After Ripple’s (XRP) victory against SEC on Thursday, Ethereum’s (ETH) price broke above $2,000 for the first time since April 2023. With Ethereum now gradually approaching the ETH 2.0 Stakers’ average purchase price, how will they react?

The Shanghai Upgrade enabled ETH 2.0 staking withdrawals in April 2023. But rather than offload their coins as many analysts predicted, Ethereum staking soared to all-time highs as investors continued to hold out for higher prices.

Ethereum Stakers Could Soon Start Folding

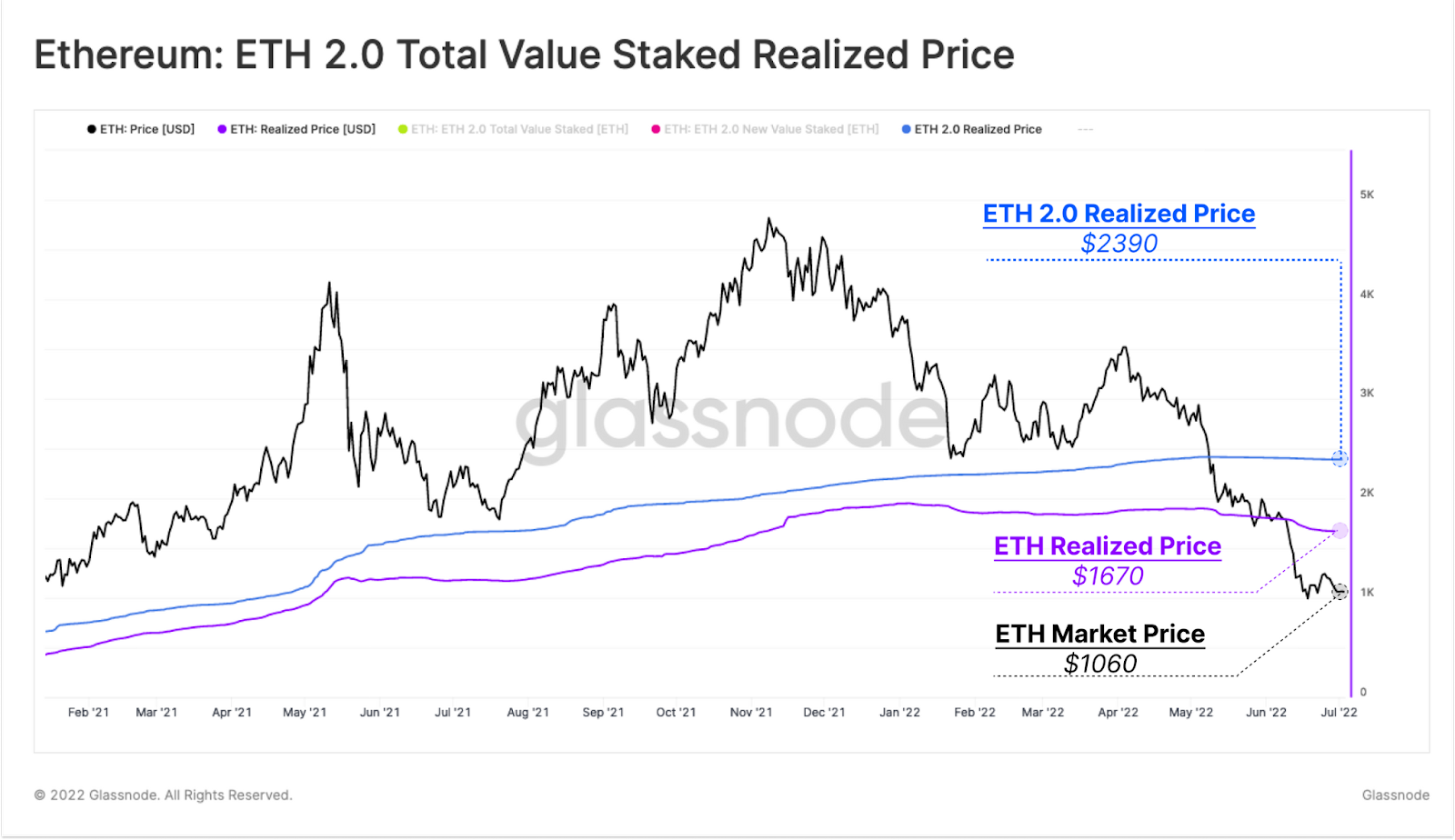

According to a 2022 report compiled by Glassnode, a significant portion of ETH staked was purchased at the average price of $2,390. Furthermore, a more recent Coinmarketcap report also highlighted that 68% of the staked ETH are held at a loss.

However, with Ethereum having gained 70% year to date, the ETH price is now approaching the break-even point for many ETH 2.0 stakers. This suggests that Ethereum may have difficulty crossing the $2,500 resistance.

Read More: Best Crypto Sign-Up Bonuses in 2023

Ethereum Stakers Could Turn Attention to Liquidity Staking Protocols

Ahead of the Shanghai upgrade, on-chain data shows that liquidity staking protocols like LidoDAO and Rocket Pool began to gain traction.

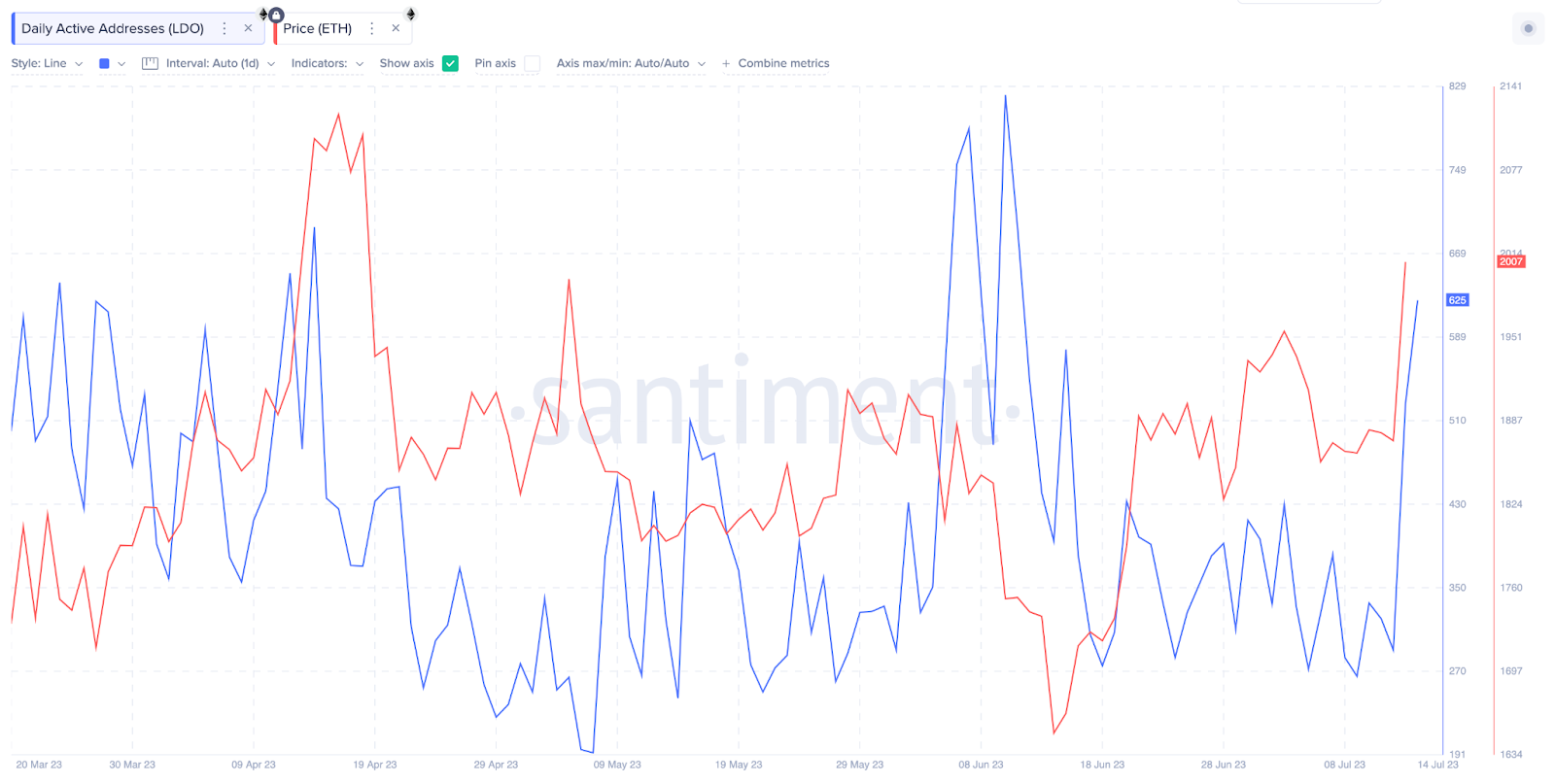

The chart below illustrates that since the conclusion of the Ethereum Merge in April, user activity on LidoDAO has become closely correlated to the Ethereum price.

Pointedly, Ethereum’s price has gained 22% between June 14 and July 14. As seen in the chart below, LidoDAO Daily Active Addresses also began to surge around June 16. As the ETH price soared above $2,000, LDO user activity surged 126% to reach 625 daily active users.

Daily Active Addresses evaluates user activity on a blockchain network by adding up the number of wallet addresses carrying out transactions. The recent upswings in LidoDAO network activity can be attributed to ETH price gains.

When the Ethereum price rises, a few more ETH 2.0 stakers become profitable and can move some of their stake coins to the LidoDAO ecosystem.

Firstly, liquidity staking protocols like LidoDAO allow investors to get exposure to ETH 2.0 Staking without forking over the minimum 32ETH required on the mainnet. Secondly, they also allow the users to obtain wrapped versions of ETH (stETH) which they can deploy for other transactional purposes.

This helps stakers to mitigate the opportunity cost of staking permanently on the Ethereum mainnet.

Read More: 9 Best Crypto Demo Accounts For Trading

ETH Price Prediction: The Bulls Could Struggle to Hit $2,500

To reiterate, a significant portion of ETH 2.0 stakers had purchased their coins at an average price of $2,390. If they choose to break up their 32ETH and move some over to liquidity staking protocols once they break even, ETH could struggle to hit the $2,500 rally, even amid strong bullish momentum.

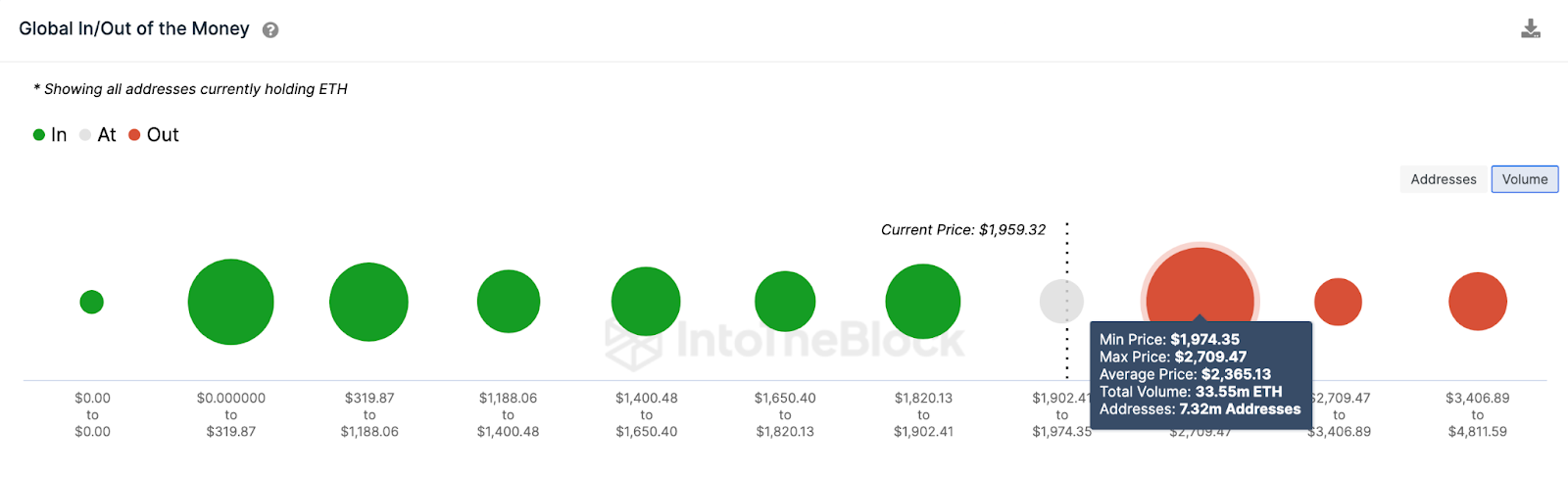

The IntoTheBlock Global In/Out of the Money Price data further validates this projection. As seen below, 7.3 million investors are currently holding 33.55 million bought at the average price of $2,365.

If the analysis above holds true, the ETH price rally could slow down significantly once it approaches $2,500. Worse still, they could trigger a downswing toward $1,970.

Conversely, if the bulls can change the narrative once ETH can break above the $3,000 mark, however, as seen above, the 9.2 million investors that bought 3.88 Million Ethereum coins at the average price of $3,075 could halt the rally.

But if that resistance level is broken, ETH can rally toward a new all-time high of around $5,000.

beincrypto.com

beincrypto.com