Research from Bybit highlights a growing institutional bullishness on Ether, driven by the expected positive impact of the Dencun upgrade on the Ethereum blockchain.

Dencun, slated for March 13, will introduce various Ethereum Improvement Proposals (EIPs) including proto-danksharding aimed at reducing Layer-2 transaction costs, per developers.

“While the upcoming upgrade will not likely lead to the same impact as the Merge, the potential successful implementation will likely bring a tailwind to ETH and other Layer 2 tokens,” the report said.

The last significant upgrade to Ethereum, known as Shapella, took place in April 2023. It marked a milestone as it allowed users and validators to withdraw their staked ether from the network.

Institutional Shift from Bitcoin to Ether

According to Bybit, optimism towards Ether began in Sept. 2023 and picked up momentum in Jan. 2024, reaching about 40% of institutional portfolios. The team also noted that expectations for the SEC’s approval of a Spot Ether ETF by the end of 2024 are adding to the positive sentiment surrounding Ether.

Bybit said that institutions started reducing their Bitcoin holdings in early Dec. 2023, at a time the asset tested a crucial resistance level of $40k. Thereafter, their Bitcoin holdings continued to decline. It remains unclear whether this shift from Bitcoin to Ether represents a short-term tactical adjustment or a medium-term strategic reallocation.

With the Bitcoin halving coming up in April 2024, it’s risky to be negative about the crypto asset because the halving is generally seen as a good thing, Bybit indicated.

Retail vs. Institutional Investment Styles

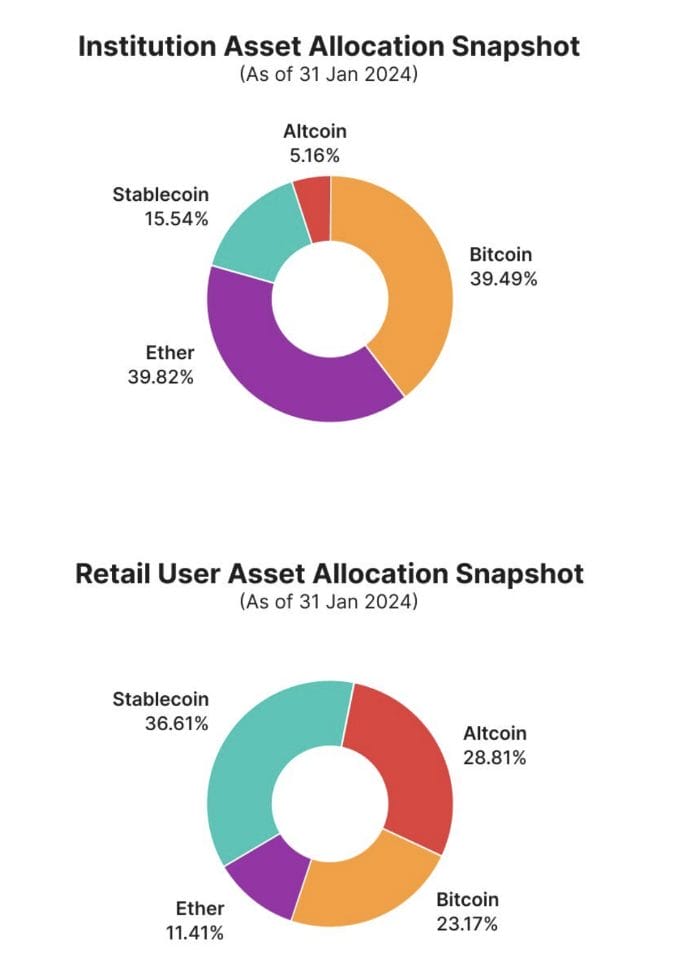

The report also provided a breakdown of asset allocations. It showed that institutions allocated about 40% to Bitcoin, 40% to Ether, 15% to stablecoins, and 5% to altcoins from July 2023 to Jan. 2024.

According to Bybit, institutions have raised their portfolio focus on Bitcoin and Ether from 50% to 80%. In contrast, retail users have a lower concentration in Bitcoin and Ether, with these two assets making up about 35% of their total portfolios.

“Retail users have a very distinct investment style, relative to institutions, with a higher tilt into altcoins and with more cash (e.g., higher stablecoin percentage),” the report said.

Retail Users Show Greater Confidence in Bitcoin vs. Ether

In another notable difference, retail users were found to have relatively stronger optimism toward Bitcoin compared to Ether. Bybit said they did not invest in Ether to the same extent as institutions during the research period.

Additionally, retail users have not reduced their positions in Bitcoin since the period between Dec. 2022 and Sept. 2023.

“The distinctive investment style of retail users might have to do with their higher leverage, which demands a higher level of portfolio assets as collateral (INS leverage at ~12; Retail users’ leverage level at ~20),” Bybit said.

Retail Investors Maintain Higher Altcoin Exposure

The report revealed that retail users still hold larger positions in altcoins compared to Bitcoin and Ether. However, there is a prevailing cautious sentiment towards altcoins among most users.

Institutions significantly reduced their overall positions in altcoins by half in percentage terms. They were observed to have nearly exited all positions in highly volatile token categories, such as meme, AI, and BRC-20 tokens, except for L1, DeFi, and metaverse tokens.

“Despite jaw-dropping returns in 2023, institutions have not been fans of those high-risk high return bets in 2023. We only observe a clear increase in the holding for meme tokens from the beginning of Sept until October,” Bybit said.

Additionally, Bybit discovered that although Solana has outperformed, both institutions and retail users were not holding SOL for extended periods.

In the third quarter of 2023, Solana held a significant position in the portfolios of both institutions and retail users. However, as Solana rebounded and reached $40, institutions and retail users opted for profit-taking.

cryptonews.com

cryptonews.com