- Ethereum 2.0, also known as ETH2, is Ethereum Classic blockchain’s initial upgrade focused on enhancing the pace, scalability, and efficiency of Ethereum’s network.

- Since the announcement of adopting the proof of stake algorithm, staking activities have increased on the Ethereum network.

- Relay regarding merging wholly with Ethereum 2.0 is still active, but some infrastructure needs to be settled to make sure the network reaches there.

What is Ethereum 2.0

Ethereum 2.0, or ETH2, is Ethereum Classic blockchain’s initial upgrade concentrated on intensifying the pace, scalability, and efficiency of Ethereum’s network.

Ethereum 2.0 has stayed prolonged in its development since the Beacon Chain got active in 2020. Various upgrades have been done since then to make the network ready for the ultimate move for adopting proof of stake. Lately, it is the Kintsugi testnet that enables the blockchain users to get a peek regarding what is to be transpired when the ultimate move of merging happens.

The act regarding ETH 2.0 was initiated a year ago, and some remarkable occurrences have happened since then. In this write-up, we are going to review the year and everything that has occurred regarding the network afterward.

More Than 7% Supply of Ethereum has been Staked

Since the adoption of the proof of stake algorithm has been declared by Ethereum, staking maneuvers have soared on the network of Ethereum. Rather than the requisition of miners in order to contend and validate blocks similar to the proof of work, the network needs the verifiers that require 32 Ethereum in order to operate the node. Every verifier will be getting a reward for assisting in the confirmation of transactions happening in the network and making it secure for the users.

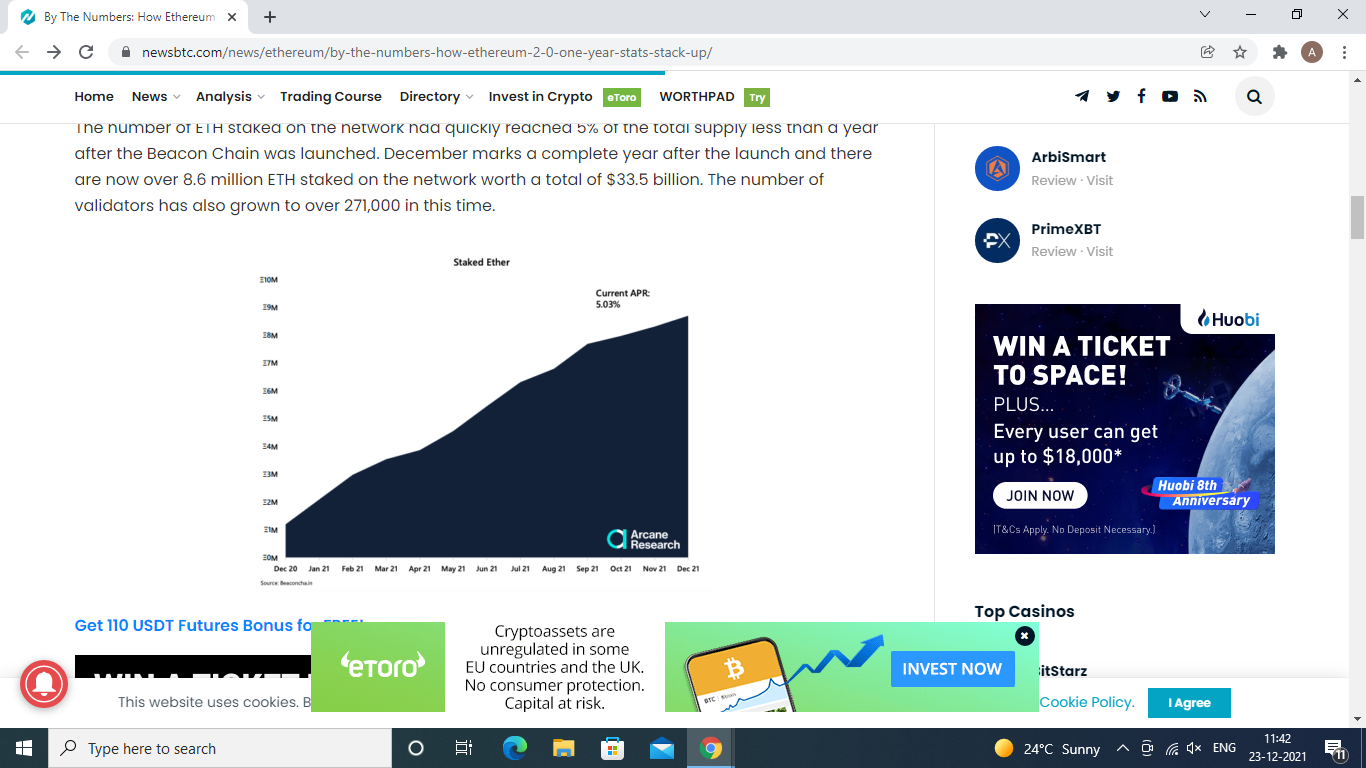

In less than a year, 5% of the ETH supply has been staked since the launch of the Beacon chain. 8.5 Million ETH has been staked that are worth $33.5 billion, and the total verifiers have reached a whopping 271,000. December completes a year of the launch of the Beacon network.

Currently, 7.33% of Ethereum has been staked on the network and most probably will grow in the future as it shifts near the merge. APY might rise because of the unburnt fee as well as MEV, which will be received by miners rather than miners in the latest PoS algorithm.

Ethereum Getting Close to Merge

Relay regarding merging wholly with Ethereum 2.0 is still active, but some infrastructure needs to be settled to make sure the network reaches there. One of them is Lido, a validator network which is multi-user, developed by Obol Network. Liquid staking tokens are enabled by this on the Network of Ethereum.

Another decentralized staking facility is Rocket Pool which has gone live in mainnet. Both of these assisted the network in getting closer towards Ethereum 2.0, simplifying the process of staking tokens for the users.

Kintsugi testnet was launched on Monday. It is the initial significant testnet to be launched on ethereum and will lead up to upcoming testnets, which represent the functionality of the network after merging.

thecoinrepublic.com

thecoinrepublic.com