Following a significant downturn in March, liquid staking derivatives (LSD) protocols experienced another withdrawal of 380,000 ether, valued at roughly $1.17 billion, from leading LSD platforms since April 1, 2024.

Ethereum Exodus: $1.17 Billion Pulled From LSD Platforms

In the initial two weeks of April, a notable reduction of 380,000 ether was observed in the top liquid staking derivatives (LSD) protocols. On April 1, 2024, these platforms collectively held 13.53 million ETH across 27 distinct decentralized finance (defi) platforms, as per archived data from defillama.com. Presently, after this decline, approximately 13.15 million ETH, valued at $41.5 billion based on current exchange rates, remains.

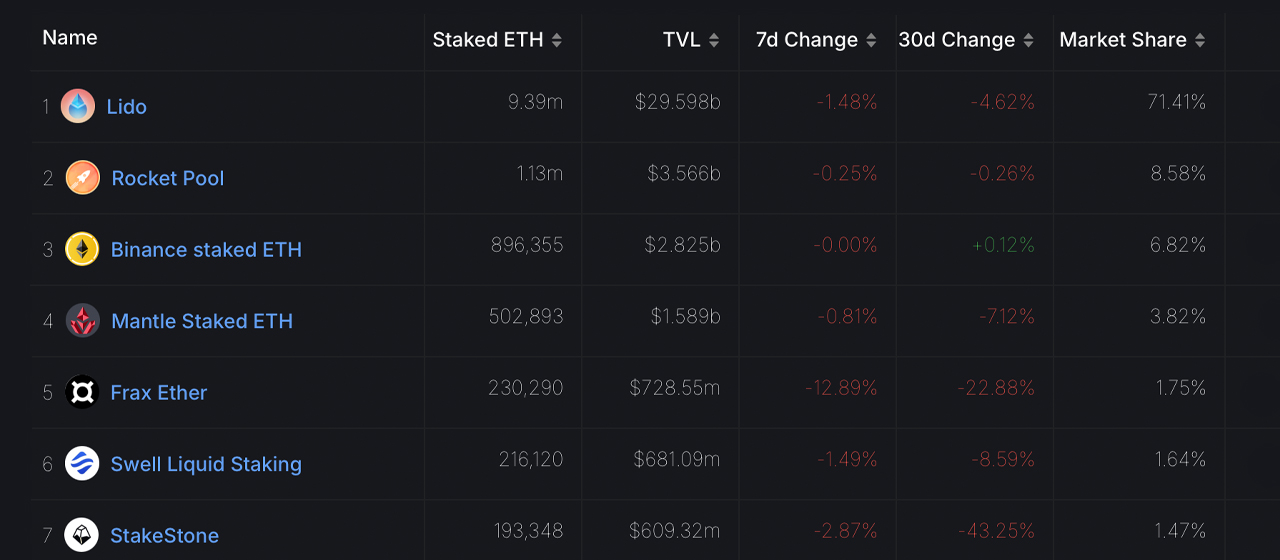

Fifteen days prior, Lido managed 9.65 million ether, but as of this Monday, the figure has reduced to 9.39 million. This accounts for 260,000 ether of the overall reduction attributed to withdrawals from Lido. Rocket Pool maintained its holdings at 1.13 million ETH, showing no change. Binance’s ETH LSD protocol decreased slightly from 896,355 ETH to 896,181 ETH in the same period. Meanwhile, Mantle’s holdings diminished from 508,015 ETH to 502,893 ETH.

The LSD protocol by Frax Ether underwent a more pronounced decrease, dropping from 278,977 ether to 230,290 ETH. Similarly, Stakestone, another top LSD player, recorded a decline from 278,977 ETH to 230,290 ETH. Despite the reduction of 260,000 ether, Lido continues to dominate the sector, commanding 71.41% of the total $41.5 billion in value locked. Rocket Pool accounts for approximately 8.58% of the ether locked across the 27 defi applications.

As the ether exodus from LSD platforms persists, uncertainty clouds the future of these LSD defi protocols. The substantial removal of 720,000 ethereum since March indicates a shifting sentiment among investors. Whether this indicates a temporary shift or a long-term downturn is yet to be determined, highlighting the unpredictable nature of defi markets and investor behavior this year.

What do you think about the 380,000 ether unstaked over the past 15 days? Let us know what you think about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com