Fidelity, a leading name in financial services, has submitted a proposal to the United States Securities and Exchange Commission (SEC) for integrating staking rewards into its spot Ethereum exchange-traded fund (ETF).

This move aims to boost investor returns by tapping into the Ethereum staking market.

Impacts of Fidelity’s Ethereum ETF Revision

In its detailed filing, Fidelity indicated plans to stake a portion of the ETF’s Ethereum ($ETH) holdings. This action would be carried out through reputable staking providers, which might include Fidelity’s affiliates.

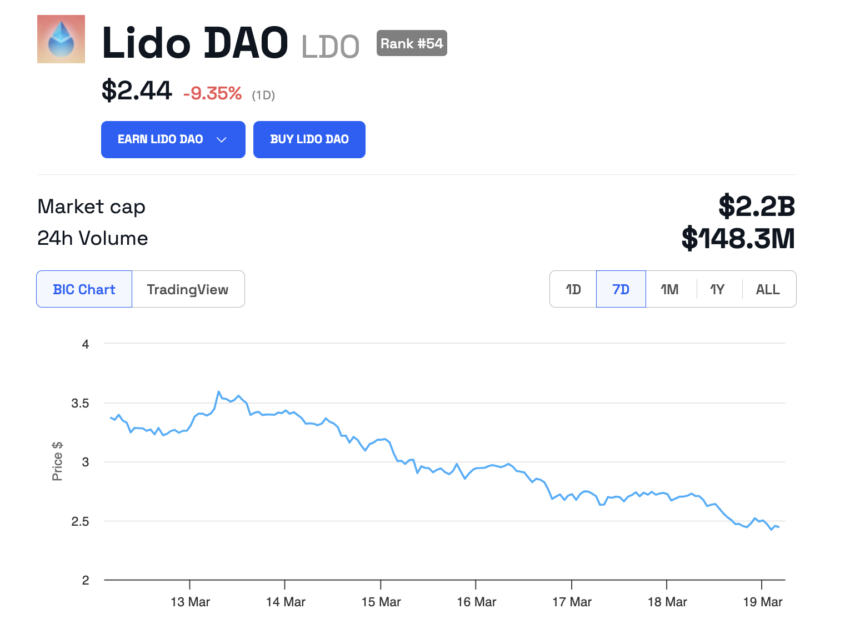

The staking announcement had an immediate impact on the market, particularly on Lido DAO, a major player in Ethereum staking.

Following the news, Lido DAO’s price experienced a notable surge, jumping 9% from $2.47 to $2.69. Despite this spike, the broader market trend saw Lido DAO’s price retracting to $2.44, reflecting a 9.35% decline in the past 24 hours.

Read more: 11 Best DeFi Platforms To Earn With Lido’s Staked $ETH (stETH)

Fidelity’s initiative places it among eight contenders seeking SEC approval for Ethereum ETFs. This group includes companies like Ark 21Shares and Franklin Templeton, which have also expressed interest in staking. The trend points to a growing recognition of staking’s potential to enhance ETF yields.

However, integrating staking into ETFs has its challenges. Critics argue that it complicates the investment product and could deter regulatory approval.

The community’s skepticism is palpable, with concerns over the added regulatory complexities staking introduces. Not to mention, the SEC has already delayed Fidelity’s spot Ethereum ETF application on multiple occasions.

“That makes the ETF even more unlikely in our opinion. One extra layer of tricky SEC complication,” Autism Capital said.

Read more: Ethereum ETF Explained: What It Is and How It Works

With the SEC’s decision pending, the crypto community is on edge. The deadline for the SEC’s verdict is approaching, with a final decision expected by May 23.

Analysts, including Bloomberg’s Eric Balchunas, speculate on the outcomes, estimating a 35% chance of approval by the deadline.

beincrypto.com

beincrypto.com