Ethereum (ETH) price opened trading at $3,140 on April 25, as the pioneer smart-contract network begins to show early signs of an imminent recovery phase. On-chain data trends show ETH investors’ reaction to the Bitcoin halving could be pivotal to the next rally.

Is Ethereum price on the verge of revisiting $3,500?

Investors Stake ETH $620M Worth in 5-days

The Bitcoin network executed its 4th Halving on April 20, sparking wild volatility across the global crypto markets as investors move to front-run potential gains from the landmark event.

Since the Bitcoin halving, Ethereum price has struggled for momentum amid falling market liquidity and skittish sentiment among short-term swing traders. But curiously, on-chain data trends show that Ethereum node validators have taken on a more positive outlook.

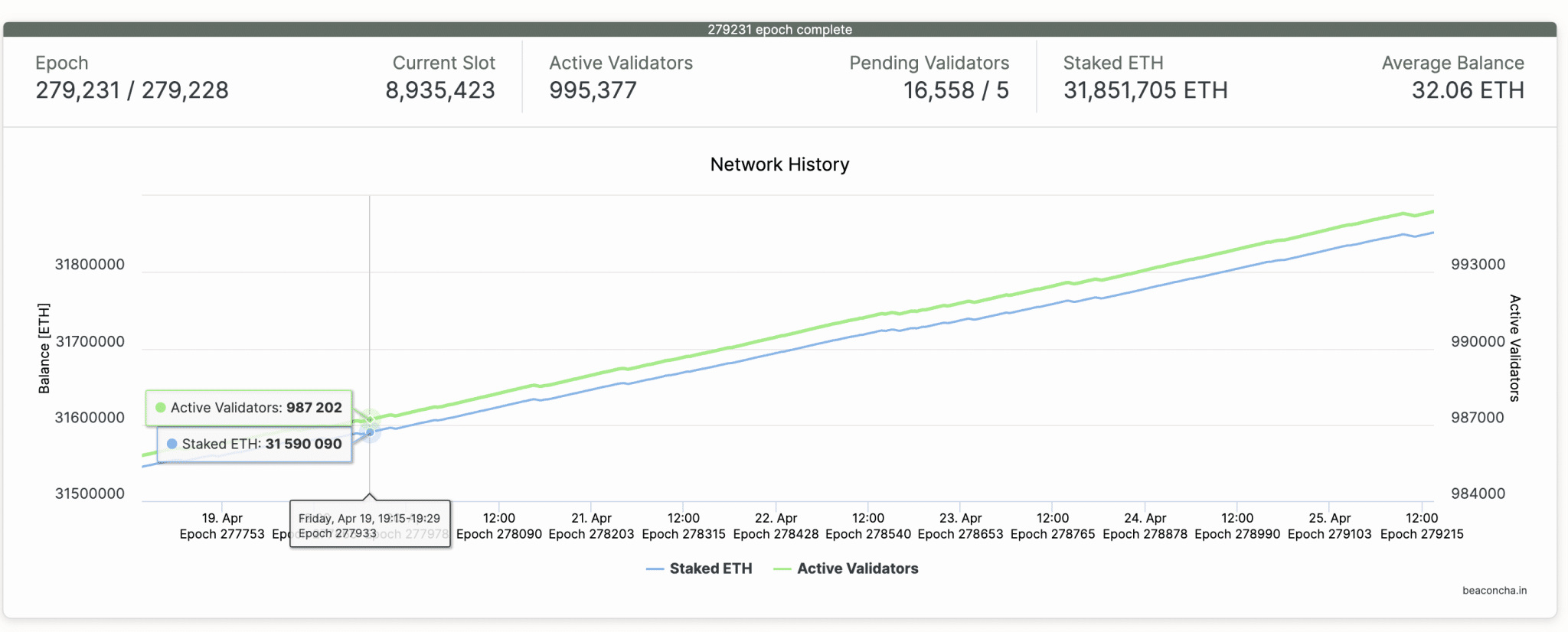

The chart below shows official data on the real-time changes in the number of ETH coins deposited in the Ethereum Proof-of-Stake (PoS) Beacon Chain smart contracts.

On the Bitcoin halving day on April 20, the total staking deposits on the Ethereum Beacon chain stood at 31.6 million ETH. Interestingly, investors have since staked an additional 300,000 ETH, bringing the total stake to 31.9 million ETH at the time of writing on April 25.

Like every PoS network, increasing number of staked coins enhances the security of the Ethereum network. But more importantly, it reduces the short-term market supply. During a period of slow market demand, this could be critical in slowing down the sell-side pressure.

Valued at the current prices, it implies that Ethereum have staked coins worth over $620 million within 5-days of the Bitcoin Halving. Evidently, this has played a pivotal role in helping ETH price defend the $3,000 support level in the last few days.

ETH Price Forecast: Rocky Road to $3,500

Albeit temporarily, node validators pulling $620 million ETH from the immediate market supply puts Ethereum price on course to consolidate above $3,000 as the bulls plot the next attempt at the $3,500.

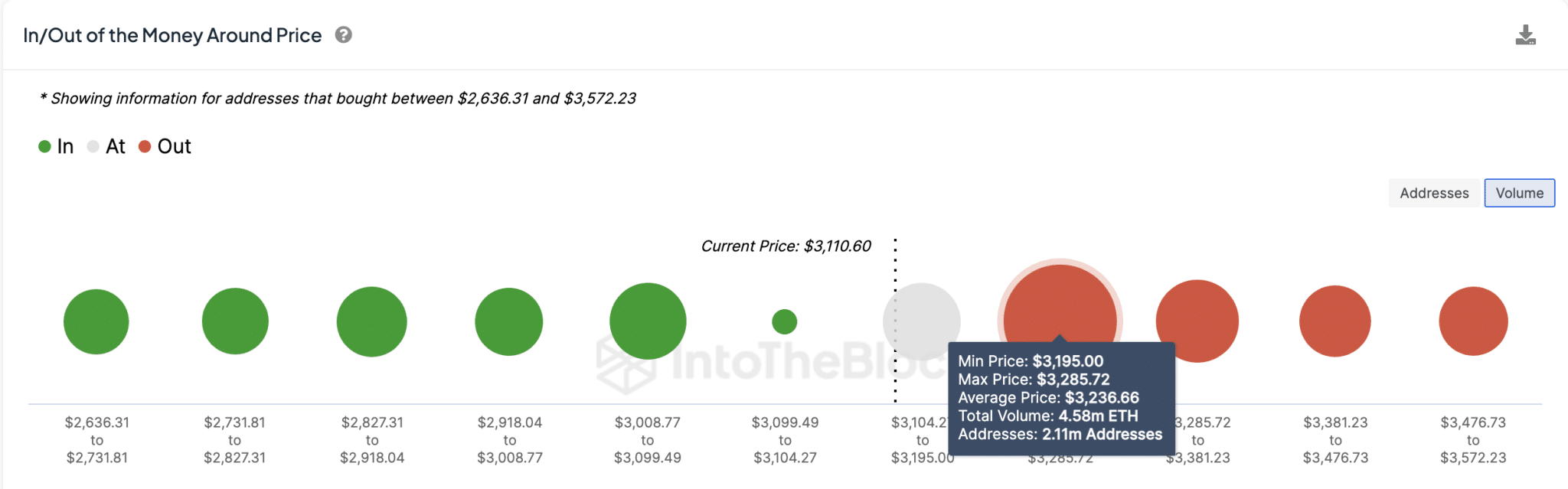

However, to reclaim $3,500, IntoTheBlock’s In/Out of the Money chart below shows that ETH must first scale the looming sell-wall at the $3,250 territory.

As illustrated above, 2.1 million addresses had acquired 4.58 million ETH at an average price of $3,236. If they opt to exit at their break-even point, the ETH price could experience intense headwinds and struggle to break above $3,250 in the near term.

If the Ethereum stakers keep depositing more coins into the Beacon chain, bulls could capitalize on the thinning market supply to stage a decisive breakout above $3,500.

However, in the event of a bearish reversal, ETH could tumble as low as $2,918 before finding a formidable support cluster.

thecryptobasic.com

thecryptobasic.com