Ethereum (ETH) Price remains below $2,000 despite a resounding 15% rise in the global cryptocurrency market cap (TOTAL CAP). Are institutional investors overlooking Ethereum amid the Crypto ETF rave?

On-chain data and general market sentiment suggest that crypto derivates traders appear to be favoring Bitcoin ETF over ETH alternatives. How could this impact ETH price?

Ethereum is Struggling to Maintain Steady User Traction

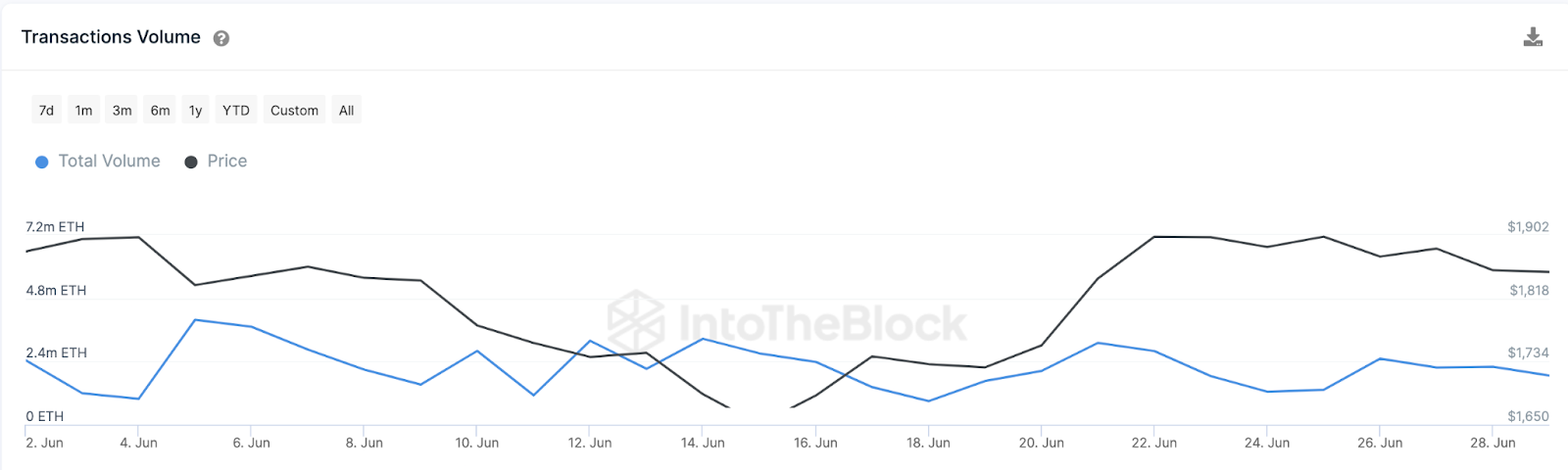

Fluctuating user activity is one of the key factors that has slowed down the ETH price rally in recent weeks. According to IntoTheBlock, ETH has not been able to maintain steady growth in Transaction Volume despite renewed interest among institutional investors.

The chart below shows how ETH Transaction Volume fluctuated wildly in June 2023. At the monthly peak on June 5, 3.98 million ETH were transferred among Ethereum users. Since then, it formed a series of zig-zag patterns before it reached 1.86 million ETH again on June 28.

Transaction Volume provides a picture of real-time changes in economic activity carried out by network participants. When it rises, it puts upward pressure on the price of the underlying token.

Over 20% of Ethereum’s circulating supply is currently staked in smart contracts. Most investors are more interested in generating passive income from their ETH than utilizing it in daily transactions.

This has played a pivotal role in ETH price stagnation in recent weeks. If the Transaction Volume remains in a downtrend, ETH price could face more headwinds in the coming weeks.

Read More: Best Upcoming Airdrops in 2023

Bitcoin ETF is Hogging All the Attention

Furthermore, Ethereum also appears to be losing ground to Bitcoin in the battle for investors’ attention. Reports show that institutional investors are showing a preference for Bitcoin ETF over similar ETH funds.

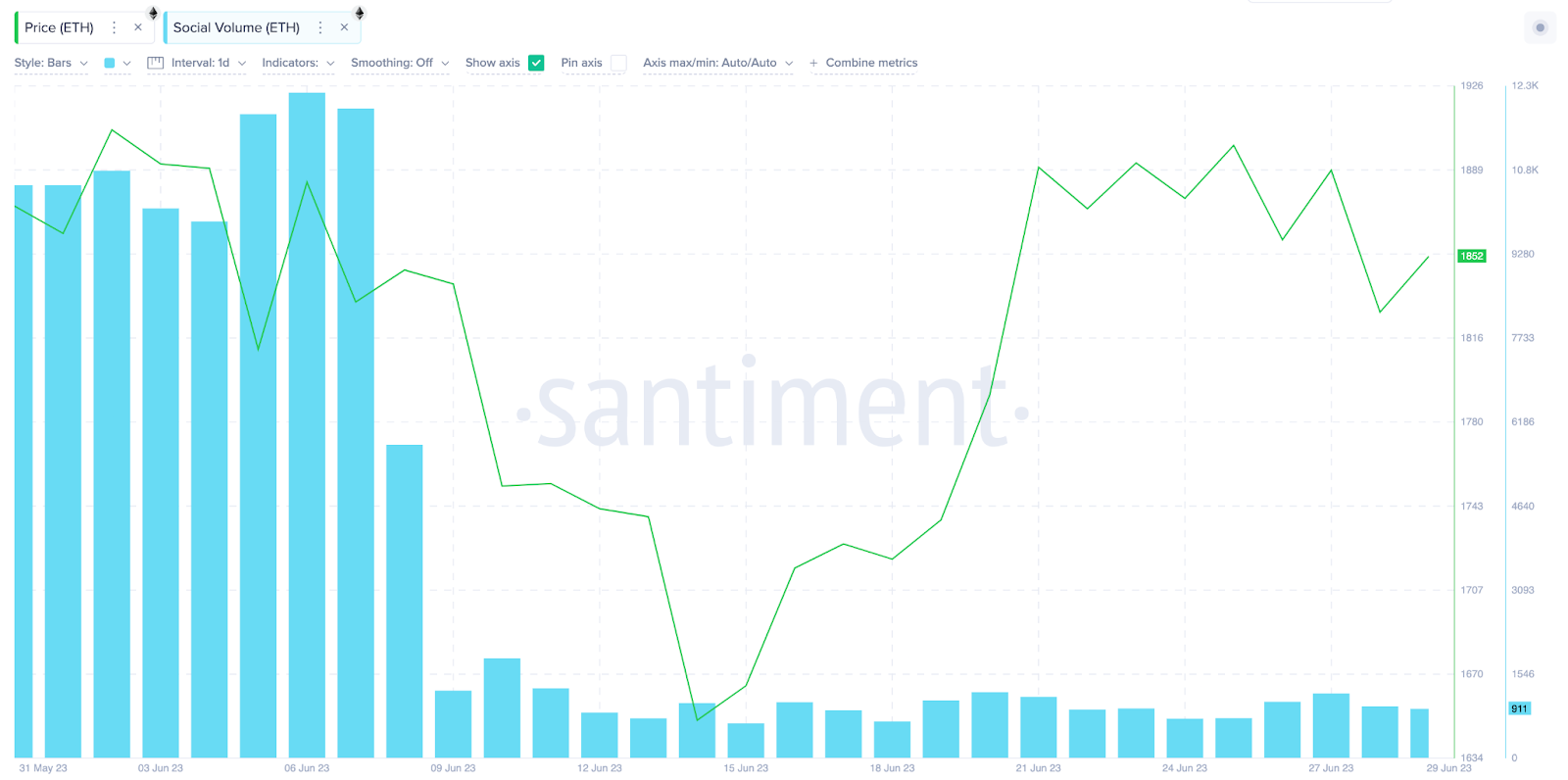

On-chain data corroborate this report, as ETH Social Volume has dropped significantly in recent weeks.

As of June 29, ETH Social Volume is down 86% to 1,655 from its recent high of 11,959 on June 7.

Social Volume tracks the volume of mentions of a project across relevant crypto media channels. When it drops significantly, as seen above, it indicates that investors are paying less attention.

In summary, fluctuating transaction volumes and lag in social sentiment could see ETH prices continue to move at a relatively slow pace.

Read More: Best Crypto Sign-Up Bonuses in 2023

ETH Price Prediction: Consolidation around $1,900

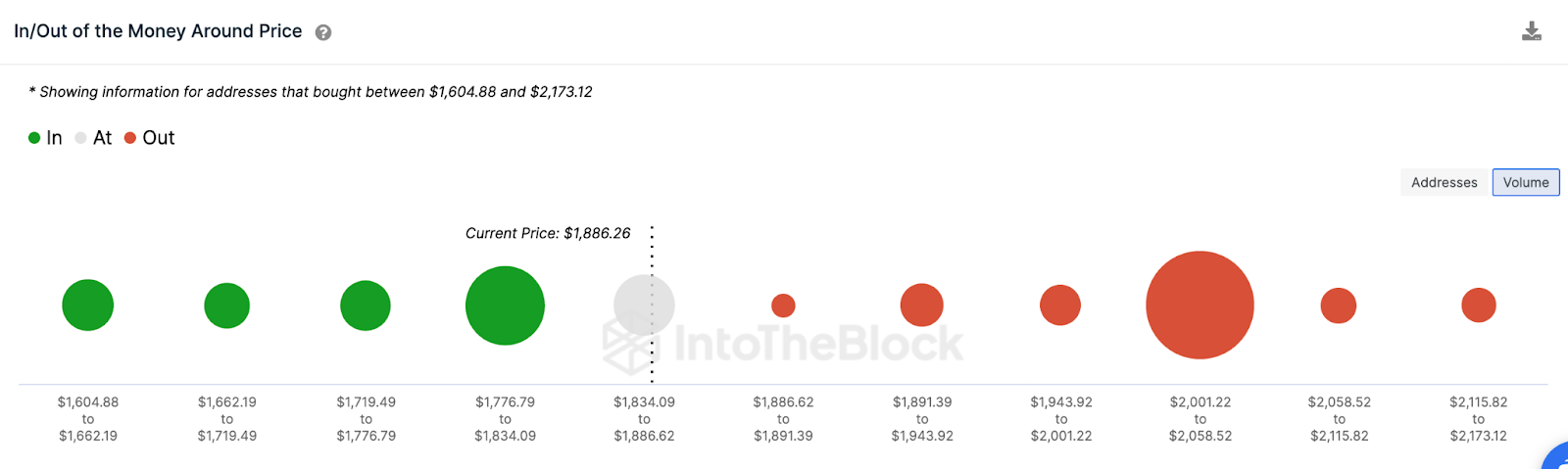

Given the aforementioned factors, the ETH price will likely consolidate around $1,900 in the coming days. As seen below, 2.3 million investors that bought 1.52 million ETH at the average price of $1,908 could slow down the rally.

If ETH scales that zone, it will face another major resistance around the $2,000 mark. At that zone, 660,000 that bought 26 million ETH could look to book some profit.

Still, ETH could fall into a downtrend if the price slips below $1,800. However, the buy-wall from 3.39 million investors that bought 11 million ETH at the average price of $1,803 could offer support.

But failure to hold that support line could otherwise trigger a further drop toward $1,700.

beincrypto.com

beincrypto.com