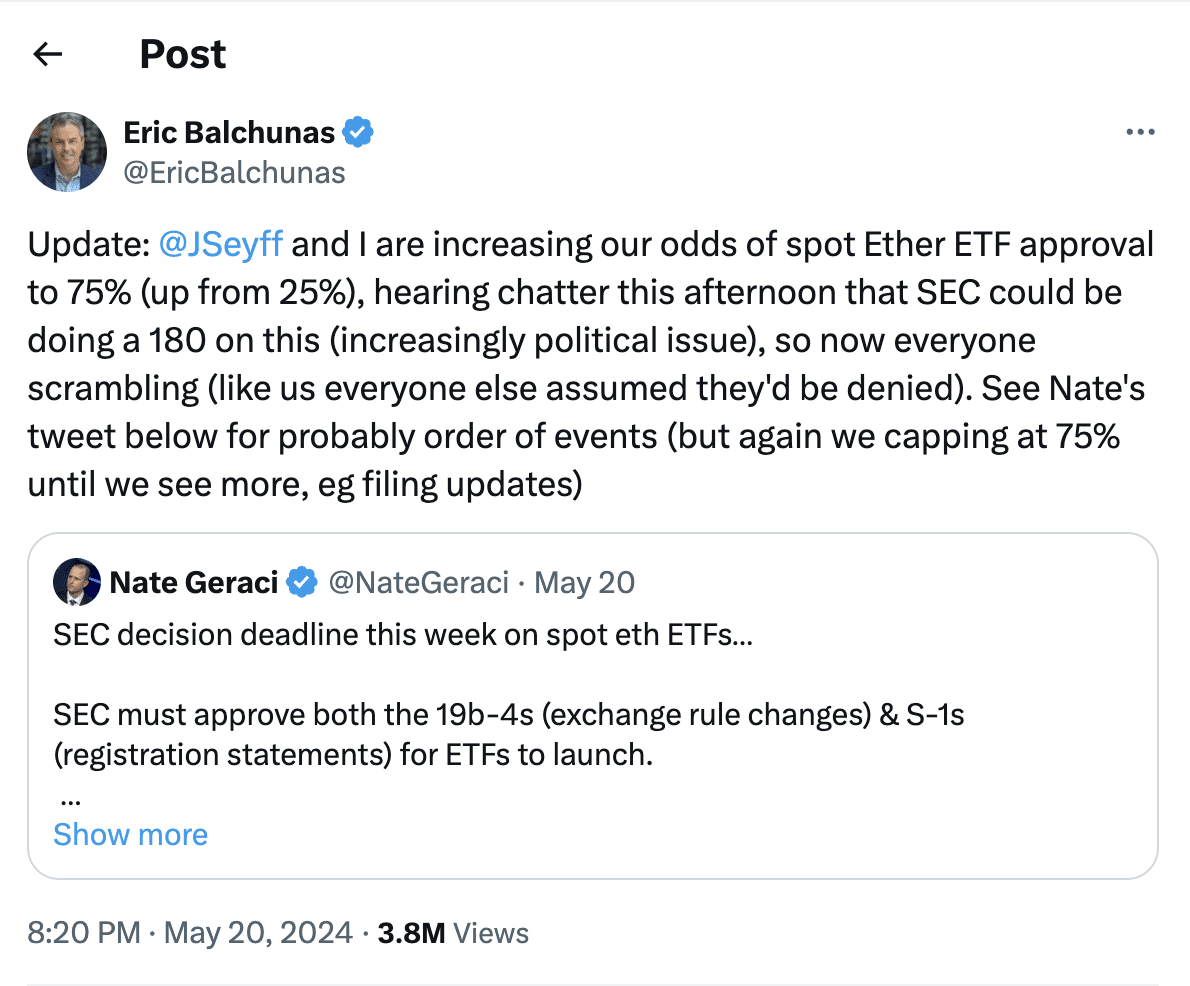

On May 20th, Bloomberg ETF analyst Eric Balchunas increased the probability of a spot Ethereum ETF approval from 25% to 75%. His post on X gained over a million views in an hour, leading to a significant rise in ETH prices and a surge in the broader altcoin market.

Bloomberg Analyst Predicts 75% Chance of Ethereum ETF Approval This Week

Eric Balchunas, a well-respected Bloomberg analyst in the crypto ETF space, recently updated his forecast, boosting the likelihood of a spot Ethereum ETF approval to 75%.

Balchunas, who has been a key figure in the news coverage of the spot Bitcoin ETFs launched in January 2024, shared his insights on X, causing instant ripples across the crypto markets. ETH prices spiked more than 10% within minutes of his post.

Balchunas indicated hearing “chatter this afternoon that SEC could be doing a 180 on” spot Ethereum ETF applications. The SEC, which has been mostly silent on Ethereum ETFs, has been deliberating whether to classify ETH as a security or a commodity. This silence had previously been interpreted as a negative sign for ETF approval chances.

However, with a looming deadline for multiple ETF decisions on May 23rd and 24th, there is increasing pressure on the SEC to act. Balchunas referenced another tweet from Nate Geraci, a crypto ETF expert, explaining that the SEC must approve both the 19b-4s (exchange rule changes) and S-1s (registration statements) for ETFs to launch. Geraci suggested that the SEC could approve the 19b-4s first and take more time to scrutinize the S-1s, allowing for a more thorough review of the applications.

This strategic delay could be beneficial, as it would give the SEC additional time to address the complexities involved in approving these ETFs. Recently, ARK and 21Shares amended their application to remove staking, likely to make their proposal more appealing to the SEC. Although removing staking could be seen as a drawback, it might improve the chances of approval.

Balchunas’ revised outlook is noteworthy given that just a week ago, he considered the odds of a spot ETH ETF approval to be “slim to none.” His dramatic shift to a 75% likelihood indicates substantial new information or insights.

How Will Ethereum Price React to ETF Approval?

The approval of a spot Ethereum ETF would mark a significant milestone for crypto adoption, potentially opening the door for a broader range of investors and pushing ETH to new all-time highs above $4,900.

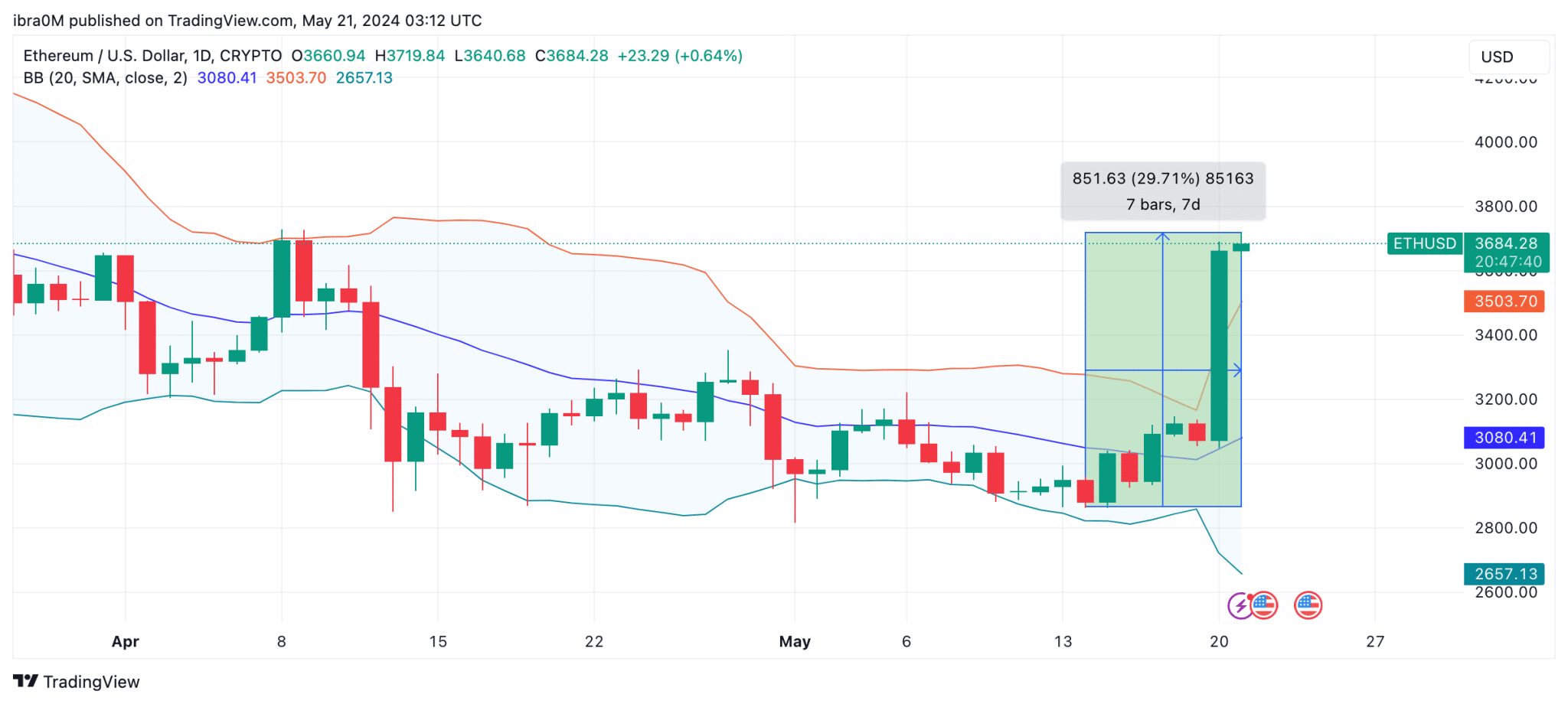

As seen above, Ethereum price surged 19% from $3,408 to $3,719 within the last 24-hours as investors reacted to Bloomberg analyst’s insights on the Ethereum ETF approval prospects. Haven broken above the upper-limit Bollinger band indicator, bull are now firmly in control of ETH short-term price action.

However, strategic investors will be wary of this rapid price surge. If the SEC issues an official approval later this week, it could spark a sell-the-news wave among paperhand swing traders looking to book quick profits, potentially causing a retracement toward the $3,500 level.

The path of the Ethereum ETFs parallels the spot Bitcoin ETFs’ approval process, suggesting that despite the SEC’s relative silence, an approval could be imminent.

thecryptobasic.com

thecryptobasic.com