Amid a tumultuous week for the crypto market, $ETH whales have made substantial moves, cashing out millions before Ethereum's price downturn. In the past four days of market downtime, three smart traders have offloaded a staggering 26,946 $ETH, equivalent to a jaw-dropping $95.7 million. Their combined profits stand at an impressive $39 million, according to data from Spot On Chain.

The first trader, identified as "0xb82," executed a strategic move, selling 7,300 $ETH for $24.4 million in stablecoins via Binance, netting a handsome profit of 22.7%, which is equivalent to a remarkable $4.59 million. Not far behind, "0xebf" deposited 8,870 $ETH, valued at $33.1 million, onto Binance on March 16, reaping an estimated total profit of $25.3 million, an impressive 55.8% gain.

Lastly, "0xa43" sold 10,776 $ETH for $38.2 million on March 15, realizing a notable $9.14 million profit, equating to a 31.5% gain.

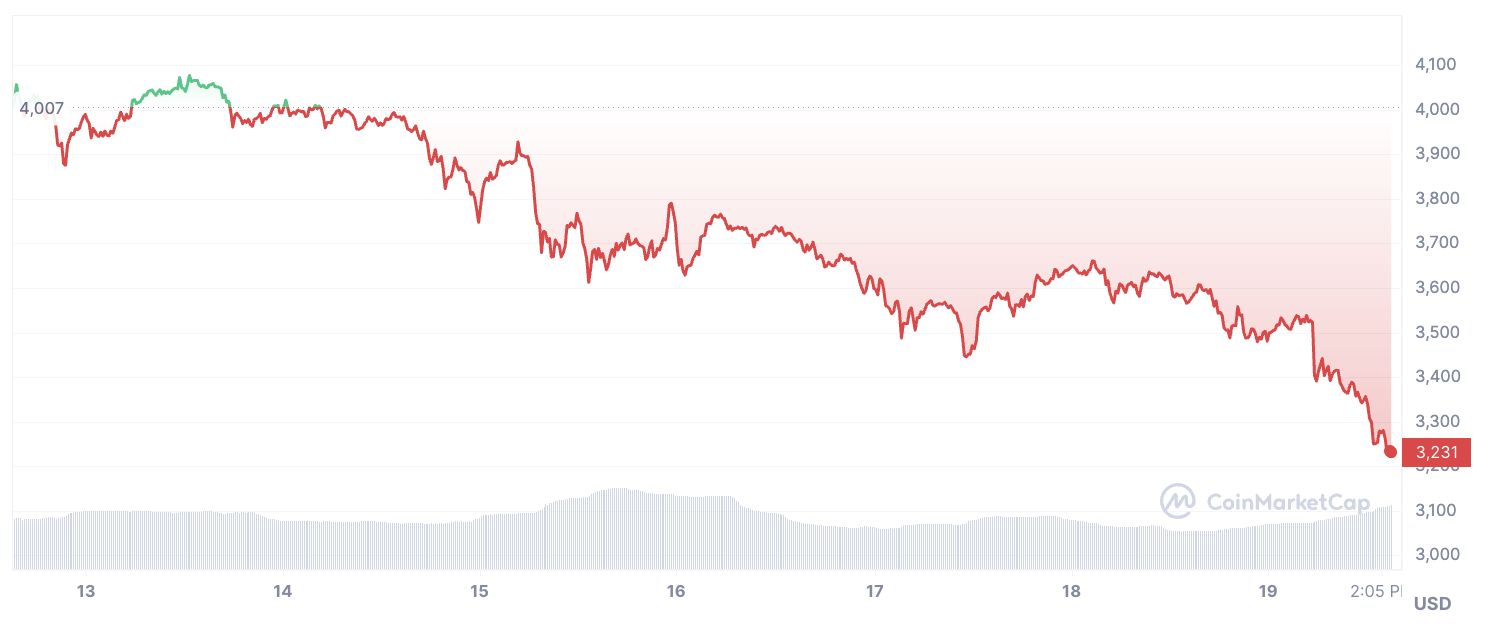

These moves come against the backdrop of Ethereum's price plummeting over 11% since the start of the week. After reaching a two-year high of $4,093 last week, Ethereum faced a significant sell-off, driving its price down to $3,200 per $ETH.

CoinGlass reports that within the past 24 hours, positions totaling $120 million were liquidated, with an estimated 85% of them being long positions, suggesting a wave of sell-offs and profit-taking among investors.

The mass cash-outs by $ETH whales amid the price drop raise questions about the future trajectory of Ethereum and the broader cryptocurrency market. Whether the main altcoin finds a foothold will largely be both the cause and the consequence of how events develop further.

u.today

u.today