US Securities and Exchange Commission (SEC) Chair Gary Gensler announced that spot Ethereum exchange-traded funds (ETFs) will likely launch this summer.

He made this statement during a budget hearing with the Senate Appropriations Committee on Thursday, June 13.

Ethereum ETFs Almost Ready to Trade

Gensler highlighted that the final approval process for these ETFs is progressing well. The SEC had previously given the green light to a group of initial applications. Now, the final registration requirements, known as S-1 filings, are being managed at the “staff level.”

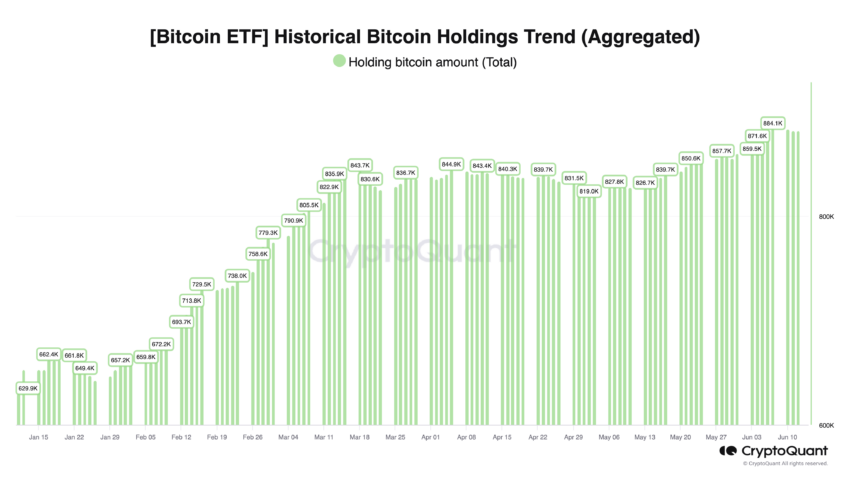

Once approved, these ETFs will allow investors to trade funds holding actual Ethereum. Therefore, introducing Ethereum ETFs will provide broader market access to it. This move mirrors the earlier establishment of spot Bitcoin ETFs, which now hold over 882,000 BTC, worth more than $59 billion.

Read more: Ethereum ETF Explained: What It Is and How It Works

During the hearing, Gensler was asked if Ethereum is a commodity. He refrained from giving a definitive answer, reflecting the SEC’s ongoing uncertainty regarding Ethereum’s classification. In contrast, Commodity Futures Trading Commission (CFTC) Chief Rostin Behnam stated that Ethereum is a commodity.

Still, the forthcoming Ethereum ETFs mark a significant development in the cryptocurrency market, promising increased accessibility and investment opportunities for investors.

beincrypto.com

beincrypto.com