Franklin Templeton has recently filed for a spot ether ETF, joining the competitive landscape of companies aiming to bridge traditional finance with digital assets.

According to their filing, the proposed ETF aims to provide investors with a convenient alternative to directly acquiring, holding, and trading Ethereum.

This move comes after the Securities and Exchange Commission (SEC) approved issuers for Bitcoin ETFs earlier in January, with Franklin being among the nearly a dozen firms to launch such a product.

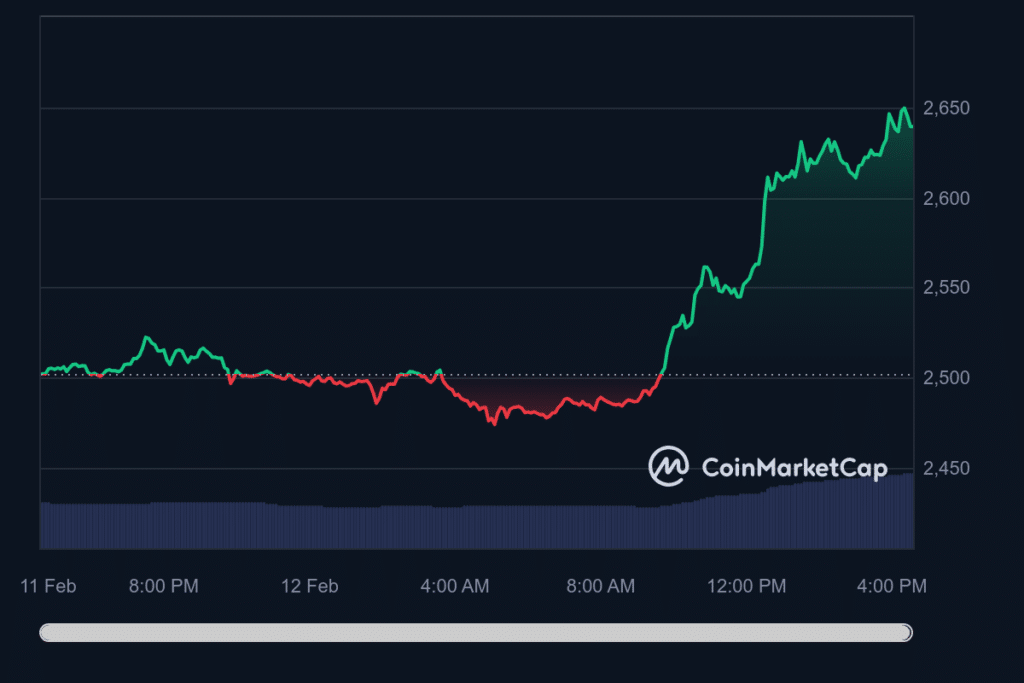

Franklin Templeton just joined the spot #Ethereum ETF race. pic.twitter.com/zJvk9seXe3

— James Seyffart (@JSeyff) February 12, 2024

The firm expressed interest in staking the ether held by the fund, a strategy also considered by Ark 21Shares, which updated its prospectus to include staking language—a feature not present in BlackRock’s filings.

Franklin’s filing suggests the fund could engage in staking through trusted providers, potentially earning staking rewards of ether tokens (ETH), which could be treated as income.

Approximately 25% of the total ETH supply is currently staked. With a decision on spot ETH ETFs anticipated in May, Bloomberg Intelligence analyst James Seyffart estimates a 60% chance of SEC approval.