Ether.fi ($ETHFI) token price has gone parabolic in the past few days. The token surged to an all-time high of $6.80, much higher than its all-time low of $0.23. This surge has brought its total market cap to over $708 million, according to CoinMarketCap.

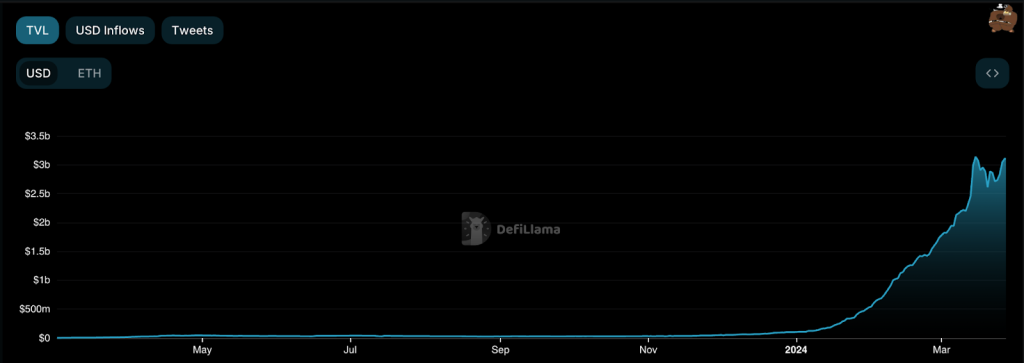

Ether.fi has had a remarkable growth rate in the past few weeks, making it one of the fastest-growing platforms in the crypto industry. Data compiled by DeFi Llama shows that the network has grown its total value locked (TVL) has jumped to over $3.17 billion. It has over 847k $ETH in its ecosystem.

Ether.fi total value locked

This trend has transitioned Ether.fi to become the 12th biggest player in the decentralised finance (DeFi) industry. It has also become the second-biggest player in the fast-growing restaking platform after EigenLayer.

Ether.fi is a DeFi platform in the restaking industry. The concept behind this approach is relatively simple. In it, a user stakes Ethereum ($ETH) and gets eTH, which is a natively restaked liquid staking token.

Restaking is seen as a better approach to the traditional approach of staking, In it, users stake already liquid staking tokens to be staked with validators in other networks, As a result, users can earn more rewards while helping to protect Ethereum’s network.

Ether.fi uses a different approach to restaking. In it, users hold the eETH and weETH where the native restaking happens at the protocol level. The benefit of this is that users can redeem your $ETH out of the eETH/weETH without any delay.

Therefore, the ETHFi token price is soaring because of the growing demand for these restaking solutions. Analysts believe that these assets will continue soaring in the coming months. For example, Lido, the biggest liquid staking platform has grown to over $34 billion in assets.

The post $ETHFI price goes vertical as Ether.fi’s restaking assets rises appeared first on Invezz

invezz.com

invezz.com