After the United States Securities and Exchange Commission (SEC) finally approved applications from Nasdaq, Cboe, and NYSE to list exchange-traded funds (ETFs) tied to the price of Ethereum (ETH), certain trades by a US politician have come into the limelight.

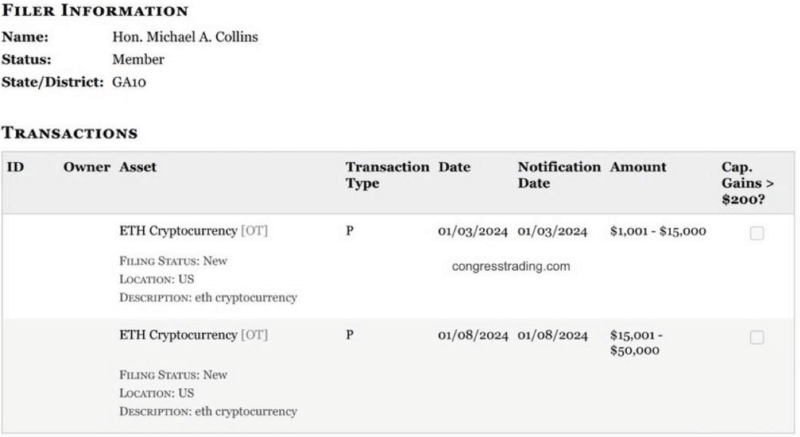

Specifically, Michael Collins, the US representative for Georgia’s 10th congressional district, disclosed in January 2024 a $65,000 investment in Ethereum, as Finbold reported at the time, and more recently, highlighted by Quiver Quantitave, in an X post on May 24.

Furthermore, in addition to his January 2024 purchases, Collins had also bought Ethereum three times in 2023 – on October 9, November 5, and December 28 – in sales that amounted to $75,000, according to the data shared by markets analytics platform unusual whales on January 10.

For those wondering, Representative Michael Collins has bought around 75k in Ethereum, $ETH since October 9th, before the Spot Bitcoin ETFs.

— unusual_whales (@unusual_whales) January 10, 2024

Ethereum is up ~59% since his first buy. https://t.co/Crnzut2oRw

Ethereum news effect

Meanwhile, Ethereum was at press time changing hands at the price of $3,687.03, which represents a drop of 3.50% in the last 24 hours but nonetheless an advance of 21.68% across the previous seven days, and an accumulated gain of 13.03% on its monthly chart.

That said, according to crypto trading expert Michaël van de Poppe, the crypto market had already priced in the recent positive Ethereum news, as reflected in the form of the crypto asset’s strong 20% move, but the actual listing and inflow would demonstrate whether a strong upwards continuation can happen.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com