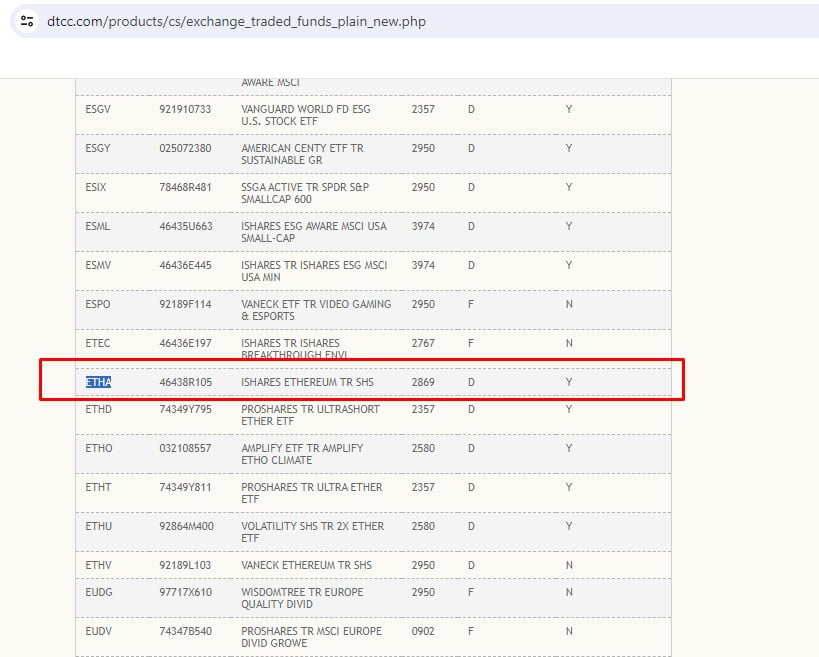

BlackRock’s spot Ethereum ETF has been listed on the Depository Trust and Clearing Corporation (DTCC) with the ticker symbol $ETHA. The listing follows the US Securities and Exchange Commission’s (SEC) approval of eight spot Ethereum exchange-traded funds (ETFs).

The SEC filings list eight Ethereum ETFs from VanEck, Fidelity, Franklin, Grayscale, Bitwise, ARK Invest & 21Shares, Invesco & Galaxy, and BlackRock’s iShares Ethereum Trust, proposed for listing on Nasdaq, NYSE Arca, and the Cboe BZX Exchange, as reported by Crypto Briefing.

Although the SEC has approved the 19b-4 forms associated with these ETFs, trading will remain on hold until the SEC approves each ETF’s S-1 filing. The timeline for this approval process varies, with estimates ranging from a few weeks to several months.

The SEC has reportedly begun discussions with ETF issuers regarding S-1 forms. Bloomberg ETF analyst James Seyffart suggests that the SEC’s approval of the S-1 filings could take at least two weeks, after which trading of the spot Ethereum ETFs can commence.

An SEC spokesperson declined to comment on the recent approval.

Briefly after the approval, asset manager VanEck submitted the amended S-1 form to the SEC. The firm also released a 37-second advertisement to celebrate the landmark approval, inviting viewers to “Enter the ether.”

cryptobriefing.com

cryptobriefing.com