According to Tara, a notable crypto market analyst, Ethereum (ETH) could be gearing up for rebound after reaching a previous target low set at the $2,960 price.

Ethereum has been one of the victims of the ongoing market correction, having collapsed 23% from the $3,726 high on April 9 to a two-month low of $2,850 on April 13. Despite a mild rebound from this low, ETH remains in bearish territories, exhibiting choppy price movements in the battle to reclaim $3,000.

In an analysis, Tara called attention to these price movements, suggesting that the bearish pressure could continue, eventually leading to a collapse to $2,700, aligning closely with a pivotal retracement level. This bearish push was expected to materialize as a product of the ongoing correction.

ETH Exhausts Correction

However, in an updated report, Tara confirmed that this correction might already be over amid a shift in sentiment across the general market. For context, Bitcoin (BTC) recently hit its correction target of $59,700 today, recording a bullish push above $63,000 in an impressive upsurge after the retest.

#Ethereum UPDATE! SO, I believe #ETH is actually done with it's correction now too. It did hit the 1:1 of W1 at 2960 and now that #BTC has already hit target, I believe this is all ETH is going to get. I explain more in my video update with Casi that will be posted later today!… https://t.co/dzcLevpsC4 pic.twitter.com/qWzieBmKAV

— TARA (@PrecisionTrade3) April 18, 2024

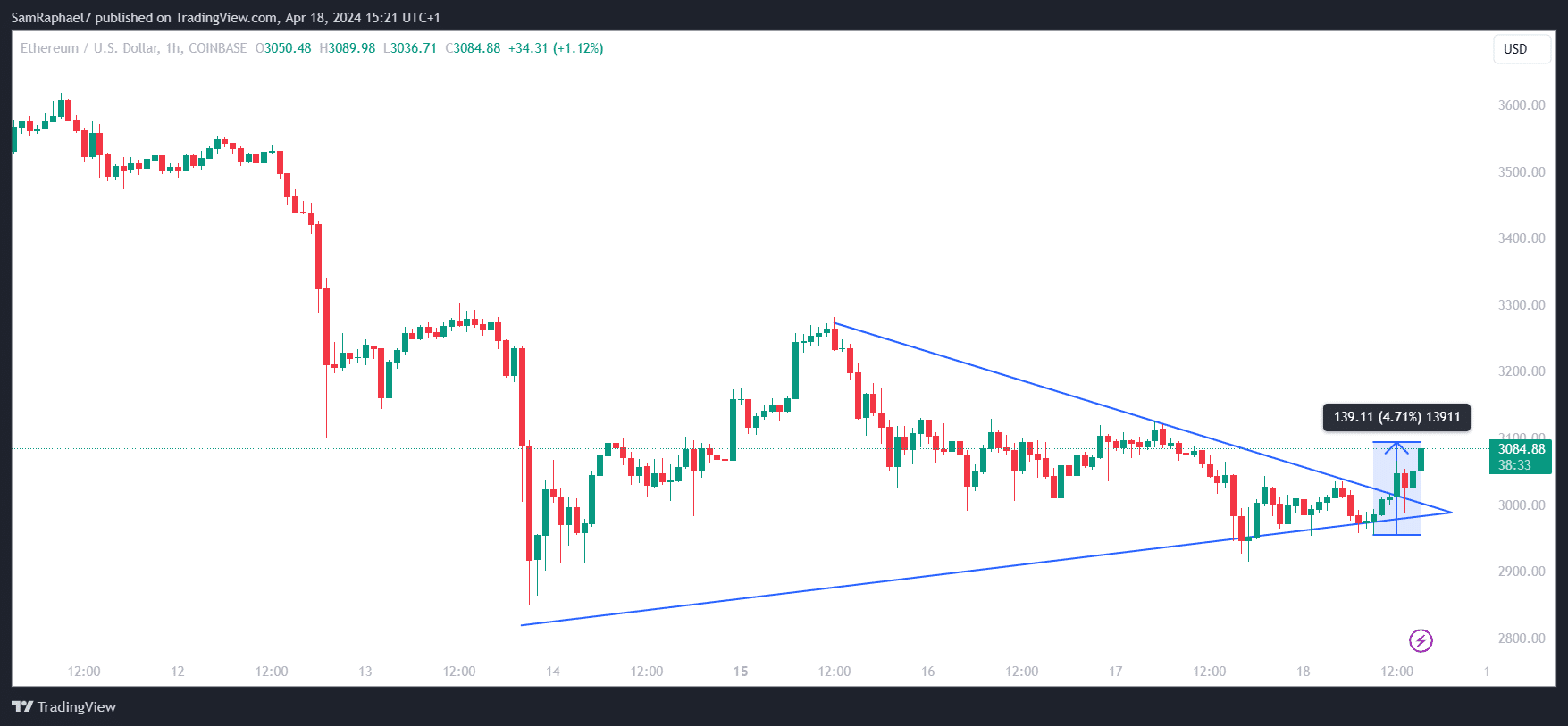

Ethereum has capitalized on this uptrend, recording green candle closes on the 1-hour chart from 07:00 today (UTC). This flip in momentum came up after ETH retested the lows at $2,960, coinciding with Bitcoin’s retest of $59,700.

According to Tara, the $2,960 threshold represented a potent retracement level. Notably, such support zones are typically leveraged for a push toward recovery. This was the case with Ethereum, as it has now rallied by 4.71% over the last seven hours since touching $2,960.

As a result of this bullish switch, ETH broke above the $3,000 again, seeking to establish firm support above this psychological level. However, Ethereum faces stern resistance at the Fibonacci 0.382 level stationed at $3,115, as highlighted by Tara in previous analysis.

Ethereum Looks to Sustain Bullish Momentum

Should the bears retake control of the scene, Ethereum would need to hold above the $2,996 to hedge against any steeper drops to the recent lows. This level aligns with the support mounted at the upper trendline of a recently formed symmetrical triangle on the 1-hour timeframe.

However, Ethereum’s hourly RSI has continued to push upward following a collapse from the price drop to $2,960. The RSI currently shows bullish momentum in the short term, but Ethereum would need to breach the 50-day EMA at $3,164 to confirm this bullishness. This also syncs with the Fib. 0.382 level at $3,115.

Amid this pivotal moment, CryptoQuant data confirms a decrease in Open Interest, suggesting that Ethereum could be on the verge of a trend reversal from bearish to bullish. In addition, funding rate indicates a predominance of long sentiment, demonstrating investor behavior at this point.

Moreover, the Coinbase Premium Index has recorded a mild uptick in recent times, signaling that there is an increase in demand for Ethereum among U.S. institutional investors. ETH currently trades for $3,083, up 3.15% today on the journey to recovery.

thecryptobasic.com

thecryptobasic.com