- The Dencun upgrade went live on the Holesky testnet on Wednesday.

- Ethereum’s next milestone is Dencun upgrade’s mainnet release, likely in March 2024.

- Ethereum price is $2,371, unchanged in the past 24 hours.

Ethereum’s second most important upgrade after the Merge is the Dencun upgrade. This packs in EIP-4844, an Ethereum Improvement Proposal, to reduce transaction costs for Layer 2 chains.

ETH price is $2,371 on Wednesday, with the altcoin rallying nearly 2% in the past week.

Also read: LUNA teases arrival of Cosmos-based protocol Alliance’s assets on Terra

Ethereum’s Dencun upgrade set for mainnet release

Ethereum Core developers announced the successful rollout of the Dencun upgrade on the Holesky Testnet early on Wednesday. Following its smooth release, the upgrade is ready for its mainnet release and could arrive as early as March 2024.

In a series of tweets on X (formerly Twitter), developers announced that the next step for Dencun upgrade is the mainnet. Parithosh J, Ethereum Core developer, tweeted:

Holesky is finalized for Deneb :D

— parithosh | (@parithosh_j) February 7, 2024

Churn limit looks good so far and blobs are flowing smoothly!

Next stop, Mainnet! https://t.co/MiEsJfHvFz

The testnet rollout turned out to be an uneventful one, increasing confidence among Ethereum holders and market participants. Terence, another Core developer, noted that the participation of nodes dropped by approximately 5% and this is likely due to node operators being offline. Terence did not see any bugs being reported yet.

Holesky is finalized for Deneb. Another successful upgrade!!

— terence.eth (@terencechain) February 7, 2024

Participation dropped by approximately 5%, which I suspect is mostly due to node operators being offline. I have not seen any bugs reported yet. https://t.co/qlrZFedAnN

Ethereum price eyes rally to $2,500 target

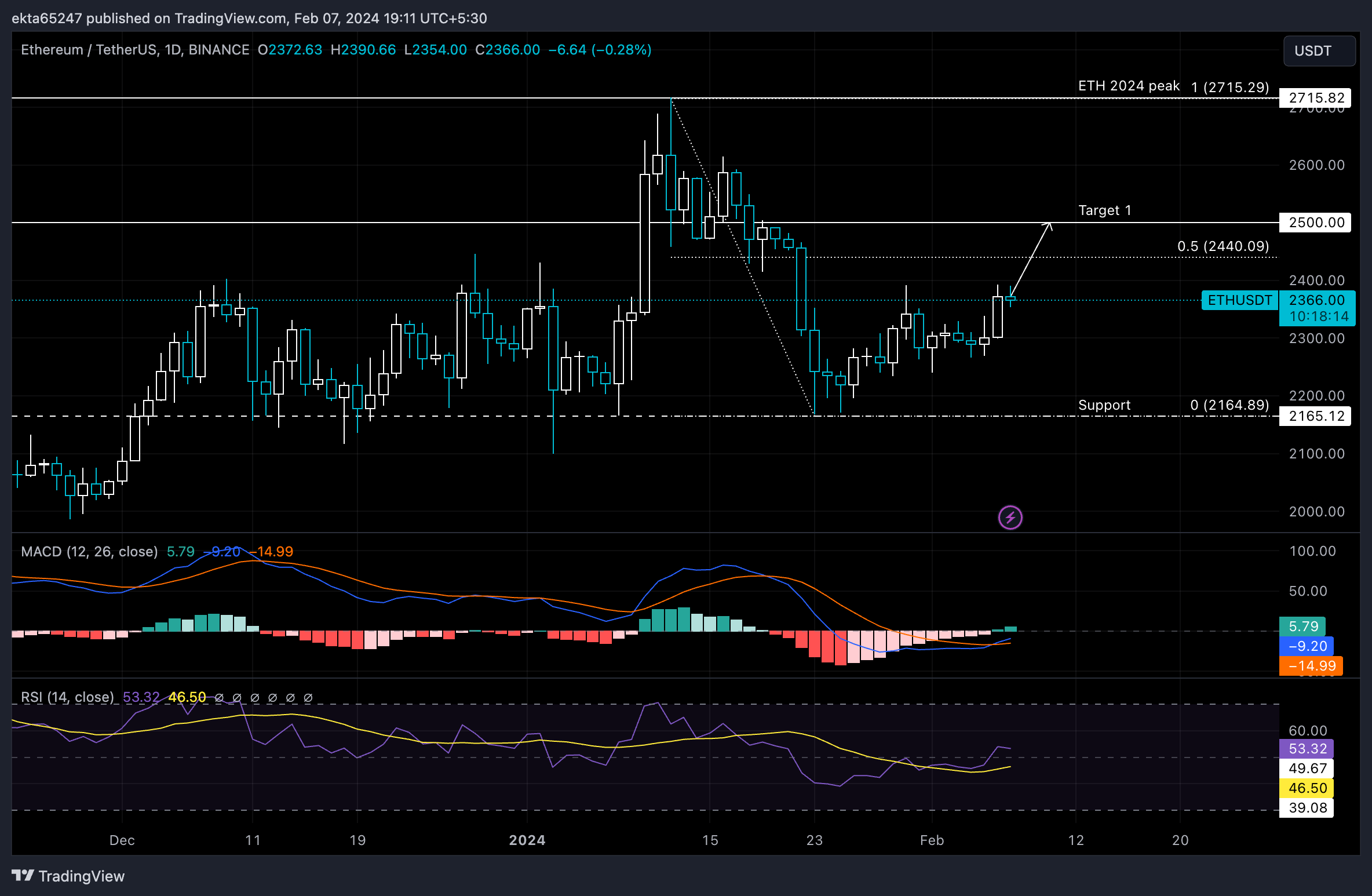

Ethereum price remained largely unchanged in the past 24 hours. The altcoin has been in a consistent uptrend since January 24. If Ethereum price continues to climb higher, it could rally towards the 50% Fibonacci Retracement of Ethereum’s decline between January 12 and 23, at $2,440.

A successful break past this resistance at $2,440 could push ETH towards its target of $2,500. The green bars on the Moving Average Convergence Divergence (MACD) indicator signal there is bullish momentum and Relative Strength Index (RSI) reads 53.32, sustaining above the neutral level. These indicators support the thesis of Ethereum price increase.

ETH/USDT 1-day chart

A daily candlestick close below the $2,267 support level could invalidate the bullish thesis for Ethereum and the altcoin could bleed to $2,164.

fxstreet.com

fxstreet.com