Ethereum has experienced an alarming price surge, increasing by 30% since Monday, and is now nearing $4K for the first time in 70 days. Analysts attribute this rally to the SEC’s more favorable stance on spot Ether ETFs.

This change in perspective has prompted market analysts to increase the likelihood of these ETFs being approved to 75%, driven by active discussions about speeding up 19b-4 filings. According to Nate Geraci, a notable commentator on cryptocurrency developments, the SEC is facing a decision deadline this week concerning spot Ether ETFs.

SEC decision deadline this week on spot eth ETFs…

— Nate Geraci (@NateGeraci) May 19, 2024

SEC must approve both the 19b-4s (exchange rule changes) & S-1s (registration statements) for ETFs to launch.

Technically possible for SEC to approve 19b-4s & then slow play S-1s (esp given reported lack of engagement here).

Geraci’s insights suggest that while the SEC is likely to approve the necessary 19b-4s, which are exchange rule changes, they might delay the S-1 registration statements, reflecting a hesitance in full engagement. Bloomberg analyst James Seyffart echoes this cautious stance, suggesting that despite regulatory advancements, ETF listings could be weeks away.

Still a potentially long way from a launch. But these filings prove that all of the rumors and speculation and chatter have been accurate. Need to actually see SEC approval orders on all the 19b-4s AND THEN we need to see S-1 approvals. Could be weeks or more before ETFs launch

— James Seyffart (@JSeyff) May 21, 2024

With at least five issuers, including major financial entities, having filed revised 19b-4 applications, the market remains on alert. These revised filings notably omit staking-related content, aligning with the SEC’s regulatory concerns.

Optimism Boosts Crypto Market

The anticipation of SEC approval has infused the cryptocurrency market with optimism, contributing to a notable surge in prices. As of press time, the $ETH token is presently trading at $3,758.98, marking a 2.71% increase over the last 24 hours. Its market cap has also risen, up by 2.83% to approximately $452.43 billion.

$ETH/USD 1-Day Chart (Source: CoinMarketCap)

Additionally, Bitcoin soared past $70,000, reaching a peak of $71,958, though it experienced a slight retracement. Nevertheless, it maintained a strong position, trading just below $70K at the day’s close.

Ethereum Nears $4,090 Peak Again

Ethereum’s price has surged more than 25% in the last two days, now nearing the $4,090 mark reached on March 12 of this year. This significant rise from a low of $3,050 continues Ethereum’s upward trend, driven by positive expectations for ETF approval. The cryptocurrency is approaching a critical retest of its March high, with the potential to exceed the highest price since December 2021.

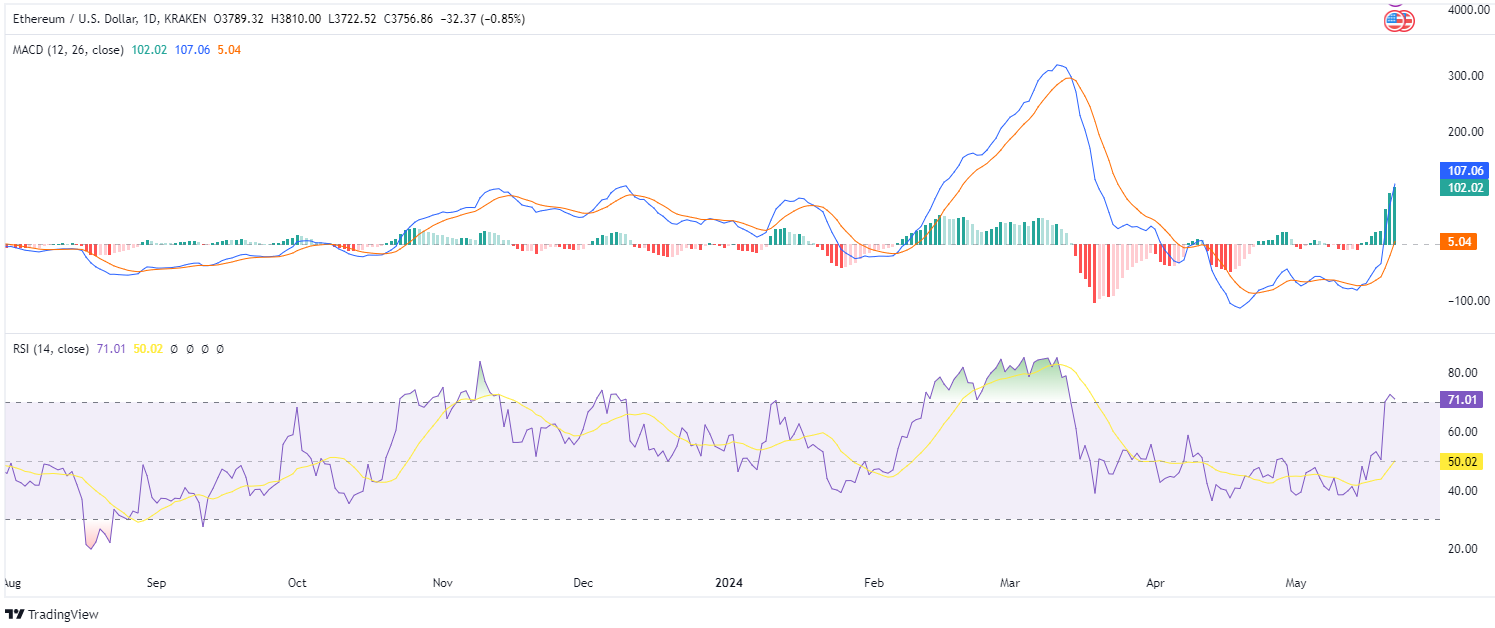

$ETH/USD 1-Day Chart (Source: Tradingview)

Since reaching a peak earlier in the year, Ethereum’s value had previously declined to test the 50% midpoint of its rise from the October 2023 low of $2,537. Despite fluctuations in trading, support buyers successfully maintained this level until the recent breakout. Now, Ethereum is on the brink of surpassing the March 12 high, which would represent the highest valuation since the record $4,891.70 seen in December 2021.

$ETH/USD 1-Day Chart (Source: Tradingview)

Technically, the Moving Average Convergence Divergence (MACD) indicator shows a robust upward momentum. Positioned at 107.06 and moving above the signal line, the MACD suggests that the bullish trend may continue propelling Ethereum’s prices to new heights. The widening green bars of the MACD’s histogram further affirm this positive market sentiment.

However, the Relative Strength Index (RSI) points to a potential overheating in the market. Presently situated in the overbought territory at 71.01, the RSI indicates a strong buying pressure that could lead to a temporary price correction as traders begin taking profits. Despite this, the significant distance above the signal line hints at potential further growth before any major pullback occurs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

coinedition.com

coinedition.com