Unnamed state authorities are currently investigating the Ethereum Foundation, as reported. This non-profit organization, headquartered in Switzerland, plays a crucial role in supporting the Ethereum community. The investigation appears to have stemmed from a GitHub commit. Let’s take a look at this Ethereum news in more detail.

The Foundation disclosed that they’ve been approached by a state authority, with confidentiality being requested. However, there’s a dearth of information regarding the investigation’s scope and purpose at this juncture.

Contenu

- 1 Ethereum News: Ethereum Under Investigation?

- 2 Ethereum News: What Could be the impact on Ethereum Ecosystem?

- 3 Ethereum News Impact: $ETH Price to Crash?

- 4 Where to BUY Ethereum?

Ethereum News: Ethereum Under Investigation?

The Ethereum Foundation, a Swiss non-profit pivotal to the Ethereum ecosystem, is currently being investigated by an undisclosed “state authority,” as revealed on the group’s GitHub repository.

As of now, the extent and specifics of the investigation remain unclear. A GitHub commit from February 26, 2024, mentions: “We have received a voluntary enquiry from a state authority that included a requirement for confidentiality.”

Now, just one hour ago:

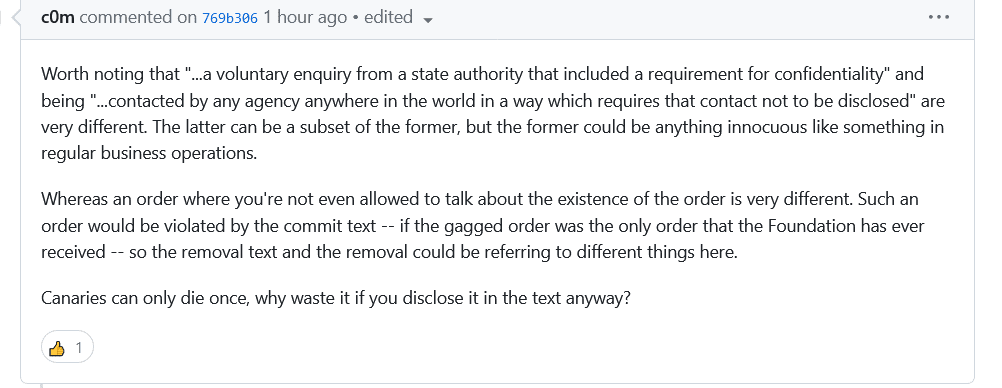

This excerpt from GitHub is discussing the importance of distinguishing between different types of inquiries or orders from authorities. The first type mentioned is a “voluntary enquiry” that requires confidentiality, which could be something routine or innocuous related to regular business operations. The second type mentioned is more serious: an order that prohibits disclosure of its existence, which is much more restrictive and legally binding.

The text emphasizes that while the former type of inquiry could be disclosed in the commit message without violating confidentiality, the latter type would be explicitly violated by such disclosure. Therefore, if the Foundation received only the latter type of order, mentioning its existence in a commit message would breach the order’s terms.

Ethereum News: What Could be the impact on Ethereum Ecosystem?

The private investigation arrives amidst a period of significant evolution in Ethereum’s technology and a potential turning point for its main asset, $ETH. Notably, numerous American investment firms are looking to introduce an exchange-traded fund (ETF) for $ETH. However, the Securities and Exchange Commission (SEC) has been cautious in its approach, despite recently greenlighting several Bitcoin ETFs.

This scrutiny could have various impacts on Ethereum. Firstly, it might introduce uncertainty and volatility in $ETH’s market, potentially affecting its price and investor sentiment. Additionally, prolonged regulatory scrutiny could delay the introduction of an $ETH ETF, limiting accessibility for mainstream investors and hindering the asset’s broader adoption.

Moreover, the investigation’s timing amidst Ethereum’s technological advancements suggests potential concerns regarding compliance, governance, or other regulatory issues. Addressing these concerns effectively will be crucial for Ethereum’s continued growth and success in the cryptocurrency ecosystem.

According to a report by Fortune, the SEC is considering classifying $ETH as a security, which could bring significant changes for Ethereum, $ETH ETFs, and the broader cryptocurrency market. Fortune also noted that the SEC has been issuing investigative subpoenas to U.S. companies in recent weeks.

At the moment, the exact details and focus of the investigation remain unclear. A GitHub commit from February 26, 2024, revealed that the Ethereum Foundation received a voluntary inquiry from a state authority, with a request for confidentiality.

The potential impact of these developments is noteworthy. If the SEC were to classify $ETH as a security, it could lead to stricter regulations and compliance requirements for Ethereum and related projects. This could affect investor confidence, market dynamics, and the overall trajectory of the cryptocurrency industry. Additionally, uncertainty surrounding regulatory scrutiny could delay or disrupt plans for an $ETH ETF, limiting accessibility for mainstream investors and potentially impacting $ETH’s price and adoption.

Ethereum News Impact: $ETH Price to Crash?

At the time of writing this $ETH price is trading at $3,256.57. It is already down by 1.13% in the last one hour and 18.37% in the last seven days.

The Ethereum community is in trouble with reports suggesting that the SEC is eyeing Ethereum for potential reclassification as a security, as per Fortune. This news has everyone on edge, especially since it could have big consequences not just for Ethereum itself, but also for plans to introduce an $ETH ETF and the wider cryptocurrency world.

The SEC’s recent moves, including sending out subpoenas to U.S. companies, are adding to the uncertainty swirling around Ethereum’s regulatory status. We’re all left wondering what exactly the investigation is focusing on, making the situation even more nerve-wracking.

While it’s tough to say for sure what’s going to happen, the possibility of Ethereum being labeled a security is definitely causing some jitters in the market. People are taking a wait-and-see approach, which could lead to some ups and downs in Ethereum’s price in the short term. Ultimately, though, it’ll come down to how Ethereum and regulators handle these regulatory hurdles and whether they can keep investors feeling confident in Ethereum’s long-term value and its role in the decentralized world.

Where to BUY Ethereum?

Bitget stands out as a reliable crypto exchange. It provides a user-friendly interface, making it easy for both beginners and experienced traders to navigate and make transactions at the lowest fees on the market. To get started with Bitget, you need to create an account, complete the necessary KYC procedures, and then you can begin trading a variety of altcoins available on the platform.

cryptoticker.io

cryptoticker.io