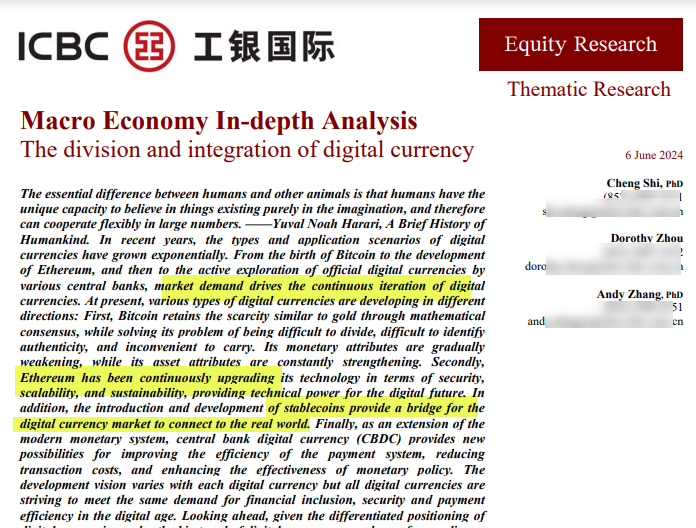

Recently, the Industrial and Commercial Bank of China (ICBC), which is the world's largest lender, published a detailed analysis that shows the rapid development and increasing diversity of digital currencies.

In the report Bitcoin ($BTC) is compared to gold, while Ethereum ($ETH) is called “digital oil".

According to historian Yuval Noah Harari, human imagination is also said to have been the driving force behind the digital currency revolution, which has seen an exponential growth in both the number of these currencies and their uses. And state-owned Chinese banks have consistently backed them, noted Matthew Siegel, who works for VanEck as head of digital asset research.

This is because different digital currencies have taken different development paths due to market demand, as stated in ICBC's post. Bitcoin ($BTC) has been praised for maintaining its gold-like scarcity through a mathematical consensus mechanism that solves the problems of divisibility, authenticity, and portability.

This is because different digital currencies have taken different development paths due to market demand, as stated in ICBC's post. Bitcoin ($BTC) has been praised for maintaining its gold-like scarcity through a mathematical consensus mechanism that solves the problems of divisibility, authenticity, and portability.

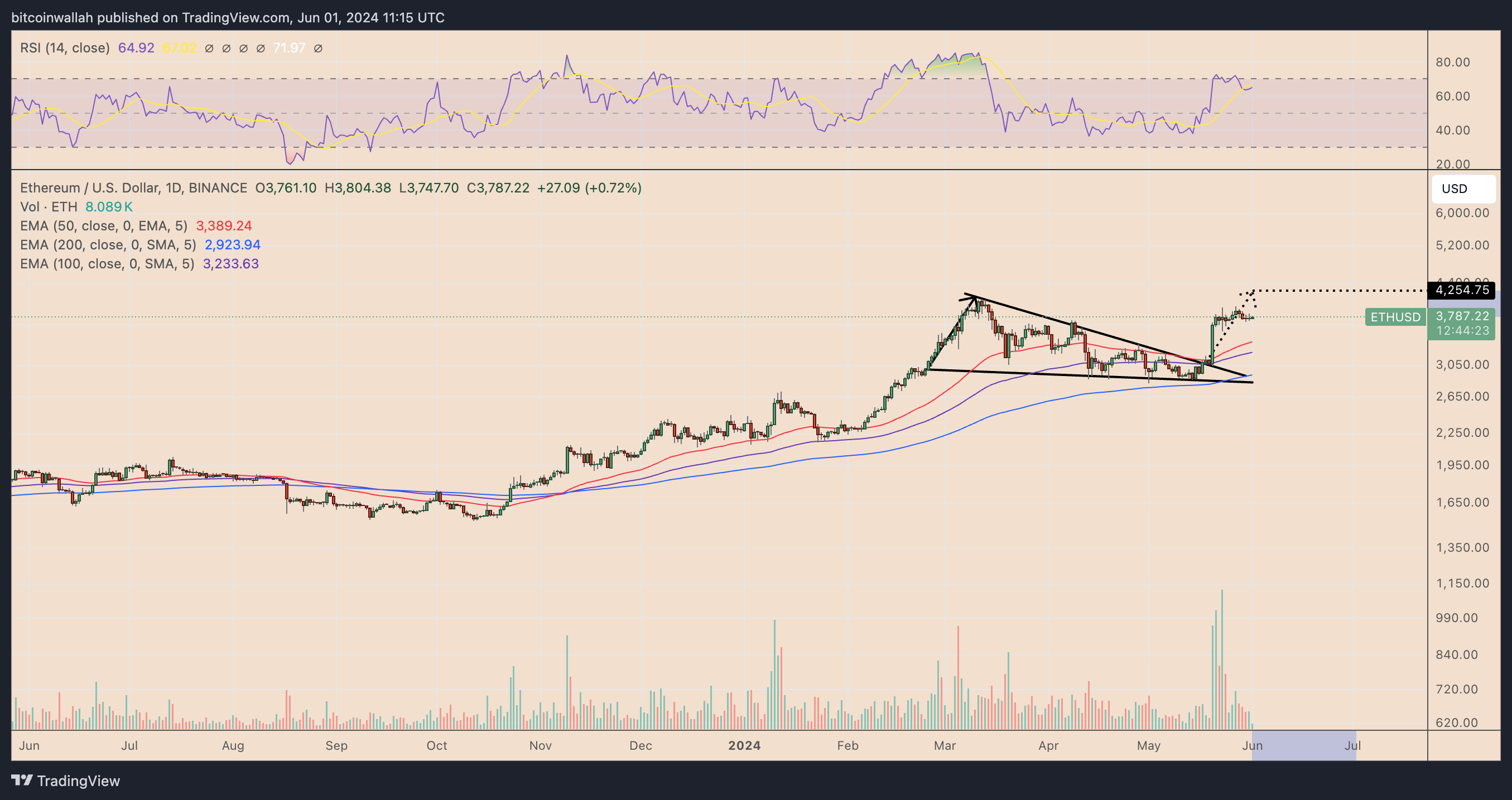

Perceived as “digital oil' for future technological advancements, Ethereum ($ETH) is revolutionary with the assertion of system Web3 applications around it. In doing so, it has become vital to decentralized finance (DeFi), non-fungible tokens (NFT) and others by developing complex smart contracts that are a programming language known as Solidity that can run on the EVM (Ethereum Virtual Machine ).

Despite all these achievements so far, Ethereum still faces some challenges, including but not limited to insecurity in the network itself versus vulnerability to hacker attacks; scalability issues due to the growing number of users consuming large amounts of energy. These problems are solved by introducing various solutions that include the sharding technique within Eth2.0 as well as the Proof of Stake (PoS) mechanism.

Additionally, according to the report, stablecoins play an important role in bridging the digital with the real economy by offering stability and enabling seamless transactions. It also highlights how central bank digital currency systems can increase the efficiency of payment systems, reduce transaction costs and promote financial inclusion if privacy, security and regulatory issues are addressed.