A massive crypto whale recently offloaded $46 million worth of Ethereum ($ETH) amid a critical period for the crypto market.

This transaction has stirred considerable attention as the market anticipates the US Securities and Exchange Commission’s (SEC) decision on the spot Ethereum exchange-traded funds (ETFs).

Crypto Whales Cash Out on Ethereum

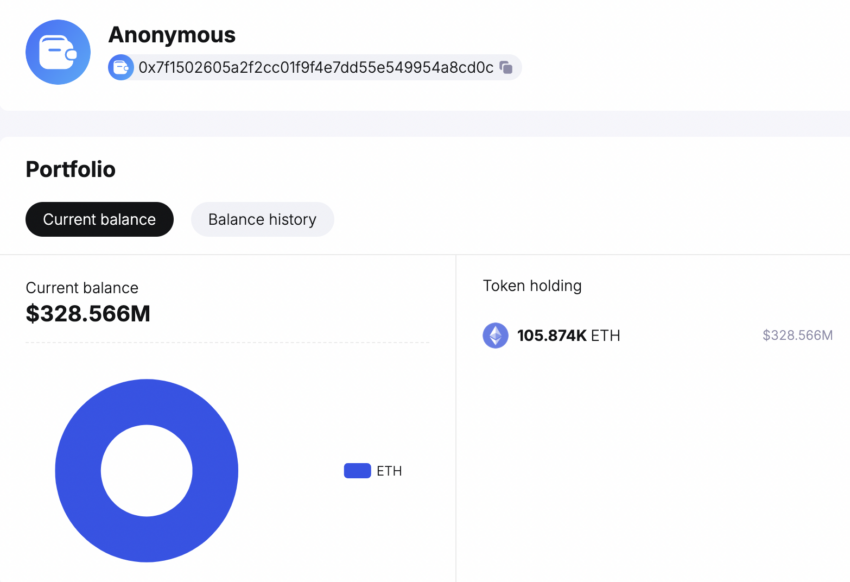

According to the on-chain analysis platform Spot On Chain, the crypto whale, identified by the wallet address 0x7f1, deposited 15,000 $ETH (~ $ $46 million) to Kraken at $3,065 each on May 20. This transaction marks the first time this whale has moved such a significant amount to Kraken.

“Notably, the whale is currently gaining a massive estimated total profit of $172.4 million (+86.7%) from $ETH,” Spot On Chain mentioned.

This profit stems from strategic movements, including withdrawing 120,874 $ETH from Kraken at an average cost of $1,645 per $ETH in September 2022. With the recent deposit, the whale’s remaining Ethereum holdings stand at 105,874 $ETH, valued at approximately $327 million.

Read more: Ethereum ($ETH) Price Prediction 2024/2025/2030

This development occurs as long-term Ethereum holders show signs of selling. Ethereum has surged by over 9% from last week’s lows, and crypto whales’ must have capitalized on the price surge.

BeInCrypto recently reported that another notable Ethereum investor, known by the wallet address 0x2ce, transferred 4,153 $ETH, worth about $12.17 million, to Coinbase.

Moreover, data from Glassnode, an on-chain analysis platform, reveals a 15% decline in the total supply of $ETH that had remained unmoved for five to seven years. Specifically, this metric dropped from 11.6 million $ETH in late February to the current 9.8 million $ETH.

The timing of these transactions coincides with the impending SEC decision on spot Ethereum ETFs. On May 23, the SEC is expected to announce its ruling on VanEck’s spot Ethereum ETF.

The regulatory agency’s cautious stance reflects the broader challenges within the crypto market. Jan van Eck, CEO of VanEck, expressed skepticism regarding the SEC’s approval of spot Ethereum ETFs. During an interview at the Paris Blockchain Week, he mentioned that VanEck and Ark Invest’s applications might face rejection.

“The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the Bitcoin ETFs — and right now, pins are dropping as far as Ethereum is concerned,” van Eck explained.

Moreover, Bloomberg’s senior ETF analyst Eric Balchunas estimates less than a 35% chance of SEC approval for Ethereum ETFs. Similarly, bets on Polymarket place the likelihood at just 10%.

Read more: Ethereum ETF Explained: What It Is and How It Works

The SEC’s recent delay of BlackRock’s Ethereum ETF application, seeking public input on fraud and manipulation concerns, further highlights the regulatory complexities. The transition to a Proof-of-Stake (PoS) consensus mechanism has added layers of scrutiny. The SEC questions whether Ethereum now meets the Howey Test criteria for security.

As the market eagerly awaits the SEC’s decision, the actions of significant Ethereum holders and the broader regulatory environment will undoubtedly shape the crypto industry in the coming months.

beincrypto.com

beincrypto.com