Notably bullish flows hit ether’s options market early Monday, indicating budding hope for a recovery rally ahead of the year-end.

Institution-focused over-the-counter desk Paradigm saw 18,500 contracts of the $4,400 call option and 14,000 contracts of the $4,200 call option change hands during Asian hours. These trades due for expiry on Dec. 31 were executed on Paradigm and booked on Deribit, the leading exchange for cryptocurrency options by volume and open interest.

A call option gives the purchaser the right, but not the obligation, to buy the underlying asset at a predetermined price on or before a specific date. A call buyer is implicitly bullish on the underlying asset.

While options’ primary use case is to protect spot or futures market exposure from unexpected bullish or bearish moves, speculators sometimes punt on the underlying asset by simply buying calls or puts.

“The two trades were traded live and appear to be a large directional bet for a move higher into year-end,” Patrick Chu, director of institutional sales and trading at Paradigm, told CoinDesk.

Theoretically, the $4,400 call represents a bet that ether would settle above that level on Dec. 31. However, buyers can square off positions before the expiry if ether chalks a quick move higher, boosting the value of bullish bets.

Note that out-of-the-money (OTM) calls at strikes higher than the underlying asset’s current market price (CMP) are relatively cheap compared with strikes at or below the CMP and tend to gain significant value on a sudden move higher. Thus, traders often snap up OTM calls in a bid to make outsized gains.

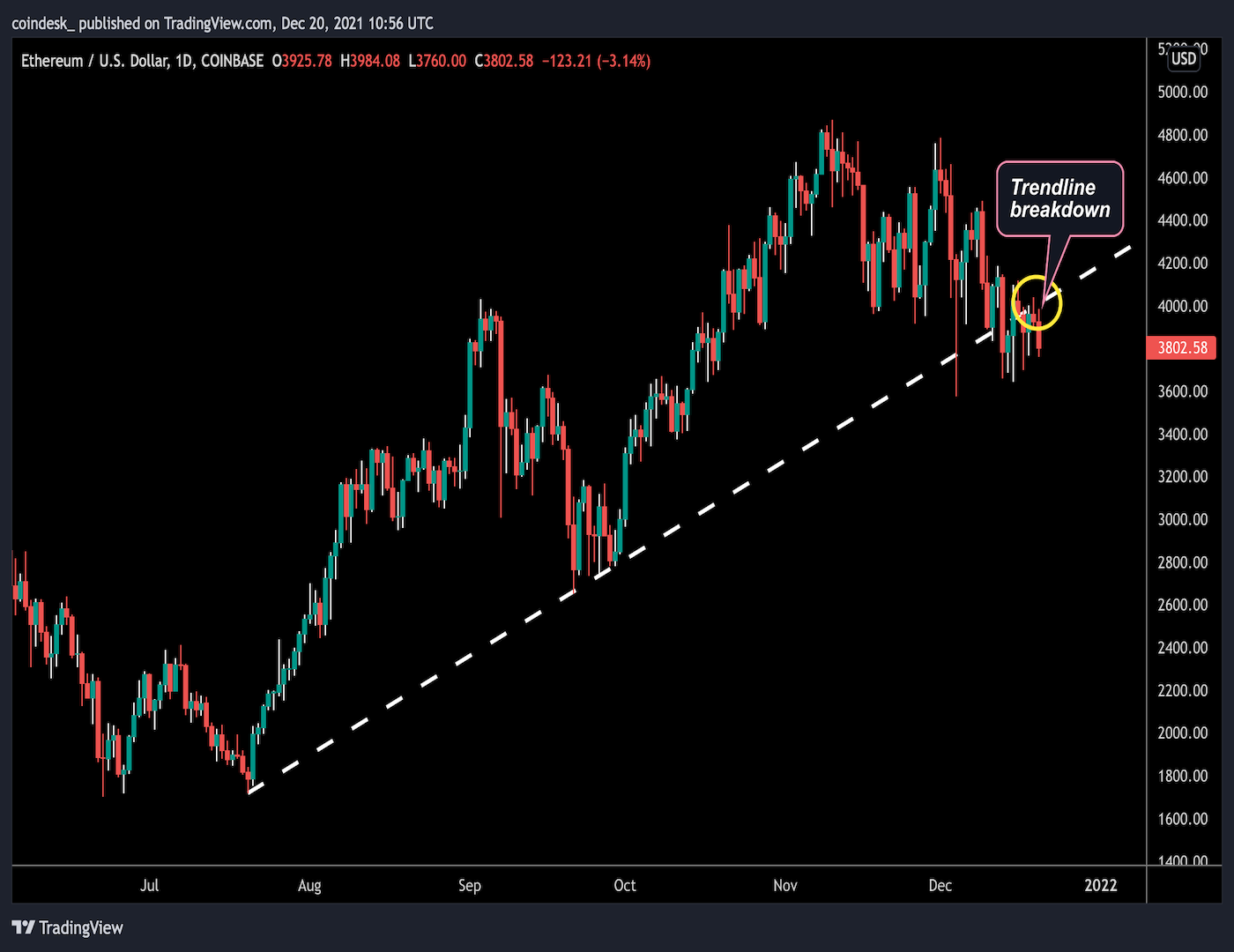

Despite sizeable buying activity in the $4,200 and $4,400 calls, the overall options market still signals caution.

Also read: Bitcoin, Ether Dip in ‘Bearish Asia Session’ as China Rate Cut Fails to Inspire Risk Buying

coindesk.com

coindesk.com