesis.

beincrypto.com

beincrypto.com