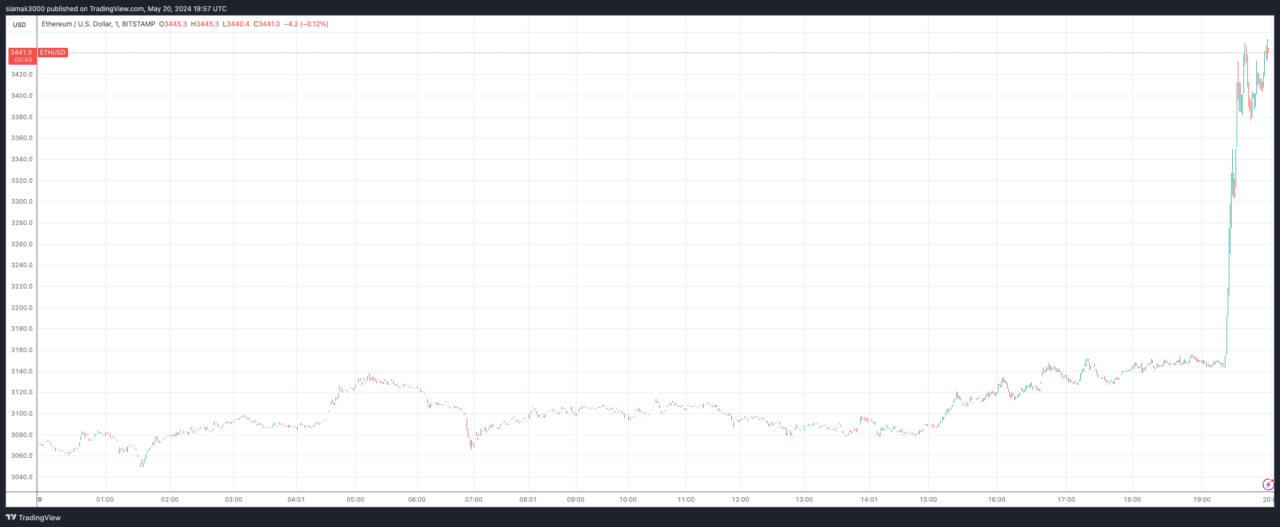

Ether (ETH) experienced a significant price surge, climbing 11.4% during U.S. trading hours on Monday. The rally was sparked by a noteworthy update from two well-known Bloomberg ETF analysts, Eric Balchunas and James Seyffart, who substantially increased their estimated likelihood of the U.S. Securities and Exchange Commission (SEC) approving spot ETH ETFs.

In a post on the social media platform X, Balchunas shared that he and Seyffart had revised their odds of spot Ether ETF approval from 25% to 75%. The decision to increase the odds was based on rumors circulating in the afternoon, suggesting that the SEC might be reconsidering its stance on this increasingly political issue. Consequently, market participants are now scrambling to adjust their positions, as many had previously assumed that the ETFs would be denied approval.

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they'd be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

The SEC is currently facing several final deadlines this week regarding the approval or denial of spot ETFs, having postponed decisions on these funds on multiple occasions. The potential approval of spot ETH ETFs is expected to have a significant impact on the cryptocurrency market, as it would provide a new avenue for institutional investors to gain exposure to Ether.

In response to the news, Bitcoin (BTC) has also experienced gains, rising more than 5% and approaching the $70,000 level.

The positive sentiment surrounding the potential approval of spot ETH ETFs appears to be spilling over into the broader cryptocurrency market as investors anticipate increased institutional adoption and liquidity.

Featured Image via Pixabay

cryptoglobe.com

cryptoglobe.com