Investors are giving bullish signs on Ethereum (ETH) as staking deposits reached a new all-time high, summing to a total value locked of over 27.40 million ETH on August 14, and the Ethereum Name Service (ENS) collected $235,000 in fees on a single day (August 13), the highest value since September 11, 2022.

Both record-breaking metrics show that Ethereum investors are willing to keep their money on the Ethereum Network for different reasons.

Data retrieved from Glassnode by Finbold shows a total of 27,407,435 ETH locked into the ETH 2.0 depositors contract. Investors stake these amounts so they can become the network’s validators, being rewarded for a yield of around 3.29% yearly, unable to sell the tokens short-term.

📈 #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 27,407,435 ETH

— glassnode alerts (@glassnodealerts) August 14, 2023

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/GDUfBsMe58

Ethereum Name Service domains exceed 2.6 million

As for the ENS data, the report made by the renowned crypto news reporter Colin Wu shows a record amount of daily fees paid by users to register a personalized human’s-readable Ethereum address, not seen in 11 months.

Ethereum domain name service provider ENS captured $235,000 in fees on August 13, the highest since Sep 11 last year. ENS DAO (0xFe…44b7) has about $132 million in assets, including 10m ENS, 15,000 ETH, and 14.13 m USDC. The total number of active ENS domain names has exceeded…

— Wu Blockchain (@WuBlockchain) August 14, 2023

These addresses are exchanged as Ethereum domains, giving the complex blockchain addresses a unique domain that can be used to receive transactions made in the Ethereum blockchain.

More fees being paid to the service also means more demand for registering new addresses by users and investors of the leading layer-1 smart contracts blockchain in the cryptocurrency markets.

According to Colin Wu, the total number of active ENS domain names has exceeded 2.6 million.

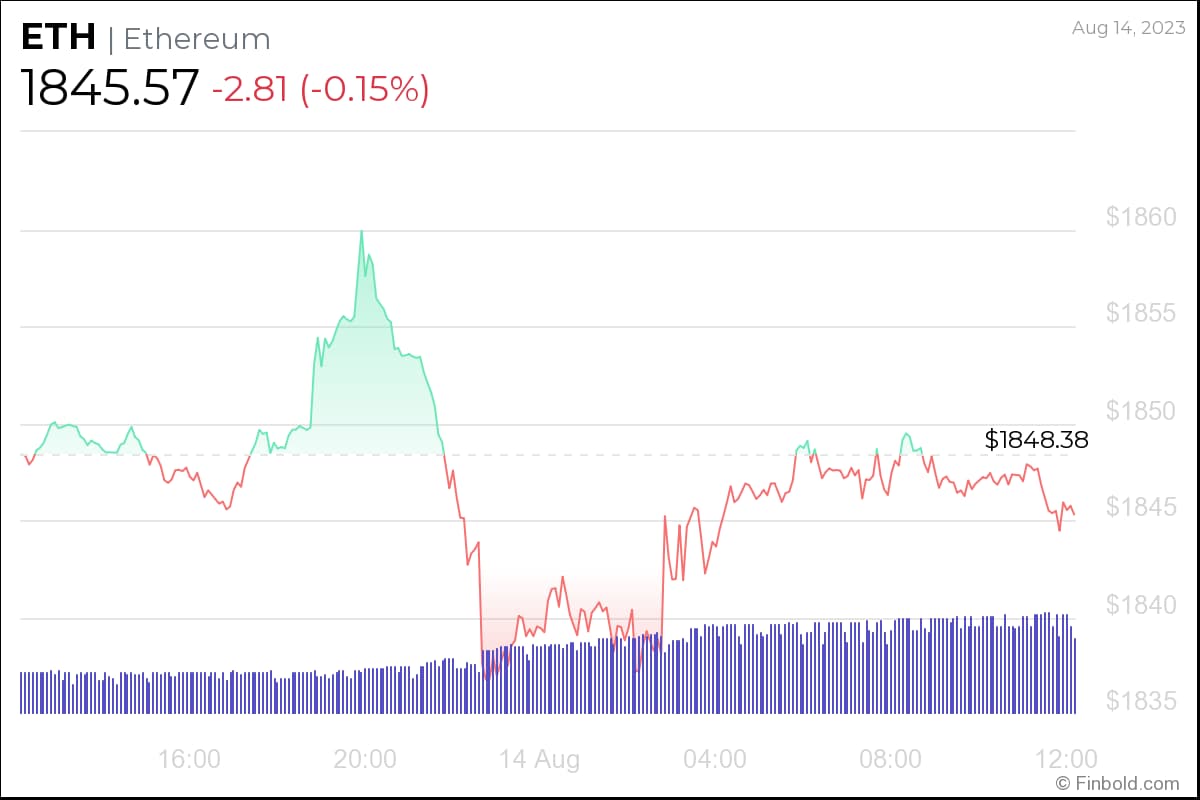

Ethereum price analysis

ETH is trading at $1,845, by press time. With 0.15% losses in the last 24 hours, and gains of 0.84% in a 7-day timeframe.

Ethereum mostly kept a low volatility week, but the exchanged volume in the last 24 hours saw an increase of 90%, according to CoinMarketCap, with over $4.04 billion in ETH being exchanged in the spot market globally.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com