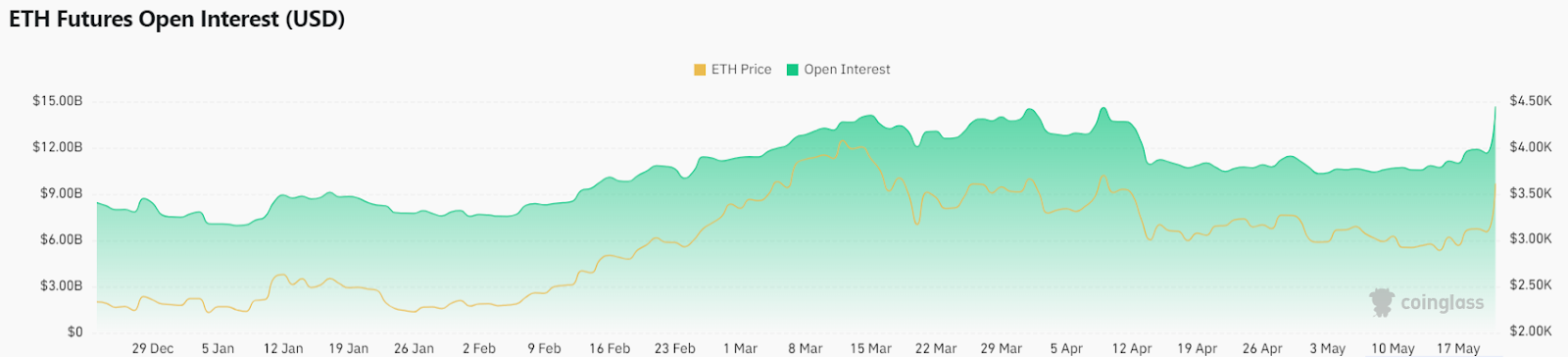

Yesterday, Ether’s price soared by over 20% following comments from Eric Balchunas, a senior analyst at Bloomberg, who significantly raised the likelihood of an Ethereum exchange-traded fund (ETF) approval from 25% to 75%. Consequently, the ETHBTC ratio, which gauges Ethereum’s value relative to Bitcoin, rebounded from a three-year low. Simultaneously, open interest in Ethereum futures climbed to an impressive $14.68 billion, hinting at potential further increases shortly.

Ethereum’s Open Interest Touches New High

Ether ($ETH) futures have hit new levels of popularity, driven by a renewed hope regarding the possible approval of spot $ETH exchange-traded funds (ETFs) in the U.S. The notional open interest, representing the total dollar value of active Ether futures contracts, surged by 25% to a new high of $14.6 billion over the last 24 hours, as per Coinglass.

This surpasses the previous record of $13.2 billion set on March 15. This increase is indicative of a significant influx of capital into the Ether market, predominantly from bullish investors. As the second-largest cryptocurrency by market capitalization, Ether saw its price surge by nearly 17.5% to $3,700. The rise in both price and open interest is generally seen as a confirmation of the ongoing upward trend.

Late Monday, Bloomberg’s ETF analysts revised their forecasts, boosting the likelihood of the U.S. Securities and Exchange Commission (SEC) approving spot $ETH ETFs from 25% to 75%. Concurrently, it was reported that the SEC had urged exchanges interested in listing and trading potential spot ether ETFs to expedite updates to their 19b-4 filings. This move by the regulator indicates an effort to accelerate the approval process.

Since that announcement, the crypto community on X has been filled with hopes that the SEC may be set to approve a spot $ETH ETF, potentially indicating a more favorable regulatory stance towards cryptocurrencies in general.

The low is likely in on #Ethereum. pic.twitter.com/4FQCJuElv8

— Michaël van de Poppe (@CryptoMichNL) May 21, 2024

According to a prominent crypto analyst, Van De Poppe, the bottom for $ETH price arrived as ETHBTC ratio made a solid bounce from the low of $0.04473 toward $0.05265. This suggests a weakening bearish momentum for Ethereum.

The upcoming decision regarding spot Ethereum ETFs has increased attention towards the $ETH options expiries on a weekly and monthly basis. At Deribit, the premier derivatives exchange, the open interest for Ether options on May 24 stands at $867 million. This figure significantly rises to $3.22 billion by May 31. In contrast, the open interest for monthly $ETH options at CME is only $259 million, with OKX slightly lower at $229 million.

The regulator is set to decide on the VanEck spot ether ETF on May 23. The SEC is required to approve the 19b-4 filings and the S-1 registration statements before ether ETFs can begin trading on stock exchanges.

What’s Next For $ETH Price?

Ether faced rejection at the resistance line of $3,720, yet the bulls prevented a decline below the 20-day EMA (valued at $3,300). Buyers will make another attempt to break above the resistance line to validate a clear trend. Bears currently have less control on the $ETH price chart. As of writing, $ETH price trades at $3,665, surging over 18% in the last 24 hours.

The bulls are poised to try pushing the price over the resistance line again. Success in this effort could indicate an upcoming shift in the short-term trend. The $ETH/USDT pair might then climb towards $4,100, and possibly reach the higher resistance level at $4,500.

On the other hand, if the bears intend to keep their control, they must drive the price below the 20-day EMA and further depress the pair below the crucial $3,000 support mark. Should this occur, the pair risks falling to the channel’s support line.