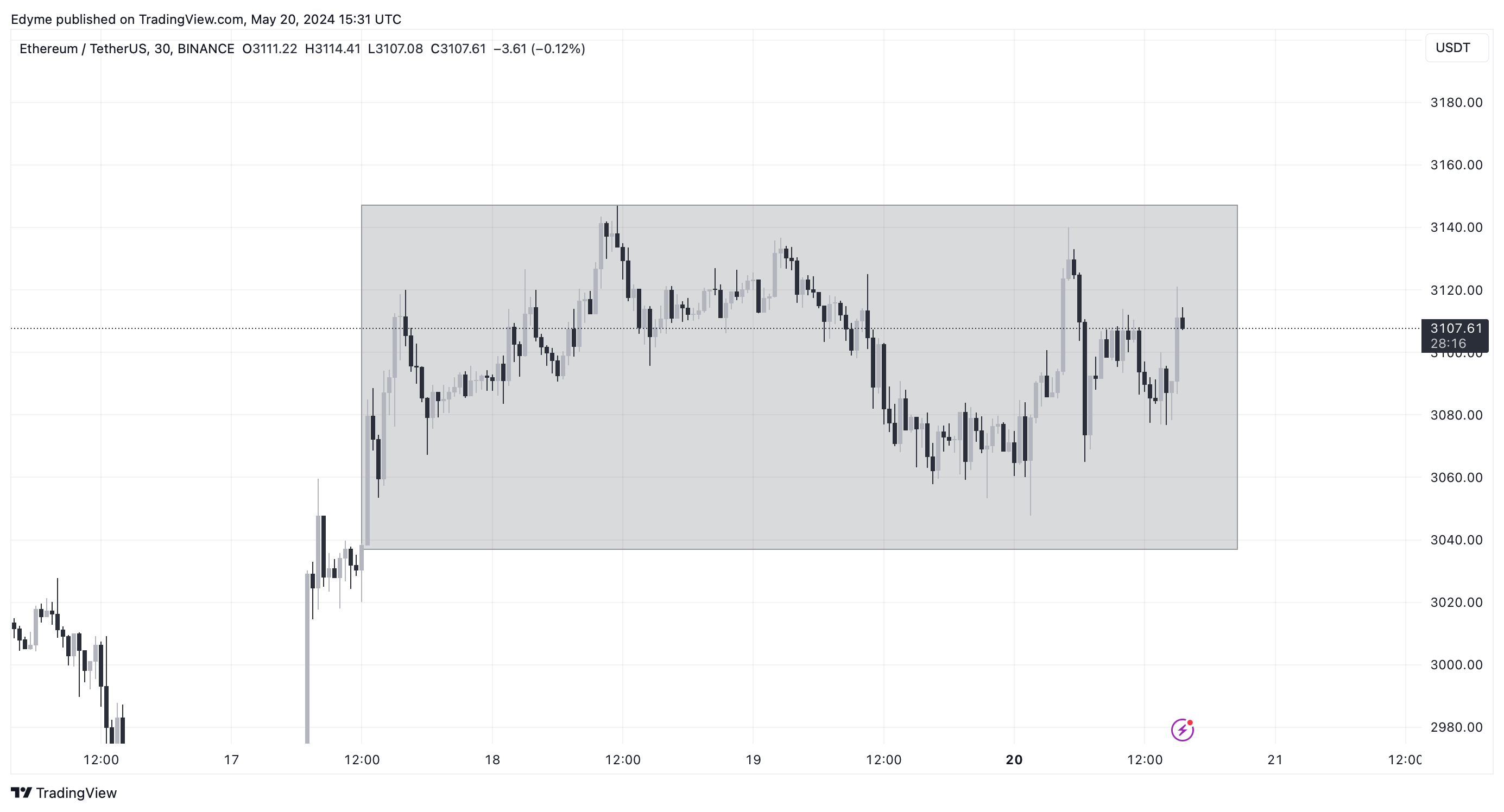

This consolidation period, often called accumulation, may be largely due to market participants awaiting the upcoming decision from the US Securities and Exchange Commission (SEC) on the approval of the much-anticipated spot Ethereum ETF.

With this critical announcement expected later in the week, buyers and sellers appear to be in a holding pattern, cautiously awaiting the news that will likely determine their next strategic moves.

Ethereum Regulatory Decisions And Market Speculation

So far, Bloomberg’s Senior ETF Analyst, Eric Balchunas, has expressed a cautious stance concerning the spot Ethereum ETF estimating only a 25% chance that the spot ETF will receive approval.

On the other hand, Nate Geraci, President of the ETF Store, has revealed that the process for ETF approval involves several critical steps, including the acceptance of both 19b-4 filings (Exchange Rule Changes) and S-1 registration statements (initial registration forms for new securities).

SEC decision deadline this week on spot eth ETFs…

SEC must approve both the 19b-4s (exchange rule changes) & S-1s (registration statements) for ETFs to launch.

Technically possible for SEC to approve 19b-4s & then slow play S-1s (esp given reported lack of engagement here).

— Nate Geraci (@NateGeraci) May 19, 2024

Featured image from Unsplash, Chart from TradingView

newsbtc.com

newsbtc.com